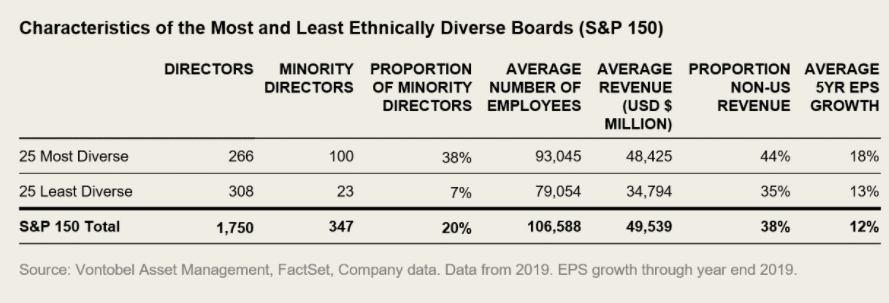

The most ethnically diverse boards among the 150 largest companies in the S&P generated higher earnings per share growth than companies with the least diverse boards according to research by Vontobel Asset Management.

Sudhir Roc-Sennett, head of thought leadership & ESG at the Quality Growth Boutique of Vontobel Asset Management, told Markets Media there is a lack of data and research on ethnic diversity.

As a result Vontobel took a deep dive into every single DEF-14A filing – where companies have to make a statement on their policies regarding diversity – across the 150 largest S&P companies and the fund manager’s US holdings.

Roc-Sennett said: “People are a silent asset and a massive cost. Yet companies do not even have to report turnover figures which is where the three former investigative journalists on our team help to track down important information that, while public, isn’t easy to find.”

He continued that women are becoming successful at debiasing companies.

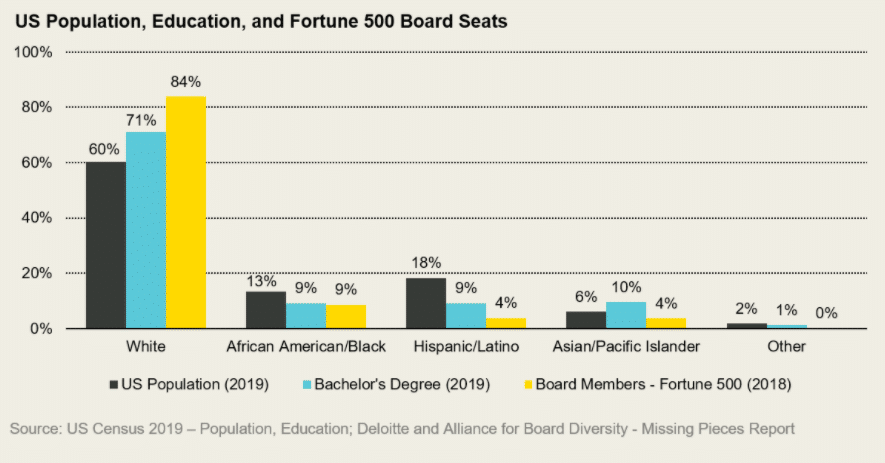

“However 40% of the US population are minorities while 69% of the board members for the Fortune 500 are white males,” he added.

Roc-Sennett wrote in a blog that Vontobel’s study found that the companies with the most ethnically diverse boards, on average, achieved a higher proportion of their business in international sales and generated a higher five-year EPS growth than companies with the least diverse boards.

“When we fail diversity in our boardrooms and workforce and eliminate certain groups from well-paid or influential jobs, the costs are borne not only by society but also in diminished long-term shareholder returns,” he added.

The most diverse sectors were health care and IT, while IT was also amongst the least diverse sectors alongside real estate.

Vontobel said companies with large international business potential have more diversity at the board level while industries such as real estate tend to be more domestically focused.

“This was also reflected within the IT sector, which is over-weighted in both the top and bottom groups,” added the blog. “What we found is that the IT firms in the top group had much greater international business exposure (average for the 6 firms was 73%) than the 5 firms in the bottom 25 (45%). Two of the bottom group’s IT firms were payments companies.”

In addition, businesses that compete on rapid innovation and were consumer-facing tended to have more diverse boards.

“Of the top 25 just over half were consumer facing, including Starbucks, Apple and Mastercard,” added Vontobel. “Within the bottom 25, just under one third directly face the consumer.”

Engagement

Roc-Sennett said the asset manager will only engage with firms where they feel they can make an impact and improve performance.

“Environmental, social and governance strategies are comparable to taking care of your personal health; you need to deal with structural problems rather than just treating symptoms when they become chronic,” he added.

For example, Vontobel has been liaising with the NY Comptroller, trustee of the New York State Common Retirement Fund, on diversity.

“The NY Comptroller has highlighted 56 large companies without a diversity policy, asking for an improved approach,” he said. “Several of these have gone to shareholder vote, including Berkshire Hathaway where they proposed a policy for recruiting directors and CEOs, and we voted alongside them on this initiative.”

Roc-Sennett concluded that diversity of thought is not only a proven driver of innovation but also of shareholder returns.

“Building out and supporting corporate diversity is not just the right thing to do – it would be madness not to,” he added.

Russell Investments

Russell Investments evaluated the return differential from asset managers who integrated ESG well into their investment practice relative to those who did not and the return from equity products with lower ESG-related risks to those with higher ESG-related risks.

Can asset managers improve outcomes by considering #ESG? What our data shows: https://t.co/DSpxNn5yai

— Russell Investments (@Russell_Invest) July 28, 2020

Leola Ross, director, capital markets research and Ningning Wang, research analyst, said in a blog: “In both cases we found evidence that considering ESG produced a return premium.”