Short interest has reached record levels across equity markets as traders anticipate plunging stock prices, analysis from Global Trading has found. Expressed as a simple average, the short cover ratio for the entire S&P 500 reached a three-year high of 4.15 on 18 September.

In late September, 14 of the S&P 500 had a short cover ratio of more than 10. In October 2023, just one stock was at this level. By the same measure, 103 S&P 500 stocks had cover ratios above five in September – up from 36 the previous October.

The short cover ratio is significant because short sellers borrow shares to sell them, hoping to buy them back later at a lower price. If prices rise, these traders have to cover their shorts, which is costly if the cover ratio is a large multiple of daily volume. Large cover ratios indicate traders are confident that this scenario is unlikely.

A wild card for short sellers are central bank actions to stimulate stock markets. According to a report by JP Morgan, Hong Kong’s short sales ratio fell from 15-22% to 13.6% of market turnover within a week as expectations of rate cuts and stimulus measures in China rose. JP Morgan defines this ratio as total market short interest divided by total market turnover.

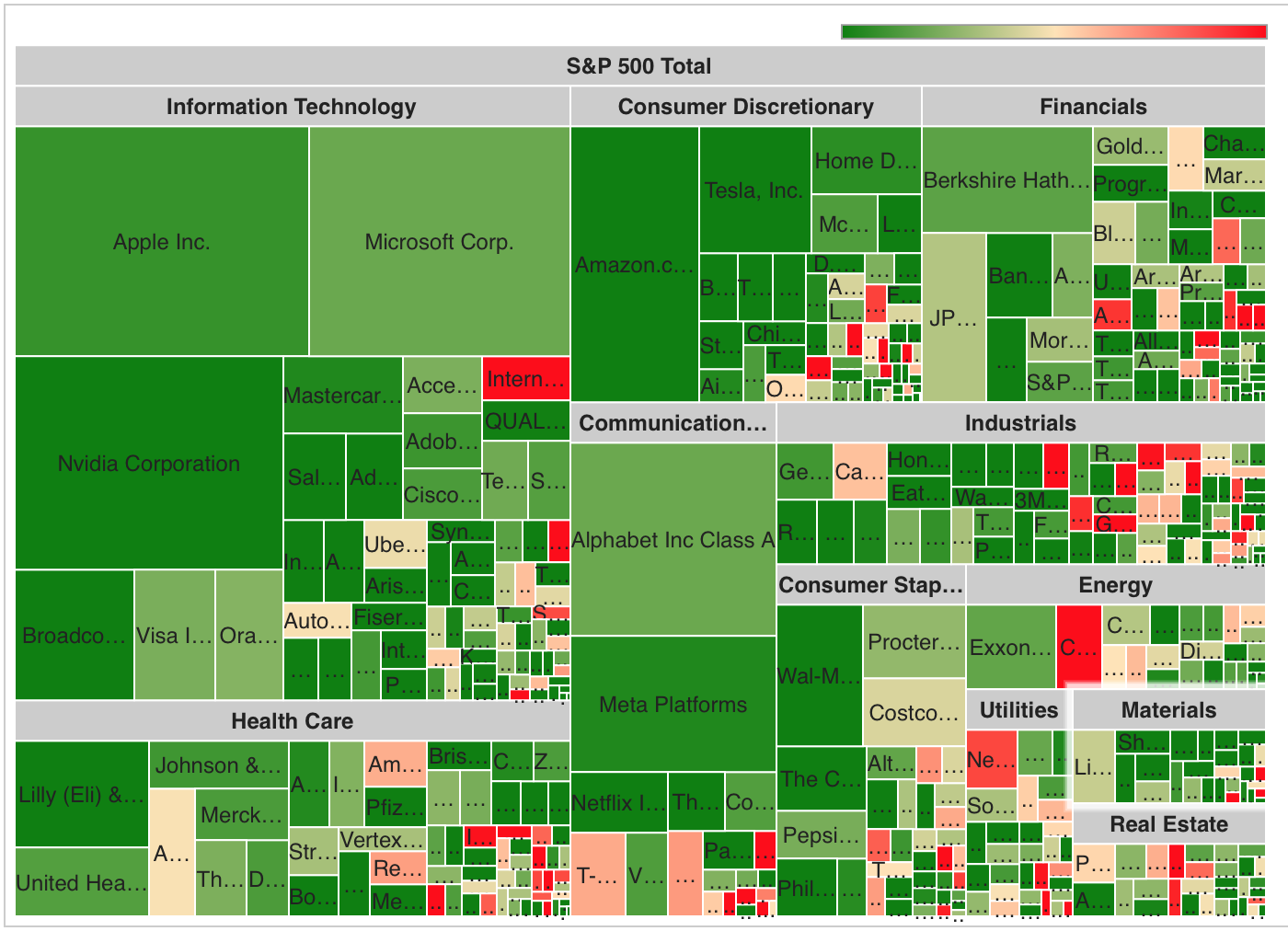

One reason for the increase in short selling may be the overvaluation of technology stocks, which several analysts have raised the alarm about, capital markets consultancy firm GreySpark told Global Trading. Kelvin Lai and Ron Sung, specialists, and Rachel Lindstrom, senior manager, said: “the price of those [stocks] has been going up for quite a long time now, since last year; so some investors may want to lock up their short sale activities. They want to rotate, they may look to another sector to relocate their portfolio. That drives up short selling activity.”

That said, mega-cap tech stocks like Nvidia and Meta still have very low cover ratios, meaning that capitalisation-weighted averages of the ratio underplay the importance of short selling. However, as the top of the index becomes less concentrated, this may change.

Short selling is no new phenomenon, but it’s one that has bred controversy and criticism since its invention – estimated to be more than 400 years ago in the Netherlands. The practice has faced various iterations of regulation across jurisdictions. Currently, fragmentation means that various regions allow short selling under particular conditions, with exceptions, or not at all.

South Korean authorities have recently introduced revisions to the Financial Investment Services and Capital Markets Act (FSCMA), with the goal of improving short sale regulations. The changes have come about after concerns were raised last year around the impact of naked short selling on fair pricing in markets, which culminated in the Financial Services Commission (FSC) issuing fines of KRW 2.5 billion (US$20.4 million) to BNP Paribas and HSBC.

In naked short selling, shares are sold without the custodian transferring ownership and without the investor ever lending the shares. The share owner, in fact, is unaware that their shares have been a part of any trading activity.

This is a risky approach to take. If sellers cannot complete the transaction within the settlement cycle and fail to deliver (FTD) the shares to the buyer, the stock’s supply can appear inflated. In turn, this can negatively impact liquidity and compress prices.

Beyond this, naked short sellers are also known to disseminate false information about stocks in order to cover their short positions at a reduced price and receive greater profits.

Once passed, the FSCMA revisions in South Korea will require institutional investors to set up their own electronic short sale processing systems and prepare relevant internal control standards. New restrictions on the stock repayment period for borrowed stocks will be put in place, monetary penalties will be strengthened and further sanctions will be introduced in order to further disincentivise the activity, according to the FSC.

In Europe and the US, naked short selling is banned with the potential exception in the case of market makers. In Japan, the practice was temporarily banned during the 2008 Greece crisis, and permanently banned five years later. In Hong Kong, it is legal.

Data visualisation by Nick Dunbar

©Markets Media Europe 2024