Passive investment strategies, (indexed funds) have continued growing in 2024, while investors continued their exodus from active equity-based funds.

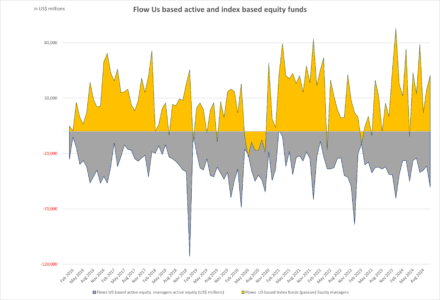

US-based equity index funds saw inflows of US$415.4 billion year to date at the end of October 2024 compared to outflows of US$341.5 billion for active managers, according to data compiled by the US Investment Company Institute (ICI). The flows are part of a continuing long-term trend, with $3.4 trillion of outflows from active funds since 2016 compared with $3 trillion of passive fund inflows, the data show.

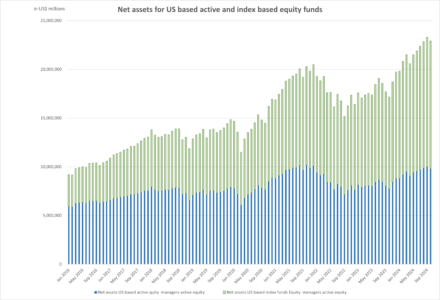

At the end of October 2024, US-based long-term mutual funds and exchange-traded funds (ETFs), net assets under management stood at US$13.13 trillion for equity index funds globally, and at US$10.98 trillion for US-centric equity index funds compared to US$9.78 trillion for global actively managed equity funds, and at $7.26 trillion for US-centric active equity funds. Index funds now account for 57% of equity funds by assets according to the ICI data, compared with 36% in 2016.

Data from ICI, Blackrock and Morningstar showed continued and record-nearing flows for passive investment in equity index funds, and more generally for exchange-traded funds (ETFs), with Blackrock showing net year-to-date inflows of $928.3 billion at the end of October 2024.

The continued outperformance of benchmark indexes over active managers was exemplified at mid-year when S&P Global performance tracking service SPIVA published its scorecard showing 57.3% of active fund managers benchmarked on the S&P500 underperformed the index. This continued outperformance for the index and the cheap cost associated with carrying related products is one of the drivers of investor appetite for passive investments.

Returns this year have been concentrated toward US mega caps which dominate the weightings of the S&P 500 index. With a new administration coming focused on deregulation, Barclays, JP Morgan, Société Générale, and Morgan Stanley have issued research notes predicting a more stock-picking-friendly.

environment in 2025. According to Malcolm Smith, head of the international equities group at JP Morgan:” We believe recent shifts in the economic and market backdrop may now once again favour an active approach to global equity investing.”

©Markets Media Europe 2024