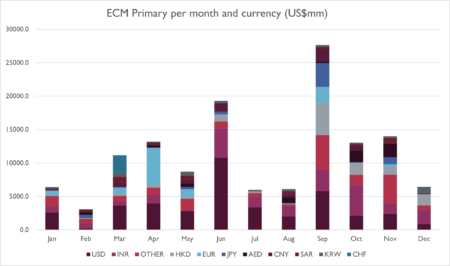

Dollar and Indian rupee-denominated initial public offerings in 2024 accounting for 56 per cent of primary issuance, underscoring the growing importance of India’s capital markets alongside traditional US venues.

The IPO landscape reflects broader shifts in global capital markets, with European financial centres increasingly sharing the spotlight with emerging market venues, particularly India and the Middle East this year.

Nasdaq was the year’s leading venue across its various platforms, in front of India’s National Stock Exchange, with the New York Stock Exchange and Hong Kong Exchange following behind. European exchanges saw notably subdued activity, compared with a surge of issuance on Middle Eastern bourses in Dubai, Abu Dhabi, and Saudi Arabia which collectively raised $12bn — surpassing the total euro-denominated issuance across all European exchanges, according to data compiled by Bloomberg.

Carmaker Hyundai Motor India’s $3.3bn capital raise which completed in October was the largest deal of the year in India, where total issuance of $22.7bn mostly consisted of smaller companies. In Europe, SIX Group accounted for $5.5bn of issuance with two deals, Galderma in Switzerland and Puig Brands in Spain. Home Furnishings group Midea raised $4.6bn in Hong Kong, part of $11.5bn of total issuance in the territory.

The market showed seasonal strength during the September to November period, though no single industry dominated issuance. Diversified holdings and REITs emerged as the most active sectors, albeit representing only a modest portion of total activity.

In league tables compiled by LSEG, Morgan Stanley climbed from the 15th position in 2023 to claim the top spot among underwriters last year, bolstered by its lead roles in the high-profile Reddit and Astera Labs offerings which amounted to US$748 million and US$774 million respectively. JPMorgan Chase and Goldman Sachs both improved their standings, securing second and third positions respectively in the league tables. A notable entrant epitomising the good issuance year in India was Kotak Mahindra Bank Ltd in tenth place, while Chinese banks suffered from the poor performance of their home market last year – China Securities moved from second place in 2023 to twenty-fifth.

©Markets Media Europe 2024