The current volume of proposed regulatory change in the US compares to the period after the passing of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was in response to the 2008 financial crisis.

Deloitte said its 2023 Capital Markets Regulatory Outlook: “In 2023, we expect the impacts to ripple across firms and markets in transformational and hard-to-predict ways.”

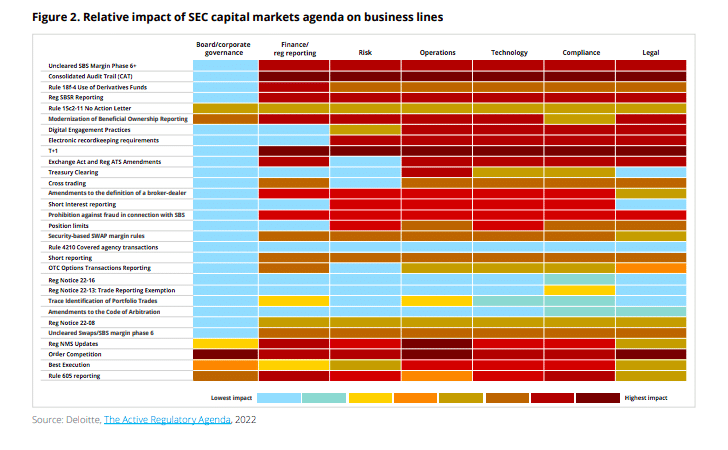

In 2022 the US Securities and Exchange Commission approved 39 proposals to amend existing or create new regulations, which included new reporting requirements and expanded the scope of entities required to register with the regulator. However, it is still uncertain how much of the proposed agenda will translate into final rules, especially with a Republican majority in the House of Representatives and potential legal to the most controversial proposals

“Firms should plan as though the proposed agenda will be enacted because, even if only a fraction is finalized, the changes will be impactful, and significant implementation efforts will be required,” added the report.

T+1

Deloitte continued that some proposals, such as reducing the equities settlement cycle from two days after a trade to T+1, are not controversial and will likely go forward unimpeded. Cutting the settlement cycle reduces risk and improves capital efficiency.

“We expect a final rule to advance in 2023 and the industry has already begun preparations,” added Deloitte. “Like previous efforts to reduce the settlement cycle, transitioning to T+1 will require significant operational change, and because of the heavy volume of regulatory activity, the teams that will be responsible for implementing T+1 are likely to be spread thin by implementing other regulatory mandates as well.”

Firms will need to press forward with operational changes, including the creation of a project management office, development of implementation plans, continuous oversight of the implementation effort, portfolio manager, trader and client education, internal and industry wide testing, and establishment of a migration command center according to the consultancy.

The implementation will be difficult as more than three quarters, 81%, of brokers and banks active within the US and Canadian markets are either using manual processes or home-grown systems to support their post-trade processes.

A survey last November from Torstone Technology, a post-trade technology provider, and Firebrand Research highlighted the need to increase automation ahead of the global push towards shortening settlement cycles to T+1 and, ultimately, T+0. India completed its transition to T+1 for equities on 27 January 2023.

Brian Collings, chief executive of Torstone Technology, said in a statement: “Manual processes and batch processing are simply not compatible with the shift to shorter settlement cycles – firms need to update and automate their middle- and back-office systems or face substantial operational risk.”

SEC Market structure proposals

In December 2022 the SEC approved proposals related to equity market structure, which Deloitte said reflect skepticism about the practice of payment for order flow and are intended to improve retail order execution quality.

In the US retail trades are not executed on exchanges but most are sold to market makers under payment for order flow agreements. The market makers internalize the flow and capture the majority of the spread, in return for offering retail investors a slight improvement on the exchange price.

“Collectively, the package comprises the most significant proposed changes to market structure in more than a decade,” said Deloitte.

The report added that the most controversial proposals are likely to be the Order Competition Rule, which would require all market participants, including market makers, to route orders to auctions hosted on national exchanges.

“The rule could potentially upend the business model of some broker-dealers and market makers if enacted in its current form,” added the report. “One of the proposals also allows for a sub-penny tick size, which potentially could reduce spreads, but may be technologically complex to implement, particularly given the specification of the proposal, which set a minimum pricing increment relative to a weighted average spread.”

The industry has until the end of March to respond to the SEC proposals.

Deloitte continued that a tumultuous period from a regulatory perspective could also be an opportunity to evaluate strategy more broadly.

“Regulatory change creates new trade-offs but might present new opportunities as well,” said the report. “An informed debate about the implications of the massive regulatory agenda on the individual firm is likely to be helpful for determining an optimal approach.”