Euronext’s expansion of single-stock options is not paying off, with the exchange reporting a decline in traded contracts across the board.

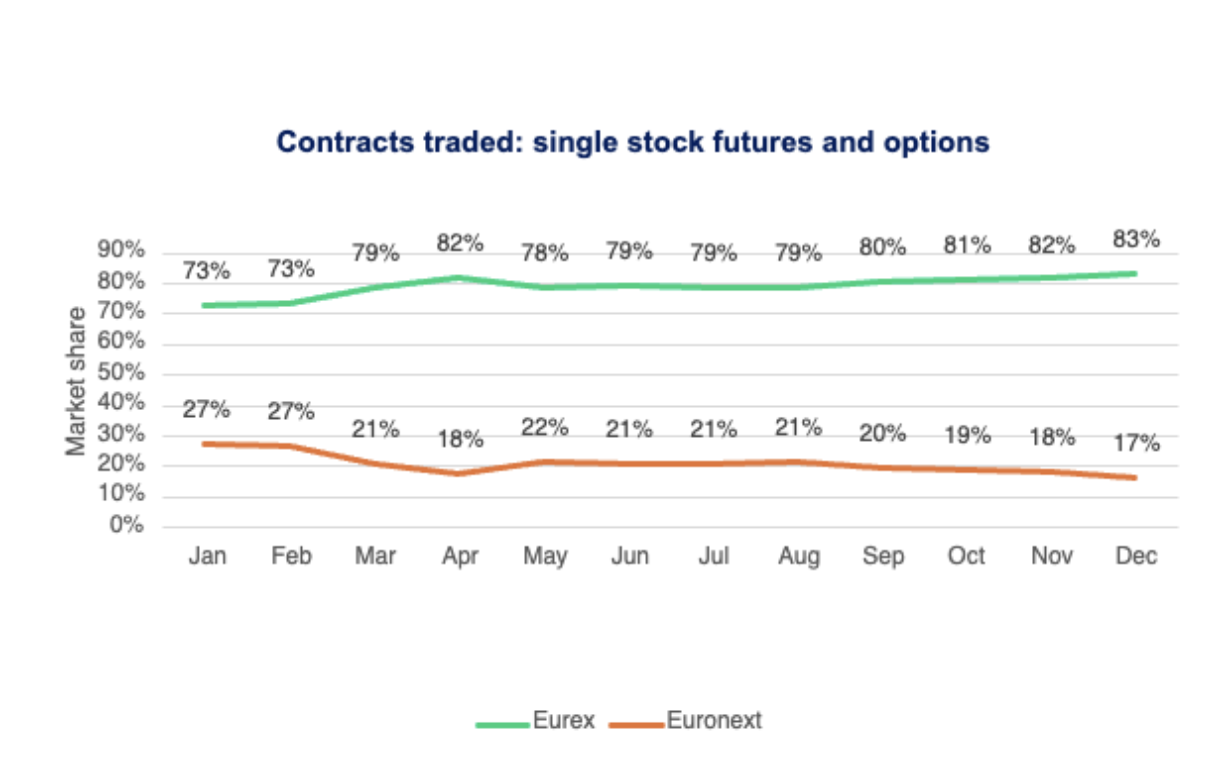

In single stock futures and options, Euronext’s market share was down 10 percentage points to 17% over the year. At year-end, 78 million contracts were traded at the exchange to Eurex’s 302.5 million.

This decline has occurred in spite of measures taken by Euronext in 2024 to minimise the gap between the two exchanges. Coverage was expanded to include all German DAX constituents, Irish single stock options and the Portuguese market, with 31 single-stock options launched in November alone.

READ MORE: Euronext steps up Eurex competition with new stock options offering

Eurex’s reign of dominance over European equity derivatives has only gotten stronger in 2024, despite Euronext’s efforts. The role of the Eurostoxx index as a pan-European benchmark gives Eurex a key advantage in volumes, and it is in non-index derivatives where the real competition is revealed.

