2022 has already been a volatile and unique year in history for the asset management industry in Asia. COVID-19 has changed the way asset buyers operate and trade, and now sanctions have been placed on Russian issuers across the globe by international organizations.

Asset buyers are keeping their ears and eyes on the U.S. Federal Reserve as they implicitly hint at increasing interest rates, which will impact the liquidity across Asian markets.

Incorporating environmental, social and governance (ESG) into an investment strategy has also become one of the main themes and drivers for asset buyers across Asia-Pacific.

Inflation & Fed’s rate hikes

As the U.S. Federal Reserve’s signals that it will increase interest rates to combat rising inflation, along with the geopolitical situation intensifying in Europe, asset buyers are revaluating what assets will perform and which assets are caught between the cross hairs of both risks.

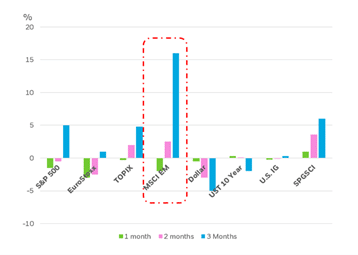

BlackRock’s analysis, which is based on past events of the Federal Reserve interest hikes, demonstrates that after volatility in the first three months after the rate increase, equities will experience a recovery. While median returns over six months for the S&P 500 and Japan’s TOPIX’s stand at around 5%, emerging markets are the only ones that power to double digits. An accommodative central bank and record fiscal stimulus is also set to favor the second largest equity market in the region– Japan, according to BlackRock’s analysts.

“COVID-19 may delay but won’t derail the activity restart that has underpinned a surge in corporate profits, its impact though will vary by country. The risks relating to a flare up in the coronavirus cases or a new mutation that evades current vaccines and force economic shutdown remain,” Winnie Khattar, Head of Market Structure iShares APAC at BlackRock told GlobalTrading.

“While some of these challenges could be short-lived, the investment case for sustainable holds strong over a long-term horizon. There are opportunities in both the long-term, by building potential resiliency into portfolios through broad ESG ETF allocations, and in the near-term, where ETFs can help investors target tactical investment opportunities that may lead to outperformance,” she added.

In other words, BlackRock told GlobalTrading that the three main themes emerging across investors in Asia in 2022 are the following:

- Inflation & central banks action, coupled with geopolitical tensions

- China ongoing policy

- COVID-19 related volatility

Federated Hermes told GlabalTrading that from an asset allocation perspective, they are seeing institutional clients spending some time thinking about whether the investment style bias they are exposed to is appropriately weighted, and specifically, if they are thinking about adding more value style investments into their overall portfolio mix.

“We are seeing institutions think about how to hedge themselves against rising interest rates. One way we are helping them do that is through floating rate investment products,” said Jakob Nilsson, The Executive Director – Head of Distribution, Asia Pacific of Federated Hermes. “For wholesale clients (private banks in our case), there is still a lot of focus on thematic funds, specifically in the sustainable investing space where we are a market leader,” he concluded.

Hedging against European geopolitics

Russia’s invasion of Ukraine is Europe’s darkest hours since World War II. It has caused Russia’s stock market to plumet by more than 40% and has resulted in an unprecedented and tragic amount of pain and death in Ukraine.

Since GlobalTrading covers asset buyers, we will focus on how the Russian invasion has impacted asset traders across Asia.

This week, GlobalTrading covered that the Singapore Exchange (SGX) recently published its expectations if the issuer, or any person or entity closely associated with the issuer, is exposed to sanctions-related risks, according to an official statement.

Singapore is also prohibiting transactions and financial services that facilitate fund raising to the Russian government and entities owned or controlled by them. The prohibition applies to the buying and selling of new securities and providing financial services that facilitate new fundraising.

South Korea, New Zealand and other Asian nations are seeking to impose sanctions on Russia that will impact Russian insures in Asia also. This has caused asset buyers across the region to find ways to hedge against Europe’s geopolitical risk.

Luca Paolini, Chief Strategist for Picket Asset Management wrote in a recent note that investors should maintain a fine line between keeping calm and being complacent.

Paolini wrote that “raw materials, gold, Swiss France, and Chinese assets could all serve as potential risks against such risks. He believes that inflation is a much greater risk, particularly given that the Ukraine crisis has caused a surge in oil prices – which were already high in the first place.

Even before the Russian invasion Picket Asset Management had raised its forecast for global inflation to 5.1% this year (from 4.1% a month ago).

Incorporating ESG is top priority for investors in Asia

Sustainable investing is taking Asia-Pacific by storm as institutional investors accelerated their ESG investments in the last two years, since the outbreak of COVID-19.

ESG investing prioritizes a company’s positive contributions to its community, the environment, and social impact. Rating companies along ESG metrics allows investors to screen potential investments to a line with their investment goals.

The global pandemic has raised the importance of ESG issues among investors across Asia, highlighting how tragic events such as global warming would impact returns.

Almost 80% of investors in Asia-Pacific increased ESG investments “significantly” or “moderately” in response to Covid-19, according to a MSCI 2021 Global Institutional Investor survey.

Asset management firms across Asia are also fighting to acquire talent who can execute ESG practices as more than 60% of investors in the region are integrating ESG into their investment strategy in the last three years, which can be compared to 30% in Europe and 44% in North America, according to BNP Paribas ESG Global Survey 2021.

Finding people who can help drive sustainability remains a challenge but given the importance of ESG to younger investors – and potential employees.

“Effective ESG fund managers in Asia need to have a hybrid profile; they must have a handle on the data science, along with a robust understanding of business, investment strategy, and the region,” said Amandine Lang, Sustainable Business Manager at BNP Paribas CIB APAC.

All asset buyers, consultants, and technologist that GlobalTrading spoke with said that asset management in Asia is here to stay and will only grow as millennial investors demand that their ETFs and mutual funds have ESG values incorporated in them. Asset managers that incorporate it will attract more investors; ones that don’t will struggle in the future across Asia.

“The ESG landscape in terms of who is leaders and who is not is still in a flux,” said Parijat Banerjee, Director, Global Markets and Asset Management, Asia-Pacific in Coalition Greenwhich. “But in three to five years, we are really going to see who the winners in asset management are and who are not. This is the time that asset managers in Asia should begin incorporating ESG values and requirements into their strategy,” he concluded.