Buy-side interest is pushing brokers to experiment with alternative trading systems (ATS), which now account for half of the US equity pie when it comes to execution. This portion is set to rise, according to a recent Coalition Greenwich survey.

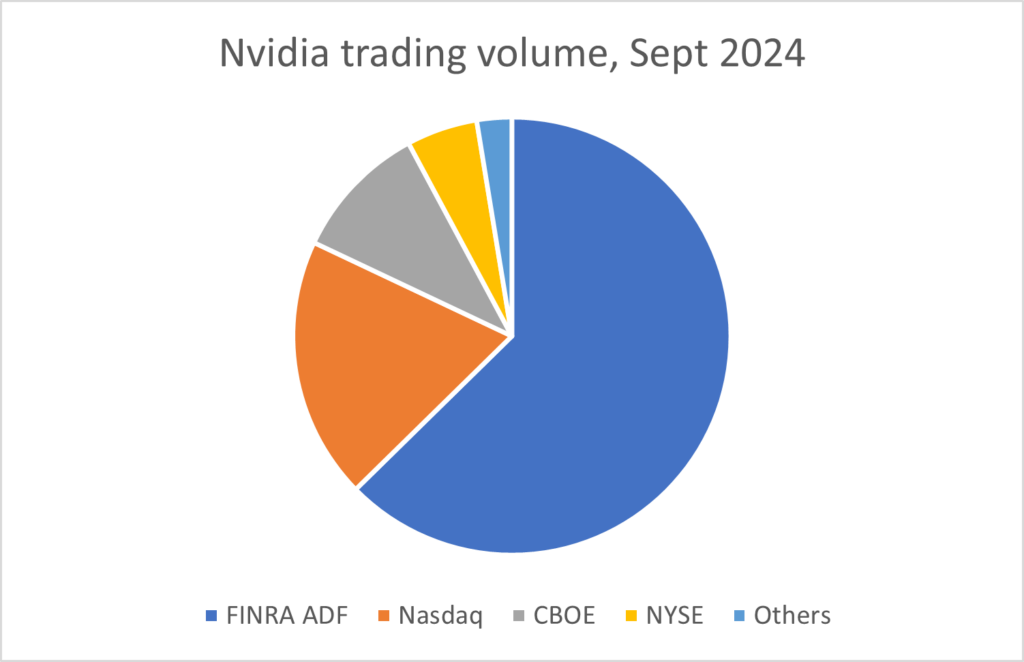

Lit trading, where limit or market orders are posted publicly by brokers, has become a minority activity in US equity markets. Large cap stocks such as Nvidia see about 60% of daily trading volume take place on FINRA’s Alternative Display Facility (ADF) with the remainder on lit venues operated by Nasdaq, NYSE and CBOE.

According to SIFMA’s Q3 2024 report on US equity markets, off-exchange trading makes up 47.3% of market share. ICE follows with 19.6%, Nasdaq with 16.1% and Cboe trails with 10.9%. There are more than 30 ATSs operating in the market, in addition to more than 200 over-the-counter venues, SIFMA stated.

In Coalition Greenwich’s survey, 91% of US low-touch brokers and their buy-side clients reported that they were at least a little interested in new trading venues, and a further 40% of participants wanted to see even more venues to choose from; something echoed by their buy-side clients. No buy-side clients of US low-touch brokers said that they had no interest in new, innovative trading venues; and just 9% of the sell side showed no interest.

The paper’s author, Jesse Forster, affirms that traders must capitalise on the opportunities that new solutions offer; failing to do so means risking falling behind. At present, brokers taking part in the survey stated that they would be able to build their own ATSs, but prefer to outsource – embracing the buy, build and integrate approach.

ATSs can give brokers a competitive advantage, providing clients with the opportunity to experiment with new venues. Taking on multiple new venues can also allow them to scale strategies and increase overall fill rather than creating individual strategies or routers for a single platform.

Compared to exchanges, which are slow to innovate and hampered by regulatory restrictions, ATSs are able to adapt and meet user demand more quickly. Some brokers shared that the mechanisms of an ATS are not important to them; what matters is their ability to provide healthy liquidity. Similarly, ATSs prioritise execution quality in their operations.

While low-touch, no-touch and automated operations are a draw for some, Coalition Greenwich reports that the accessibility of ATSs and their founders and personal customer support play a key role in their appeal to brokers. Building a network is a key to running a successful ATS, and Coalition Greenwich’s survey found that their selective approach helps them to provide enhanced execution quality.

©Markets Media Europe 2024