“big board” had been built on a technology stack that was overly complicated, hard to manage and unreliable.

ICE has completed rebuilding the technology stack for the New Stock York Exchange, which it acquired in 2013.

Jeffrey Sprecher, chair & chief executive of ICE, said on the third quarter results call on 2 November that the New York Stock Exchange had been built on a technology stack that was overly complicated, hard to manage and unreliable.

Since ICE acquired NYSE it has aimed to completely rebuild the underlying architecture with modern technology. However, given the importance of the stock exchange to the global economy, the exchange had to remain in daily use and retain its extensive connectivity to the global financial services industry, while at the same time customers could not be required to invest in making changes on their side of the firewall. Sprecher compared this process to building a new bridge while cars continue to drive across it.

“We wrapped the old technology with a modern front end and methodically rebuilt and replaced all the back-end hardware and software,” he said. “This process took us years to execute with our successful final software rollout just a few days ago, which removed the last of the NYSE’s seven legacy matching engines.”

Sprecher described the NYSE as now sitting on top of one of the most powerful, deterministic performance and resilient technology stacks in the world.

He continued that ICE is also being asked a lot about its adoption of large language models and learning algorithms. ICE has been investing in adaptive learning tools for more than a decade and incorporated learning tools into the ICE Chat system to automate workflows based on unstructured conversations between traders and the back office. The group has also been deploying learning models in its compliance efforts to recognise abnormal trading patterns.

Energy complex

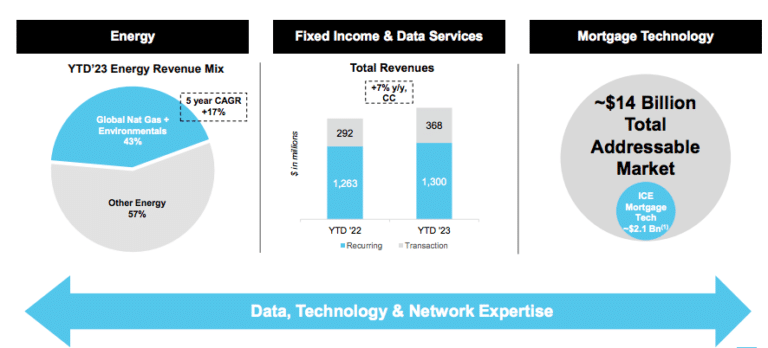

Ben Jackson, president of ICE and chair of ICE Mortgage Technology, said that ICE saw the importance of investing in an energy platform that is truly global a number of years ago. As trade dynamics become increasingly complex, customers are seeking liquidity in major global benchmarks and in products that provide for greater hedging precision and ICE’s global oil complex spans over 700 products including locational spreads, product spreads and refining spreads. He described ICE as the natural home for liquidity in these products with open interest in the oil complex rising 26% year-over-year to the end of October, while developing global gas benchmarks across North America, Europe and Asia.

In environmental markets, Jackson said ICE recognised the importance of carbon price transparency over 10 years ago by acquiring the Climate Exchange in 2010. Corporates and market participants remain committed to environmental policy to reduce carbon emissions which Jackson is is illustrated by continued growth and active market participants of 9% year-over-year.

“Cleaner energy sources, including global natural gas and environmental, made up over 40% of our energy revenues today and have grown 70% on average over the past five years, including a 30% growth in the year-to-date,” added Jackson.

Financials

ICE reported record quarterly revenues of $2bn for the third quarter, up 11% year-on-year, with net income of $541m.

Warren Gardiner, chief financial officer, said on the results call: “In the third quarter, we once again generated revenue and earnings per share growth, driven by a continuation of robust trading results across our commodity complex and compounding growth in our recurring revenues.”

Across ICE’s business segments, exchanges net revenues were $1.1bn in the quarter, fixed income and data services revenues rose 4% to $559m and mortgage technology contributed revenues of $330m.

In the exchanges business, transaction revenues of $754m were up 13% year-over-year, driven by 45% growth in energy revenue. Performance included 48% growth in global natural gas revenues and robust trends across global oil. Average daily volume grew 40% year-over-year and open interest at the end of October was up 26% over the same period.

In fixed income, transaction revenues increased by 6% to $123m, including 9% growth in execution and 5% growth in credit default swap clearing. ICE has completed the cessation of CDS clearing at ICE Clear Europe and shifted final positions to ICE Clear Credit.

Gardiner said: “Recurring revenues grew by 4% driven by strong growth across our desktop and derivative analytics offering, as we continue to see strong demand from energy and environmental focus customers, as well as the continued robust growth in our ICE Chat offerings, driven in part by growing adoption of large language models.”

Lynn Martin, president of NYSE and chair of fixed income & data services at ICE, said on the call that ICE Chat user growth is up 13% year-to-date, which boosted revenue and activity generated within energy markets.

“Energy activity generated through large language models in our energy markets was up 90% quarter on quarter compared to last year and 70% year-to-date,” she added.

Martin continued that ICE Bonds had really strong growth over the third quarter, particularly given the muted volatility in the municipal bond market and the group has been able to continue to increase adoption of munis by the retail and wealth management segments, and has also benefited from increased adoption by institutional users.

“As we’ve continued to interact with the front office customers, we’ve seen continued increasing demand for our front office tools,” added Martin. “There continues to be strong demand for those products as fixed income markets continue to electronify which manifests itself in a shortening sales cycle.”

Jackson continued that business that investments in consolidated feeds has led to accelerating adoption by large financial institutions.

In addition, ICE’s index business had double-digit growth in ETF assets under management as at the end of the third quarter, with more than $0.5 trillion in assets selecting ICE indices as their passive benchmark, according to Jackson.

In September ICE also completed the strategic acquisition of Black Knight for its mortgage technology business.

Jackson said it has been less than two months since the Black Knight acquisition closed and the firm is being integrated into the ICE mortgage technology network, which increases efficiency for customers.

“As we’ve seen across our network in futures and fixed income, these efficiency gains are best achieved through harnessing unstructured data to create mission critical information, seamlessly linking participants to that information and ensuring that the network technology underpinnings are of the highest quality and security,” Jackson added. “It is the execution of this value proposition that often propels an analogue to digital conversion of an industry and it is a blueprint that we have applied across all our businesses.”