The development of electronic trading in Asia can be classified into three distinct phases of progress.

Evolutionary Computing A Way Forward?

Looking back at the development of algorithmic trading and treating it as an evolutionary process, it is evident that no strategy is ever really complete. Algorithms must evolve! As such, the sell-side needs a dynamic framework that can support continuous measurement, analysis, and improvement.

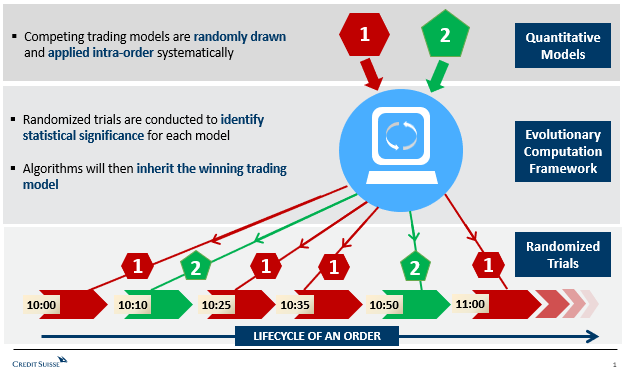

Figure 1

In computer science, evolutionary computing is employed in problem solving systems based on the Darwinian principles of natural selection. The idea is a simile of the biological order: given a population of species, environmental pressure results in a ‘natural selection’ dynamic whereby the species with the most advantageous characteristics survive and grow in the corresponding environment. Though humans are the most powerful species on the planet overall, polar bears rule the arctic, lions rule the savannah, and sharks rule the ocean reefs. By applying the same principle to algorithm design, an evolutionary computing framework pits new and existing quant models against each other to identify the best suited strategy for trading orders based upon their particular characteristics.

Introducing AlgoKaizen™

Kaizen, a Japanese term, meaning ‘continuous improvement’ is adapted from the philosophy pioneered by the Japanese manufacturing industry in the 1930’s that suggests that there is no perfect model, and that ‘systems’ must be designed to evolve and innovate constantly. Credit Suisse’s AlgoKaizen™ is an evolutionary computing framework that automatically allows for the performance assessment of competing models by using child-level randomized trials to switch between them throughout the order lifecycle for every indivdual parent order. The trial results are grouped and classified to determine the best model for a particular set of order characteristics and market conditions. Trading strategies then select the winning model, which is at the heart of what is required for delivering ‘best execution’.

A defining feature of a VWAP strategy is that it must make an intelligent assessment of when to be patient and when to pay the spread within in its overall execution trajectory plan. For this example, assume you have an existing model, Model A, which waits for the scheduled bucket time to elapse before crossing the spread. A new model is introduced, Model B, which uses the same idea, but now adds a function to look at current order book imbalance and time remaining before the bucket elapses to vary its decision making. Both models are made available to the strategy, and for the duration of any order created, a set of child-level randomized trials are run that switch randomly between Model A and Model B, illustrated in Figure 1.

Spinning Wheels

With the introduction of the algo wheel, a challenge we all face is to measure performance on the basis of unbiased data that is statistically significant. The most common form of data evaluation on the street is order-level randomized trials. At the simplest level, this tests two variants, A and B, by sending orders randomly in order to directly compare performances. Since the meaningfulness of parent-level randomized trials relies heavily on a large sample size of comparable observations over significant time horizons, the lack of turnover in several markets results in statistically insignificant observations. The AlgoKaizen™ framework solves for this problem by subjecting the two models to systematic child-level randomized trials within the duration of a single order. This process substantially increases the number of statistically significant observations even in lower turnover environments.

Furthermore traditional parent-level randomized trials assume that the extraneous factors like market regimes and order characteristics are balanced evenly across the different models. That does not always happen, and the resulting data prevents an apples-to-apples comparison. So using the traditional approach, a model that gets more data trading during inactive months could appear to be better than the model whose strength is trading around elections simply because that regime lasted longer. As the AlgoKaizen™ framework allows for child-level randomized trials on the same order it can accurately compare the effectiveness of models across different order book regimes (e.g. momentum, reversion, range bound scenarios).

Figure 2

Figure 2 illustrates a sample of the data explosion created by using child-level randomized trials over traditional parent-order randomized trials. Algorithms benefit by being equipped to systematically apply the ‘fittest’ model that is statistically proven to be effective under a particular set of conditions, allowing for a more robust and accurate process of trade planning.

Future of Self Progression Framework:

At present, the bulge bracket brokers are experimenting with ways to improve the efficiency of rolling out new algorithms to the buy-side. Just as how smartphone users now install the latest mobile operating system through a simple click of an “update” button, similarly evolutionary computing enables the buy-side to utilize the latest trade planning tools without needing to implement brand new algorithms.

The benefits of evolutionary computing does not stop there. We envision this framework will be especially important for clients who use Algo Wheels, where there is a need to optimize trading across multiple objectives and to turn around changes quickly. It is important to note that having a customizable platform that can support automated randomized trial testing and trade segmentation is only a starting point. The key to any self-progression framework is the ability to perpetually create, measure, and deploy new trade planning models. To achieve this, the sell-side needs to be in constant dialogue with the buy-side to understand their order profiles and trading objectives. The race to find the ‘fittest’ quant models has officially begun!