Settlement instructions from Asia to the US and Canada need be accelerated.

This article first appeared as Beyond Liquidity on Markets Media. Beyond Liquidity is produced in collaboration with Liquidnet.

DTCC, the US post-trade infrastructure provider, and FIX, the industry-driven standards body, have both launched products to enable more efficient, speedy communication between buy-side firms, custodians and brokers due to the global impact of the US and Canada shortening their settlement cycles next year, especially in Asia.

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on 28 May 2024 in the US and on the previous day in Canada. The US Securities and Exchange Commission said the aim is to reduce latency, lower risk and promote efficiency and greater liquidity.

Asia

Although the US and Canada are migrating to T+1 next year, global demand for North American equities means this will result in operational challenges in other regions, especially in Asia. Due to time zone differences, Asian back offices will be handling the majority of their cross-border volumes on what is effectively a trade-date basis once T+1 goes live, while settlement can currently take several days.

Making Global Settlements Work in Asia, a paper from consultancy The ValueExchange and Digital Asset found that nearly all, 96%, of settlement instructions from Asia to the US and Canada need be accelerated in the next nine months to meet the T+1 deadline.

“At best, the processing is spread across six working days each week (including Saturday mornings) as the majority of tasks need to be managed on a trade-date basis (from FX and funding to securities lending and corporate actions),” said the paper. “At worst, issue resolution can often stretch well into the Asian night and take up to three days for a single problem to be resolved.”

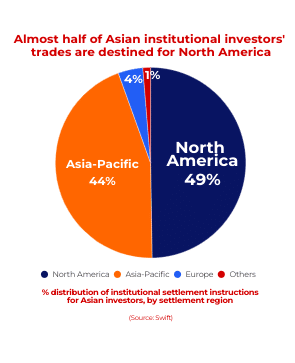

In the institutional space, 50% of Asian, cross-border settlements are for North American securities, ahead of the 45% that remains within Asia. The paper said: “More institutional trades from Asia leave Asia than remain in the region.”

Source: The ValueExchange & Digital Asset

Source: The ValueExchange & Digital Asset

This is particularly urgent as Asian back offices have the highest proportion of legacy technology globally, according to the paper with 40% more than ten years old, and 16% reaching their ‘end-of-life’ point in the coming three years, In addition, technology needs to be upgraded as around 80% of global equities are expected to move to T+1 over the coming few years.

Kelly Mathieson, Digital Asset

Kelly Mathieson, Digital Asset

Kelly Mathieson, chief business development officer at Digital Asset, argued that distributed ledger technology and smart contract languages are well positioned to meet this urgent need, giving back offices everywhere a system for settling trades that is faster and more cost-effective. Adopting a Unique Transaction Identifier (UTI) can also bring the transparency needed to avoid securities settlement failures, increase efficiency and improve the experience of all parties across the entire trade settlement life cycle.

Alex Chow, investment operations lead at the UK Investment Association, agreed in a webinar with Calastone, which provides technology to the buy side, highlighted that the move to T+1 will create a mismatch with the funding lifecycle, particularly with respect to foreign exchange, and in Australia and Asia Pacific.

Sharn Rai, product development director at Calastone, said in the webinar that moving to T+1 requires new processes due to mismatches in the fund operation cycle. For example, many funds still rely on systems like BACS in the UK for payments, which has a T+3 settlement.

Calastone highlighted that in May this year an ISITC Industry Preparedness for Accelerated Settlement survey found that operations staff at wealth and fund managers are less prepared for accelerated settlement than custodians and regulators.

DTCC Testing

One way to prepare it to test and DTCC, the US post-trade infrastructure provider, opened industry testing for T+1 on 14 August this year in the first of 21 bi-weekly cycles that are scheduled to run until 31 May 2024. The program includes opportunities for free-form testing and scripted test scenarios such as holiday processing, double settlement days and testing for recoverability and resiliency.

DTCC said in a blog in September that early indicators from the first week of the program showed that the vast majority of the top industry firms were accessing the testing environment.

In the first week of testing the following firms had started testing:

- 100% of the largest 30 clients of subsidiary National Securities Clearing Corporation (NSCC);

- 90% of the 10 largest 10 clients of DTCC’s Institutional Trade Processing (ITP) service;.

- 70% of the 10 largest clients of subsidiary, The Depository Trust Company (DTC).

Michele Hillery, DTCC general manager of equity clearing and DTC settlement service, said in a statement: “We are extremely encouraged to see such active participation and engagement with the T+1 test environment in this first week among our largest clients, and we are optimistic that these numbers will only continue to grow as testing extends over the next 9 months.”

On 19 September DTCC also said 350 investment managers are now using its central trade matching (CTM’s) automated trade affirmation capabilities to accelerate the post-trade lifecycle, as firms prepare for the move to T+1. The CTM platform automates the trade confirmation process across multiple asset classes, such as equities, fixed income and repos for both cross-border and domestic US transactions.

Val Wotton, general manager of DTCC institutional trade processing, said in a statement: “Given the number of post-trade functions that are impacted by T+1, it is critical that market participants gain an in-depth understanding of their operational efficiency and record keeping obligations as soon as possible.”

FIX messaging

In another move to improve post-trade efficiency cycle FIX, the industry-driven standards body, has launched four new message types which aim to improve operational efficiency, reduce risk and support wider industry initiatives to achieve accelerated settlement.

David Pearson, product manager at Torstone Technology, said in a statement: “FIX’s new workflow and messaging standards will drive significant improvements to post-trade operational inefficiencies by closing the existing communication gap and enabling near real-time updates on securities settlement status for end clients.”