Healthcare and technology are the two core foundations for investing today.

BlackRock’s Rick Rieder said healthcare and technology are the two core foundations for investing today as the economy shifts from carburetors to compilers.

Rick Rieder is chief investment officer of global fixed income, head of the fundamental fixed income business and head of the global allocation investment team at BlackRock, responsible for approximately $2.4 trillion in assets. Tony Pasquariello, global head of hedge fund coverage in the global banking and markets business at Goldman Sachs interviewed Rieder for the podcast, Exchanges at Goldman Sachs: Great Investors. This episode was recorded on 9 August 2023.

Rieder manages funds that are largely unconstrained, which means he can invest across stocks, bonds, geographic and he can also use derivatives.

“I’m hugely blessed to be able to run unconstrained because you can venture to where you think the opportunity is, which can change,” he added. “This year it’s about using derivatives.”

He continued that one of the good calls that BlackRock made last year was to get into cash quickly to reduce duration and risk.

“The beauty of being unconstrained is you try and figure out where the big pockets of alpha are, and then how to manage your portfolio to try and optimise return but manage the downside,” said Rieder.

In the current macro environment, Rieder said there is a 15% chance of the Federal Reserve increasing rates.

“I’m pretty 50/50 on whether you get another 25 basis points or not,” he added. “I think there is at least a 10% chance of something unexpected happening as we live in a world of geopolitical shocks.”

His opinion is that the Fed would like to be deliberate in cutting rates and ultimately bring the Fed funds rate down to a more normalised 2.5%.

Rieder believes the US economy is in pretty good shape. He compared the economy to an eight-cylinder car that used to operate at 10 cylinders due to the amount of gearing that was in the system. Now, the economy is operating at six cylinders or below which he described as “pretty good.”

“Carry is incredibly attractive and you don’t have to take a lot of risks,” he added.

He believes healthcare and technology are the two core foundations for investing today, especially those companies that are investing in research and development.

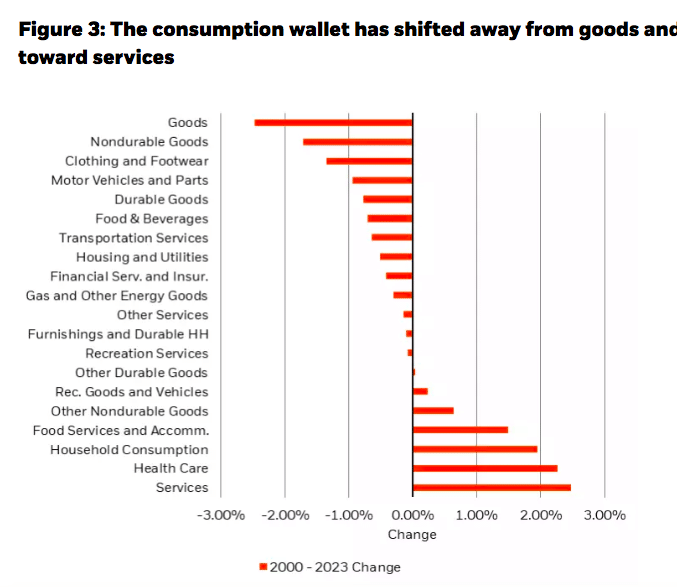

In a recent presentation, Investing in a Changing World: From Carburetors to Compilers, Rieder wrote: ” We are all too often guilty of thinking about the world in the context of a carburetor – a physical, tangible good that once governed the intake of air and fuel into an engine, even when the global economic context is increasingly oriented around something more like a compiler – intangible lines of code that govern communication between humans and machines (think artificial intelligence and machine learning). The economic data that gets collected, studied, and used to analyze the economy, has evolved much less quickly than the automobile industry, and in some cases seems to have gotten stuck in a carburetor world instead of adapting to a compiler world.”

As a result, the services consumption economy is a lot less volatile than a capital intensive, debt-financed, physical goods-based economy and is also labor-intensive, creating a persistent need for workers.

“This is a unique point in time where an investor’s objectives of stable income, capital preservation, and real capital appreciation can all be well represented through a thoughtful portfolio construct, particularly because high quality, short duration assets have the highest yields in more than 15 years,” wrote Rieder. “Investors who are able to build on that naïve barbell example to include emerging markets debt, private credit, or European fixed income can further enhance the carry and risk profile of a portfolio.”

Career

Rieder began his career in finance as credit analyst at SunTrust Banks in Atlanta after finishing business school, without an intention of going into trading.

“I was going to be a financial analyst and somebody in a trading room at EF Hutton asked me why I don’t try trading as I liked dynamic things like sports,” he said. “I remember telling my dad I am going to try this and he said trading is not a career, and I’m still doing it 35 years later.”

He continued that two things that were incredibly important early in his career were a presentation from the head of a casino and the realisation that managing money is about generating returns for clients, which can be very different from being right.

“Those two things taught me a lot about risk management,” Rieder added. “You perception of where the world is, and how people think the world is, is arguably more important than being right.”

Rieder said that one of the things that has evolved during his career is the ability to use data and technology.

“We do so much around data simulation and around sophisticated portfolio construction,” he added. “My closest friends at BlackRock are in risk and quantitative analytics.”