Cboe Global Markets wrote down the value of its acquisition of ErisX, which operates US digital asset spot and derivatives markets, by more than half but management affirmed that they continue to be enthusiastic about the long term opportunity in the new asset class.

In its second quarter results CBOE reported a $460m goodwill impairment on the purchase of ErisX which closed on 2 May.

ErisX operates a US digital asset spot market, a regulated futures exchange and a regulated clearing house. When the acquisition was announced in October 2021 Cboe said it presented a unique opportunity to enter the digital asset spot and derivatives markets. ErisX’s real-time clearing system reduces settlement risk and also allows seamless movement of collateral between spot and futures accounts.

Ed Tilly, chairman and chief executive of Cboe Global Markets, said on the results call that the digital asset market environment had changed dramatically since closing the ErisX transaction, which resulted in an accounting adjustment.

“We believe that the $220m book carrying value reflects the reality of the market today, but in no way changes our enthusiasm for the digital asset space,” he added. “We are intently focused on integrating our platforms and positioning Cboe for its next wave of growth in the quarters ahead.”

Cboe plans to operate the ErisX business as a subsidiary, Cboe Digital, with Thomas Chippas, chief executive of ErisX, remaining as head of the digital asset business reporting to Chris Isaacson, chief operating officer of Cboe. In addition to operating the existing spot, derivative and clearing platforms, Cboe also intends to develop and distribute a range of digital asset data products and develop a benchmark data stream to help market participants evaluate the appropriateness of crypto execution prices.

Tilly said the strategy for Cboe Digital has not changed and the current market downturn has increased demand from market participants for a trusted, transparent, regulated market for digital assets.

“We remain excited by the compelling strategic opportunity for Cboe and the digital asset space,” he said. “We believe the long term opportunity within the digital asset space will continue to evolve.”

In addition, Cboe expects to soon announce equity partners for the digital business and anticipates ErisX will reach EBITDA profitability within two to three years.

Brian Schell, chief financial officer and treasurer at Cboe Group, said on the results call that Cboe effectively wrote down the goodwill related to ErisX to zero and recorded a deferred tax asset of $116m.

“Our adjustment reflects the reality of the digital asset market environment today, but in no way changes our commitment to the digital assets space or what we set out to do when we announced this transaction back in October,” Schell added. “In fact, recent events only underscore the strong need for a transparent and trusted trading, clearing and data venue for digital assets and we believe that Cboe along with the help of industry partners, is best positioned to provide the solutions.”

Chris Isaacson, chief operating officer at Cboe, agreed on the call that the group’s strategy and excitement for digital assets is unchanged despite a fundamental repricing in the asset class.

“We think this provides a strategic tailwind for us with trusted, transparent, regulated markets,” added Isaacson. “We are committed to this asset class.”

John Deters, chief strategy officer at Cboe, said on the call that Cboe is talking to potential partners for the digital asset project.

“We are hearing from them that they see the demand,” Deters added. “These are largely intermediaries who touch over 80% of traditional asset volume from retail customers so they have a good line of sight.”

In addition, he said investors want to trade in a framework that has robust coin listing risk parameters, that is unconflicted, where pricing is reliable and not manufactured to create elevated spreads and there is no hidden dangerous leverage.

“Those are things that we are offering so it’s reasonable to think that, over the medium term, we can garner our fair share of the market,” said Deters.

Canada

In May Cboe also completed its acquisition of fintech NEO, which includes a fully registered Canadian securities exchange – NEO Exchange- with products ranging from corporate listings to cash equities trading and a non-listed securities distribution platform, and is already contributing revenue to the group. Overall market share in Canada now tops 12.1% according to Tilly

“We are working on integration plans that will help enable us to maximise our global equities and listing businesses,” he added.

Dave Howson, president of Cboe, said on the call that Canada has more than 241 listings including exchange-traded products and corporates focused on the innovation economy, which can be rolled out as a global strategy. He relocated from London to Chicago last week to take on his new role, which includes overseeing Cboe’s business lines globally.

“We can actually begin to go to issuers and offer capital raises globally,” Howson added.

Europe

Average daily notional value traded on Cboe European Equities was €10.9bn, up 49% from last year’s second quarter while overall market volume was up 12% percent during the quarter according to Cboe.

Cboe European Equities had 23.2% market share in the second quarter, up from 17.4% from a year ago which Cboe said was a result of positive momentum across all order books, with a particular strength in lit markets and record Cboe BIDS Europe market share. Cboe BIDS Europe became the number one block trading platform in Europe with a 33% market share according to the firm.

