BlackRock said it will maintain its previous guidance for headcount growth but senior hires will be delayed until next year as assets under management, revenues and profits fell in the second quarter of this year.

Gary Shedlin, chief financial officer at BlackRock, said on the results call that BlackRock had its fastest growth rate for employees last year and will continue to invest for growth. However, the asset manager is mindful of the current environment and will proactively manage the pace of certain discretionary investments.

“We will be delaying certain senior hires into next year,” Shedlin added. “Our estimated headcount growth for the year will be generally consistent with our earlier guidance, but 100% of that growth will be at the more junior levels of the organisation.”

Market declines along with significant dollar appreciation against major currencies reduced the value of BlackRock assets under management by $1.7 trillion from the end of last year.

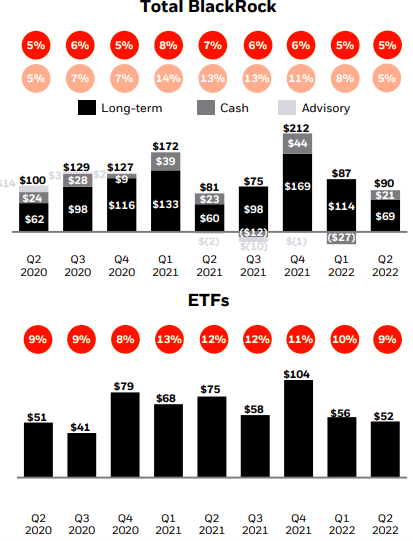

However, the firm’s total net inflows in the first half of this year were over $175bn in the first half of 2022. In the second quarter total net inflows were $90bn, representing 4% annualised organic asset growth.

“Flows were positive across all product types and regions, demonstrating the diversification of our differentiated platform, even in the face of macro and industry headwinds, and an ability to quickly adapt to changing client needs,” said Shedlin.

Fixed income

Larry Fink, chairman and chief executive of BlackRock, said on the results call that iShares, the exchange-trade fund division, launched the first US-domiciled bond ETF in the summer of 2002 which broke down many barriers in fixed income investing.

Fink continued that fixed income ETF net inflows were $31bn in the second quarter, led by record flows in May. In addition, ETF trading volumes were a record and more than 50% higher than a year ago.

“We expect the bond ETF industry will nearly triple and reach $5 trillion in assets under management at the end of the decade, driving significant growth in the broader ETF industry,” Fink said.

He explained that the challenges associated with high inflation and rising interest rates are attracting more first-time bond ETF users and also prompting existing investors to find new ways to use ETFs for active investing.

“When you consider that we built our fixed income ETF platform in an extremely low yield environment, it is particularly exciting to consider how rising rates will bring a whole new set of investors into these funds,” Fink added.

The ETF platform had $52bn in total inflows in the second quarter and Fink said there was growth in each ETF product category.

Robert Kapito, president of BlackRock, said on the call that investors are reallocating their portfolios due to market conditions through index and ETFs because it is cheaper, faster and there is more liquidity available than in individual stocks and bonds.

“That is one of the reasons why, during this volatile period, we have seen inflows into the ETF and index markets,” Kapito added.

Kapito said volatility has disrupted traditional portfolio allocations, especially as it is rare for both equities and bonds to decline in value.

“The traditional 60/40 allocations are very out of balance and the hedge between stocks and bonds has certainly weakened,” he said.

As a result a lot of money is going to be reallocated as clients rethink their target allocations and models and Kapito claimed BlackRock is the only global asset manager that can meet every reallocation scenario across fixed income, equities, cash, private markets, indexes and active.

“We expect to see a lot of reallocation and it’s not only going to go into fixed income ETFs but also into top performing and diversified fixed income funds,” he added. “I expect people that use large-cap dividend paying stocks as a surrogate for fixed income during the period of very low rates will reverse into fixed income for the yield that they desperately need for the long-term.”