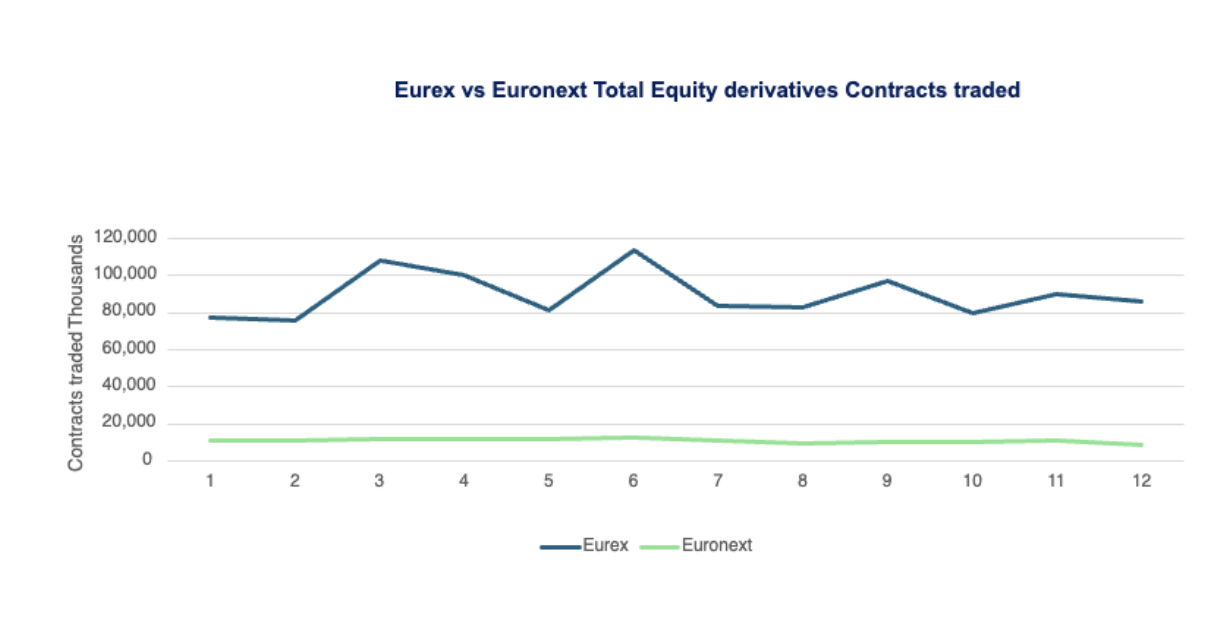

The German exchange reported 302.5 million contracts traded in 2024, up 16.7% from 2023’s 268.7 million. Comparing contracts traded in December alone, volumes were up 13% to 27.1 million year-on-year (YoY).

Euronext, by contrast, traded 128.897 million contracts in 2024 – down 4.3% on 2023’s 134.7 million. YoY, too, December volumes fell by 5.2% to 8.7 million.

As a result, market share for traded contracts tipped to year-long highs for the exchange in December, with Euronext falling to single digits (9%). This is the lowest the ratio has fallen in 2024.

A Euronext spokesperson told Global Trading: “Eurex, as Euronext, has been impacted by low volatility, mainly on index futures.”

Across equity index futures and options, 50 million index futures and options were traded on Euronext, compared to Eurex’s 751.5 million. This gave Euronext 6% of the market share in December; the highest it reached in 2024 was 7%, and the lowest 5%.

Volatility products saw a spike in interest in 2024, with Eurex’s volatility index derivatives trading 21.7 million contracts over the year – up 20.4% on 2023’s figures, which were at a four-year low. Within this, VSTOXX futures were up 14% YoY to 15 million contracts traded, while the number of VSTOXX options contracts traded rose by 38.2%, reaching 6.6 million.

Looking to the year ahead, after celebrating 10 years as a public company Euronext announced its ‘Innovate for Growth 2027’ strategic plan in November 2024. A spokesperson told Global Trading: “Euronext intends to diversify into fixed income derivatives, as part of a broader diversification strategy. We are confident that our strong local ties and our innovative offering will gain traction and allow us to gain market shares in derivatives trading in Europe.”

Goals of the strategic plan also include new trading services in cash equities, the exchange stated in November.

READ MORE: Euronext reports Q3 revenue growth; announces 2027 goals

Eurex is also branching out, announcing that from 6 January its dividend options were directly accessible to US market participants.

On receiving approval from the CFTC, Robbert Booij, CEO of Eurex Frankfurt, said: “Removing access barriers and making our products available to global investors is a top priority for us. With dividend options on key indices such as the EURO STOXX 50 Index and the EURO STOXX Banks Index, US investors have another efficient tool to manage their exposure to the European market.”

©Markets Media Europe 2024