Howson said the increase in share in European equities was helped by the implementation of an analytics driven campaign by sales to help clients achieve better results on Cboe Europe, which can be used on other Cboe venues.

In addition, Cboe said the European clearing business saw steady growth in the second quarter and the European derivatives initiative, CEDX, made steady progress

Tilly said: “While CEDX’s early volume trends have been softer than we expected due to geopolitical events in Europe delaying customer onboarding timetables, we still believe strongly in the long term strategy and the vision for this business.”

Asia Pacific

Market share in Japan increased to 3.5%, up from 2.5% a year ago as Cboe introduced a new liquidity provider programme this year to attract volume.

In Australia market share grew to 17% from 16% over the same time period and Tilly said Cboe is on track to migrate Australia to its proprietary technology in February 2023.

“Our global scale gives us the unmatched ability to efficiently scale and expand our business in new ways,” said Tilly. “We’ve acquired nine companies in the last two years, and we remain laser focused on the various stages of integration for each of these companies.”

Financial results

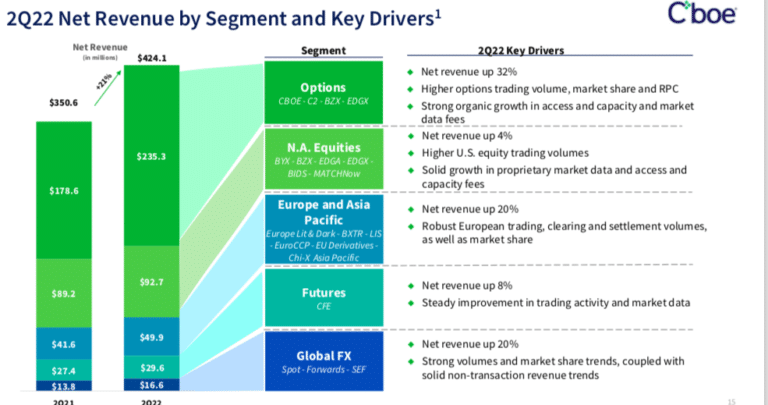

Cboe’s net revenue increased 21% in the second quarter to $424m, setting another quarterly record which the group said was driven by the strength in derivatives markets, and data and access solutions.

Schell said: “Each of our revenue categories – derivatives, data and access, and cash – posted a year-over-year gain, but every segment from options to foreign exchange also posted a year-over-year increase.”

Cboe increased 2022 total organic net revenue growth expectations to between 9% and 11%, up from the prior guidance range of 5% to 7%.

“The upgraded guidance is a testament to not only the strength of the first half results, but the durability we expect to see in the revenue base moving forward,” added Schell. “We look forward to building on the first half momentum with continued investment and integration across the Cboe platform.

In addition, 2022 organic net revenue growth expectations for data and access solutions business increased to between 10% and 13%, up from the prior guidance range of 8% to 11%.

Tilly said: “Many of our newer initiatives, like the extension of trading hours for SPX and VIX Options to nearly 24 hours-a-day, five days-a-week and the addition of Tuesday and Thursday expirations for SPX Weekly options, have outperformed our early expectations in 2022, further accelerating the strong growth across our core businesses.”

He continued that important areas of expansion include distribution as a service using Cboe’s extensive network to package high quality data from across markets to deliver a consistent and cost effective data solutions to customers; and the group’s cloud strategy which extends data to new users and geographies. The majority of increased demand for US data, 60%, primarily came from international participants – 44% from Europe and 16% from Asia Pacific.

Cboe has announced it will be using Snowflake, the data cloud company, to migrate its corporate data and analytics from on-premises systems to the cloud. In addition, Snowflake will be used as a security data lake to unify data for efficient detection and response and other cybersecurity use cases.The migration also creates the opportunity for Cboe to create new data products and services while expanding data access for market participants.

Rinesh Patel, global industry GTM lead, financial services at Snowflake, said in a statement: “The work Cboe is doing to modernize their data and analytics infrastructure and deliver faster, better insights to their internal teams and clients is a model for how the financial services industry must modernize, deliver on a more customer-centric model of operation and take advantage of the data monetization opportunities that exist in financial services.”

In November 2021 the group also launched Cboe Global Cloud, which is designed to enable customers to directly access real-time Cboe data from multiple locations around the world with as little as an internet connection and provide data products on a unified platform.

“Today we are the only truly global market infrastructure provider operating markets and delivering services around the world and around the clock every day of the week,” added Tilly.