Aerospace titan Boeing’s record-breaking US$24.3 billion in its latest US equity offering has surpassed the total secondary issuance of the last 12 months at both the London Stock Exchange (US$20.6 billion) and Euronext (US$21 billion).

Outside of the US, just the Tokyo Stock Exchange (TSE) and the National Stock Exchange of India (NSE) have seen more secondary issuance than the company over the past year.

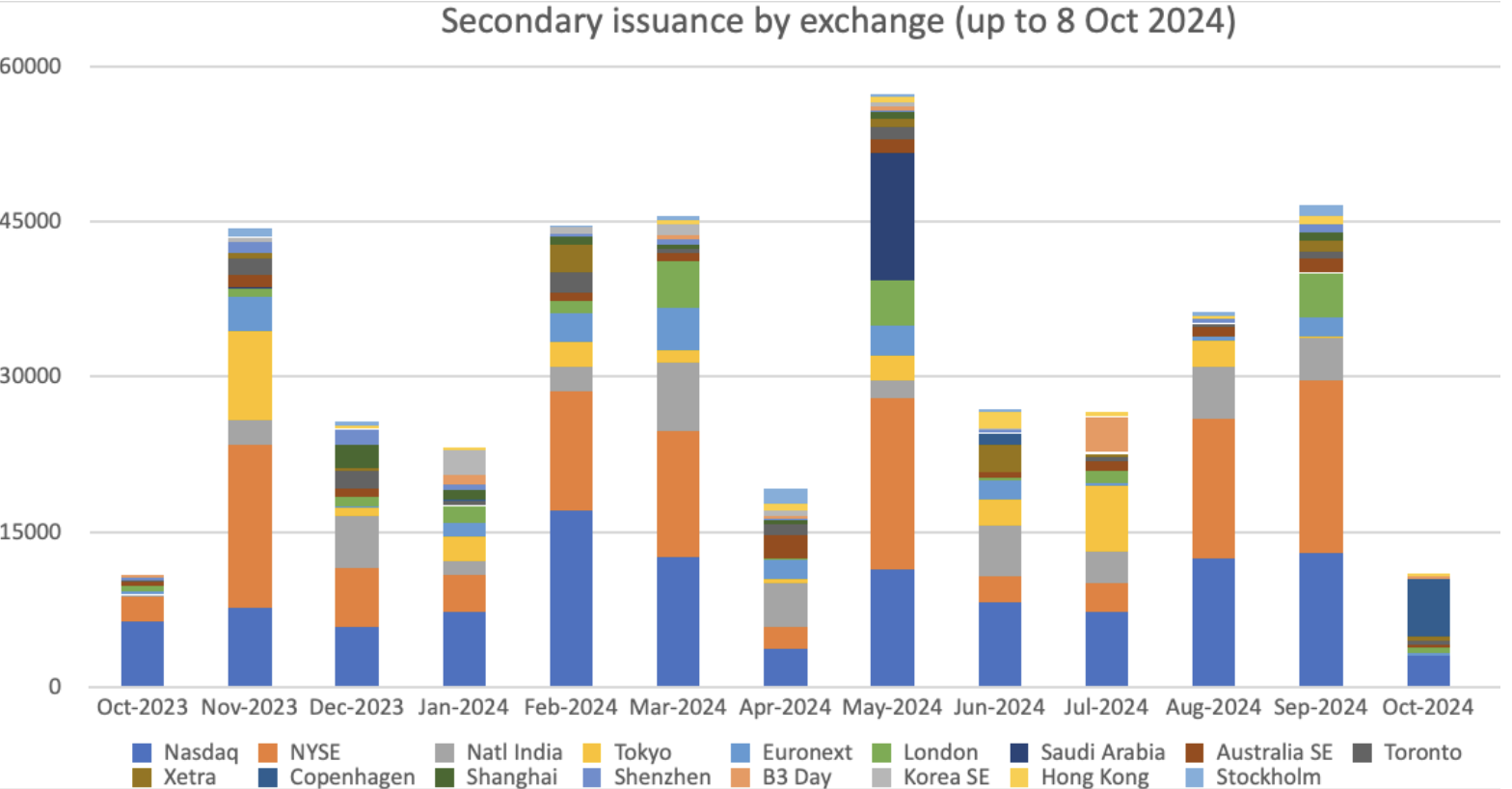

Listed on NYSE, Boeing is set to push the exchange into the top secondary issuance spot above rival Nasdaq. Since the end of October 2023 to 8 October 2024, NYSE has recorded US$105 billion in secondary issuance. Nasdaq has reported US$115 billion. After the NSE (US$41 billion), TSE (US$29 billion) and LSE, Saudi Arabia has seen US$12.6 billion in secondary issuance. This was driven by a bumper US$12.5 billion offering from oil refinery firm Aramco in June.

USD is consistently the most popular currency for secondary issuance, according to Global Trading analysis. Between October 2023 and October 2024, US$226 billion was raised.

Boeing expects to receive US$15.81 billion in net proceeds from the common stock offering and US$4.91 billion from its depositary shares offering, as it seeks to recover from a tumultuous year, strengthen its balance sheet and restore market confidence. Funds will be used for “general corporate purposes”, the company said, including repayment of debt, additions to working capital, capital expenditures, and funding and investments in subsidiaries.

Despite the issuance, S&P Global Ratings has since affirmed Boeing Co.’s credit ratings as BBB-, maintaining its CreditWatch status. This signals the agency’s belief that there is an elevated potential for a downgrade over the coming months, resulting from cash flow and credit measure recovery delays caused by delayed aircraft deliveries.

The risk of delays has been somewhat mitigated by the end of the workers’ strike, which has dogged the company since 13 September. On Monday, the 33,000 participating workers voted to ratify a new union contract with Boeing, the International Association of Machinists and Aerospace Workers (IAM) reported, agreeing to a 43.65% compounded wage increase.

Goldman Sachs & Co, Bank of America Securities, Citigroup and JP Morgan are the lead joint bookrunning managers for the offerings, with Wells Fargo Securities, BNP Paribas, Deutsche Bank Securities, Mizuho, Morgan Stanley, RBC Capital Markets and SMBC Nikko serving as joining bookrunning managers. Credit Agricole CIB, MUFG, COMMERZBANK, Santander, Academy Securities, Loop Capital Markets, Raymond James and Siebert Williams Shank are co-managers, alongside BTIG as co-manager for the common stock offering and US Bancorp as co-manager for the depositary shares offering.

©Markets Media Europe 2024