Dave Abner, global head of business development at regulated crypto exchange and custodian Gemini, expects crypto exchange-traded products to gain $100bn in assets over the next five years.

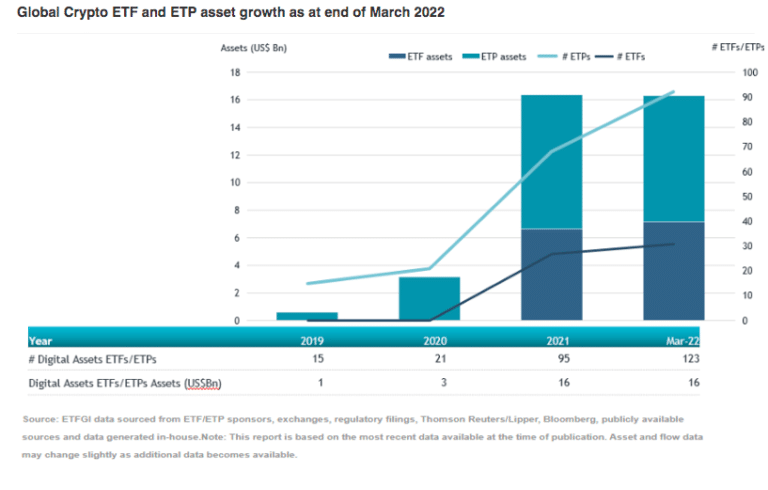

Total assets invested in crypto ETFs and ETPs were $16.3bn at the end of the first quarter of this year according to ETFGI, an independent research and consultancy firm. Crypto ETFs and ETPs listed globally gathered net inflows of $859m in the first three months of 2022, approximately half of the $1.6bn gathered in the same period last year.

Abner told Markets Media: “My expectation is that over the next five years there will probably be another $100bn in crypto ETFs.”

Before joining Gemini Abner worked in the ETF industry at WisdomTree Asset Management, including as chief executive of WisdomTree Europe, and at BNP Paribas. He claimed Gemini has the largest business servicing crypto ETF providers.

In March 2021 the crypto firm launched Gemini Fund Solutions, a unified platform providing issuers with custody, clearing, trade execution, and other capital markets services specifically designed for crypto fund vehicles, including ETFs. Abner said Gemini already supports crypto ETFs in Canada, such as the Purpose Bitcoin ETF, Brazil and Europe.

“There are plenty of issuers around the world that are working on crypto ETFs and we expect new regions to be opening up all the time,” he added. “I think it is going to be a very large industry.”

Gemini will be providing custody and clearing for Cosmos Asset Management, who will be among the first issuers to list an ETF that holds physical crypto on an Australian exchange. The Cosmos Purpose Bitcoin Access ETF in Australia has a fund of funds structure and will hold the Purpose Bitcoin ETF.

“Gemini Fund Solutions includes our institutional class custody and a unique clearing mechanism which is not offered by anyone else in crypto,” added Abner.

He continued that Gemini will support physical spot crypto ETFs in the US once they are approved by the Securities and Exchange Commission.

Separately managed accounts

Abner argued that a differentiator for Gemini is that it offers a full stack of services from custody to execution that work seamlessly together under one umbrella.

For example, in January 2022 Gemini announced the acquisition of BITRIA, a digital asset portfolio management platform for wealth and asset managers. BITRIA’s Digital Asset Separately Managed Account (SMA) and Digital Turnkey Asset Management Platform have been integrated into Gemini’s platform giving Gemini BITRIA the ability to offer financial advisors and wealth managers access to the crypto ecosystem and manage client portfolios seamlessly from one interface.

On April 27 Gemini announced the launch of Bitwise Asset Management’s first crypto separately managed account vehicle on the Gemini BITRIA platform.

Gemini is also launching a full service prime brokerage for crypto assets as institutional interest in the sector grows.

In January 2022 Gemini announced the acquisition of Omniex, a trading technology platform that provides order, execution, and portfolio management system solutions for institutional crypto trading. Gemini said the integration of Omniex with its existing crypto custody, clearing, and over-the-counter trading capabilities will enable the public launch of Gemini Prime in the second quarter of 2022 after supporting a select client base over the past year. Abner said the launch of the full service crypto prime brokerage is on schedule.

Crypto outflows

There is currently a sell-off in crypto markets but Abner believes institutions have already decided that their long-term strategies will involve crypto. He added: “You are still seeing a lot of new fund launches in the crypto space.”

For example, on 2 May Hashdex listed its first crypto ETPs tracking the NCI Europe Crypto Index at SIX. Hashdex is the fourth new crypto ETP issuer to join SIX Swiss Exchange this year. The listing took the number of crypto ETP listings at SIX Swiss Exchange since the beginning of this year to 69 and the number of crypto ETP issuers overall to 12.

Christian Reuss, head SIX Swiss Exchange, said in a statement: “I’m delighted to see that for its European market entry, Hashdex, with its strong track record starting in Brazil, chooses the Swiss jurisdiction because of its legal certainty, world-class infrastructure and our stable trading system.”

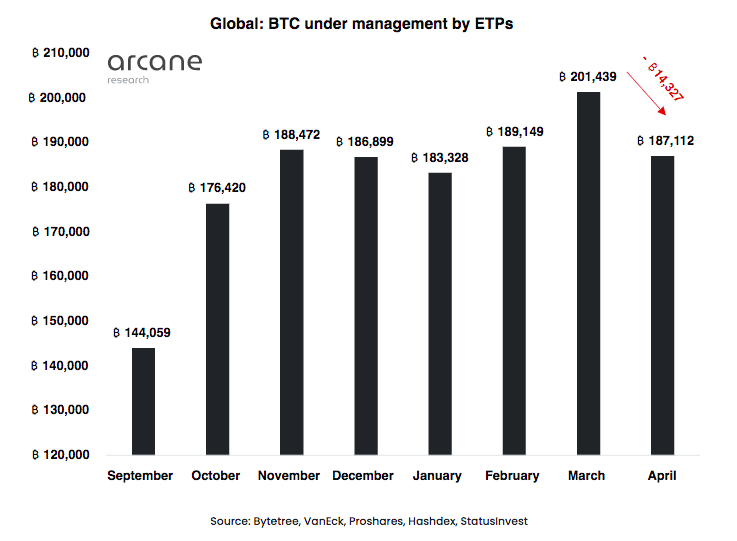

However, Arcane Research said in a report that April had the largest monthly Bitcoin ETP net outflows in history, reversing all gains seen in March.

“The global bitcoin holdings of BTC ETPs shrank to 187,000 BTC by the end of the month,” added the report. “All regions except Brazil saw net outflows. Brazil saw minor net inflows but remains small in a global context.”