Kapito expects demand for US Treasuries, US investment grade, municipal bonds and TIPs for inflation protection. He said: “A lot of that is going to come through ETFs but also through individual bonds and issues.”

Sustainable investing

Another trend defining the asset management industry that Fink highlighted is sustainable investing, which had continued strong client demand. BlackRock manages nearly $475 billion in dedicated sustainable assets for clients and had more than $20bn in net inflows in the quarter.

In May 2022 BlackRock said it secured more than $800m in initial commitments toward its $1bn target for its Impact Opportunities Fund. The new fund, which Fink said is the first multi-alternatives strategy of its kind, will invest in businesses and projects owned, led by, or serving people of color in the United States.

Fink sees one of the biggest long-term opportunities in the intersection of infrastructure and sustainability, especially as supply shocks have increased the focus on energy security and compounded the need for investment.

In June 2022 BlackRock announced it will establish a perpetual infrastructure strategy that will seek to partner with leading infrastructure businesses over the long term to help drive the global energy transition. An estimated $125 trillion of investment is needed globally by 2050 to reach net zero, more than $4 trillion per year compared to the current $1 trillion per year.

He compared the evolution of ESG investing to the mortgage market. In the 1970s Fink began his career as a mortgage trader and the launch of securitization raised many questions from investors, policymakers and regulators.

“While the mortgage market has since had many ups and downs, it is a $10 trillion market today,” said Fink.

He continued that two years ago sustainable investing was not a priority for many clients, but it is now one of the fastest growing segments of the asset management industry.

“I continue to believe that we are in the early days of this trend,” added Fink. “I believe sustainability will fundamentally reshape finance but as in the early days of the mortgage market there are a lot of questions.”

He argued that the key to avoiding excesses and missteps is better data and analytics, a common taxonomy and a globally coordinated disclosure framework to allow investors to more effectively compare companies and geographies.

Digital assets

Another area of increasing interest to clients is digital assets and BlackRock has been studying the ecosystem.

In April 2022 BlackRock was part of the $400m funding round for Circle Internet Financial, an internet finance firm and issuer of USD Coin (USDC) stablecoin. In addition to its strategic investment, BlackRock is the primary asset manager of USDC cash reserves and will explore capital market applications for the stablecoin.

BlackRock is seeing more interest from institutional clients on efficiently accessing digital assets despite the steep downturn in crypto valuations over recent months.

“This is a space that we are continuing to explore to help our clients who want to learn more, and want to participate in these assets in a transparent and efficient way,” Fink said.

Outsourced chief investment officer (OCIO) business

In March this year insurer AIG announced that certain liquid fixed income and private placement assets will be managed by BlackRock, consisting of up to $60bn of the global AIG investment portfolio and up to $90bn of the Life & Retirement investment portfolio.

Fink said BlackRock’s technology and risk management capabilities are supporting the growth of the OCIO business which has raised over $430bn.

“We expect the trend towards outsourcing to increase,” said Fink. “BlackRock is well positioned to capture this opportunity to be a trusted partner for our clients.”

Fink believes OCIO mandates will accelerate because BlackRock can provide cheaper services and a systematic approach using investment technology across all products from cash to alternatives.

He added: “This gives us a unique advantage and we see this as a huge opportunity. As well as AIG, another big US pension fund announced this week that we are going to manage their entire defined contribution platform.”

Financial results

Fink said the first half of 2022 was the worst start to the year for both stocks and bonds in 50 years with global equities down 20% and fixed income down 10%, with investors also having to navigate high inflation and rising rates.

Revenue for the second quarter decreased 6% year-over-year to $4.5bn, which Black Rock said was primarily driven by significantly lower markets, dollar appreciation on average assets under management and lower performance fees. Over the same period net income fell 22% to $1.1bn.

“Over the course of BlackRock’s 34-year history, we have experienced numerous periods of volatility and uncertainty, and BlackRock has always come through stronger,” Fink added. “I see more opportunities for BlackRock today than ever before, and remain confident in our ability to deliver long-term growth for our clients, shareholders and employees.”