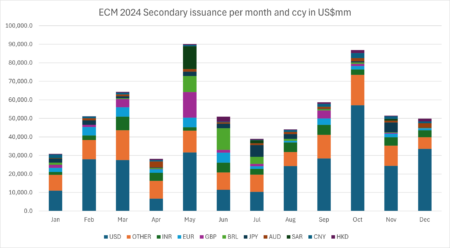

2024 was a boom year for equity capital raising, with $640bn of secondary offerings worldwide, according to Bloomberg data.

Secondary offerings were up 26% in 2024 over 2023 according to LSEG data, correlating with an overall strong market for stocks and the need for issuers to raise further equity.

Top US issuers included Boeing, which raised $18 billion in a rights issue in October, and Micro Strategy, which issued $15 billion in equity the same month “to buy more bitcoin”, according to a filing by the company. Saudi Arabia’s Aramco raised $11.2 billion in a secondary offering in May. Two Brazilian companies, Viver Incorporadora e Construtora and Cia de Saneamento Basico do Estado de Sao Paulo, raised a total of $19.4 billion during the year, according to Bloomberg.

NASDAQ and NYSE accounted for 46% of secondary issuance volume of US$288.2 billion. The London Stock Exchange saw a high value of secondary issuance compared to its small IPO volumes, led by National Grid’s secondary offerings valued at around US$10 billion and a series of deals by Haleon totalling $8.4 billion. Similarly to its strong showing in the primary space, Indian secondary offerings were 7% of the total or $US 47.9 billion.

League tables were stable with the top 5 lead managers (Goldman Sachs & Co, JP Morgan, Morgan Stanley, BofA Securities Inc, Citi) keeping their rankings and helping issue US$197.2 billion worth of stocks, amid small movements lower down in the table with Indian banks gaining while European investment banks and Chinese banks lost some ground.

©Markets Media Europe 2024