The notional equivalent amount of SOFR futures trading has overtaken the equivalent in Eurodollar contracts for three months as the industry transitions from Libor according to derivatives analytics provider Clarus Financial Technology.

Chris Barnes at Clarus said in a blog: “Remember that I am often shocked just how large the Eurodollar market is, so this is really quite some achievement.”

Barnes said the notional amount of SOFR first surpassed Eurodollars in May 2022, and that in July the amount of SOFR notional traded in futures was $43.3 trillion versus $25.7 trillion in Eurodollars.

“Put another way, the SOFR market was 69% bigger than Eurodollars in July 2022,” he added.

After the financial crisis there were a series of scandals regarding banks manipulating their submissions for setting benchmarks across asset classes, which led to a lack of confidence and threatened participation in the related markets. As a result, regulators have increased their supervision of benchmarks and moved to risk-free reference rates (RFRs) based on transactions, so they are harder to manipulate and more representative of the market.

The US Alternative Reference Rates Committee (ARRC) selected SOFR to replace US dollar Libor, although other new risk-free reference rates have also been launched. The use of US dollar Libor in new contracts was banned from the end of 2021, with limited exceptions, and five US dollar Libor settings will continue to be calculated using panel bank submissions until mid-2023.

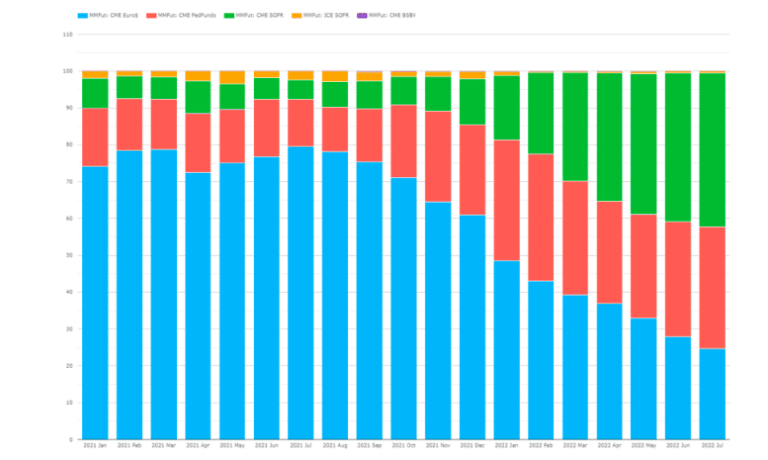

The proportion of the US dollar short-arm interest rate market is increasing according to Clarus as shown in the green bars below. SOFR is now the single largest market amongst US dollar STIRs, at 41.7% of total activity.

However, Barnes highlighted there is still significant trading in Fed Funds futures as the Federal Open Market Committee is continuing to target the Federal Funds rate, not SOFR. The combination of Fed Funds and Eurodollars is still larger than outright SOFR trading.

“Hence it ‘makes sense’ to trade the underlying future,” added Barnes. “It would have been great to have seen this activity transition to SOFR in terms of RFR adoption.”

SOFR options

CME Group reported that open interest in SOFR options reached a record 10.36 million contracts on August 9.

The single-day open interest in SOFR futures and options hit a record 17.66 million contracts, as average daily volume for SOFR futures and options reached a record 2.46 million in August.

Agha Mirza, group global head of rates and OTC products at CME, said in a statement that SOFR options open interest has grown at a record pace in 2022 for any listed options on a fixed income product.

“With open interest of 10 million contracts, SOFR options have now joined the top three largest fixed income listed options markets, becoming a highly liquid and leading risk management tool for our clients,” he added.

So far in August 2022, SOFR options average daily volume (ADV) has grown to a record 606,225 contracts, 57% up from 386,018 contracts per day on average during July 2022.

“SOFR futures ADV in August is equivalent to 150% of Eurodollar futures ADV and SOFR options ADV is equivalent to 138% of Eurodollar options ADV in August,” added Mirza.

The exchange had launched a SOFR First for Options initiative for June and July of this year. CME said it would take additional steps to build on the growth seen in SOFR futures to help significantly increase SOFR options trading including a market-wide fee waiver for SOFR options and additional market making incentives during these two months to help enhance liquidity in all venues.