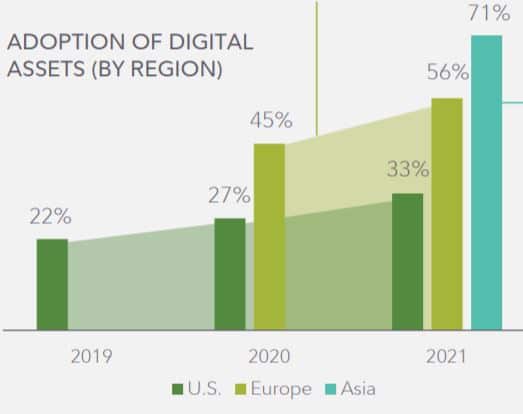

The latest Institutional Investor Digital Assets Study by Fidelity Digital Assets included responses from Asian investors for the first time this past year, and found they were far more accepting of digital assets than their US and European counterparts. Of the 299 Asian institutional investors surveyed, 71% had adopted digital assets, with 9 in 10 indicating they were actively exploring opportunities. This compares to digital asset adoption among 56% of the European institutional investors surveyed and 33% of the US ones.

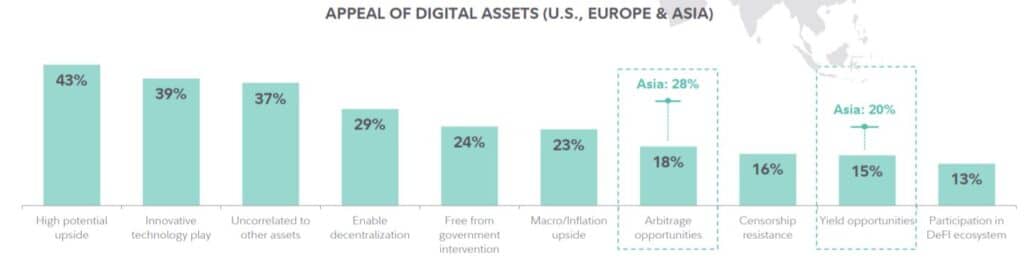

There was also significant divergence in opinion among Asian investors when asked about more nuanced aspects of digital assets, such as arbitrate and yield opportunities. The study concluded that the differentiated interest in these more complex spaces of the digital asset market is yet another way in which Asian institutional investors are ahead of the curve relative to the West within this asset class.

“Asia was definitely an early mover when it came to institutional focus on digital assets, but the rest of the world is starting to catch up,” observed Samar Sen, head of Asia at US-based crypto-trading engineering company Talos. Until recently, “unless an investment firm launched as a digital-native crypto fund, it was challenging to enter the market in a significant way due to concerns around security, custody, liquidity, settlement, regulation, AML and so on,” he added. “These have largely been addressed over the past few years with the help of firms like Talos, and we are now seeing the largest institutional investors enter the markets at scale, in Asia and globally.”

A few jurisdictions are vying for the position of Asia’s crypto hub, including Singapore and Hong Kong. “Singapore has emerged as one of, if not the, leading crypto hubs in the world, for a few reasons,” commented Sen. “Obviously, it starts with its progressive regulatory stance on digital assets, its business-friendly climate, and its strong fintech ecosystem and talent base. Beyond that, we’ve also seen that positive regulation around digital assets can bring a lot of crypto innovation – Singapore is an example, as is the US, UK, Switzerland, Germany, Hong Kong and so on. Finally, crypto is obviously a 24/7 market, so given Singapore’s 12-hour offset from New York it’s an ideal location for Talos to situate a secondary support hub as we introduce a follow-the-sun support model for our clients.”

One way in which Asia lags the West, however, is in its lack of crypto ETPs. Following the launch of several bitcoin ETFs in the US and Canada and other crypto ETP listings in Europe, the Asia Pacific market appears ripe for crypto funds. “Asset managers in the region are actively looking to explore opportunities and having an understanding of the regulators attitude towards these products will be an important consideration,” noted Irfan Ahmad, APAC Product Head at State Street Digital.

Those attitudes diverge considerably across Asia. Singapore has started granting regulatory consent to service providers of virtual assets under its the Payment Services Act, and security tokens under the Securities and Futures Act. China has gone in the opposite direction, declaring all crypto-related transactions in the country are illegal, including services provided by offshore exchanges.

Despite such inconsistencies, Asia as a whole is a dominant force in crypto. Ahmad pointed to a Chainalysis report that found 40% of the bitcoin on-chain activity conducted on the top 50 exchanges originates in Asia Pacific. “To date, investors in the region seeking exposure to crypto assets ─ such as hedge funds and family offices ꟷ have turned to private funds, that are commonly domiciled in offshore jurisdictions, and make use of alternative fund structures,” he explained. “Those asset managers looking to launch ETFs, may see initial participation in crypto via alternative funds as a means of not only testing market demand but also reassuring regulators about the issuance of mainstream ETF structures for crypto in their markets.”

As for the impediments to introducing listed funds to the region, “regulators have continued to voice concerns about pricing of crypto assets, which is yet to be standardized. Further, some markets do not yet have clear rules in place to facilitate this. The significant volatility of the underlying assets is another concern that complicates ETF approval. While crypto ETFs would trade on exchanges and be subject to trading hour restrictions, cryptocurrencies can be traded 24/7, leading to fears of how investors could be negatively impacted with no real-time exit option,” he noted.

Ahmad revealed that while regulators in Asia Pacific remain undecided about approving ETF issuance, a number of them are granting Recognized Market Operator (RMO) licenses to newly established digital asset exchanges. These can operate as private exchanges to begin with and will limit membership to accredited and institutional investors. Eventually, these exchanges could play a pivotal role in the development of the ETF market in the region.