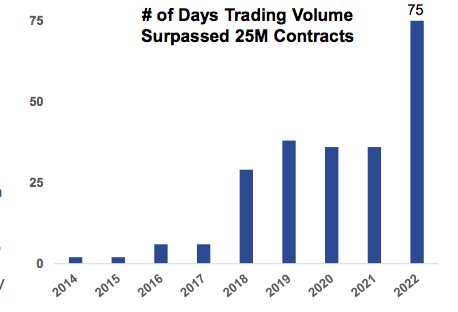

CME Group reported a 19% increase in average daily volume in 2022 to a record 23.3 million contracts, which the derivatives exchange operator said was due to global market participants navigating economic and geopolitical uncertainty.

Terry Duffy, chairman and chief executive of CME Group, said on the earnings call on 8 February: “Our 2022 performance was driven by new records in financial products, options on futures, and volume from outside the United States.”

Growth was led by CME’s financial products which finished the year up 25% to a record average daily volume of 19.5 million contracts, according to Duffy. Options also set a record average daily volume of 4.1 million contracts, up 23% versus 2021.

Non-U.S. average daily volume for full-year 2022 reached an all-time high of 6.3 million contracts, up 15% year-on-year.

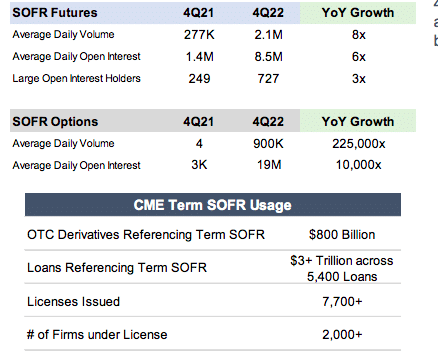

SOFR futures and options also had record volumes as Duffy described 2022 as a historic year for the LIBOR transition.

After the financial crisis in 2008 there were a series of scandals regarding banks manipulating their submissions for setting Libor benchmarks, which led to a lack of confidence and threatened participation in the related markets. As a result, regulators have increased their supervision of benchmarks and moved to risk-free reference rates (RFRs) based on transactions, so they are harder to manipulate and more representative of the market, and US regulators chose SOFR. US dollar LIBOR will cease publication on 30 June this year.

“We collaborated with market participants to shift trading behaviour, order flow and open interest to SOFR,” added Duffy. “As a result we are beginning 2023 with SOFR futures and options as the leading tools for hedging short-term interest rates with deep liquidity supporting a wide range of strategies across the forward curve.”

Average daily volume in January 2023 was roughly the same as at the end of last year, which Duffy said is a “pretty exciting” start to the beginning of the year.

“It’s really hard for me to predict volumes in the balance of the 11 months left in this year,” Duffy added. “I think this is the age of uncertainty and we are positioned to give efficiencies to people to manage and mitigate that risk.”

Digital assets

John Pietrowicz, chief financial officer, said on the earrings call that CME’s approach to the cryptocurrency products is being a regulated venue offering regulated products in a way that provides bonafide risk management and trusted access

“We saw that that value proposition ring true in the fourth quarter with some of their more widespread events in the cryptocurrency. space,” he added. “We had record volumes in November, and record large open interest holders, and that momentum hasn’t slowed down.”

In November CME added more than double the normal number of new accounts to trade crypto, and that increase has continued in January.

“That is really a testament to the marketplace broadly turning to CME in times of stress in the rest of the cryptocurrency ecosystem,” he added.

CME has also focused on developing non-tradable reference rates in real-time indices.

“We want to make sure that CME, along with our partners CF Benchmarks, remains one of the preeminent pricing providers for cryptocurrency as people need a trusted source to figure out what these assets are worth with reference rates or in real time on a tick by tick basis,’ he added. “We are at the centre of the growing ecosystem with respect to Bitcoin and Ether in regulated products and we expect that trend to continue in 2023.”

Migrating to cloud

Duffy said 2022 was a fundamental year for CME’s partnership with Google. In November 2021 CME Group announced a 10-year strategic partnership with Google Cloud, which included Google making a $1bn equity investment in the derivatives exchange.

CME has built out a cloud platform and successfully migrated some early applications and Duffy continued that 2023 will be about accelerating the migration of applications, including launching data products in the cloud.

Pietrowicz added: “We know we have very valuable data, and we know that being able to produce more of that data and analytics in the cloud is what our clients are asking for. We are highly focused on looking at new ways to develop that with our partners at Google.”

He continued that some cloud-based data analytics, artificial intelligence and machine learning-based applications and new API’s began to be rolled out in the fourth quarter. Pietrowicz said one of the reasons CME is pursuing this initiative is to increase its flexibility and speed the time to bring new products to market.

“Ultimately, we will see more of the expense in the technology line as we are renting the capacity we need, as opposed to building infrastructure,” Pietrowicz added. “That is the migration we expect to see over the next several years.”

Financials

Pietrowicz said 2022 was the best year financially for the company.

Total revenue for 2022 was $5bn, up 11% year-on-year, and operating income was $3bn. Net income was $2.7bn and diluted earnings per common share were $7.40.

Last November, CME announced fee increases which became effective on 1 February 2023. Pietrowicz said that if trading patterns are similar to 2022, full-year futures and options transaction revenue will increase between 4% and 5% in 2023.

“We take a very careful and targeted approach with the objective of not impacting volumes,” added Pietrowicz.