Closing auctions are becoming increasingly popular with traders seeking optimum price and liquidity, but could the dash for the end of the day create systemic risk? Gill Wadsworth reports.

Leaving things until the last minute is generally inadvisable but for a growing number of equity traders, the end of the day is proving an increasingly popular time to close a deal.

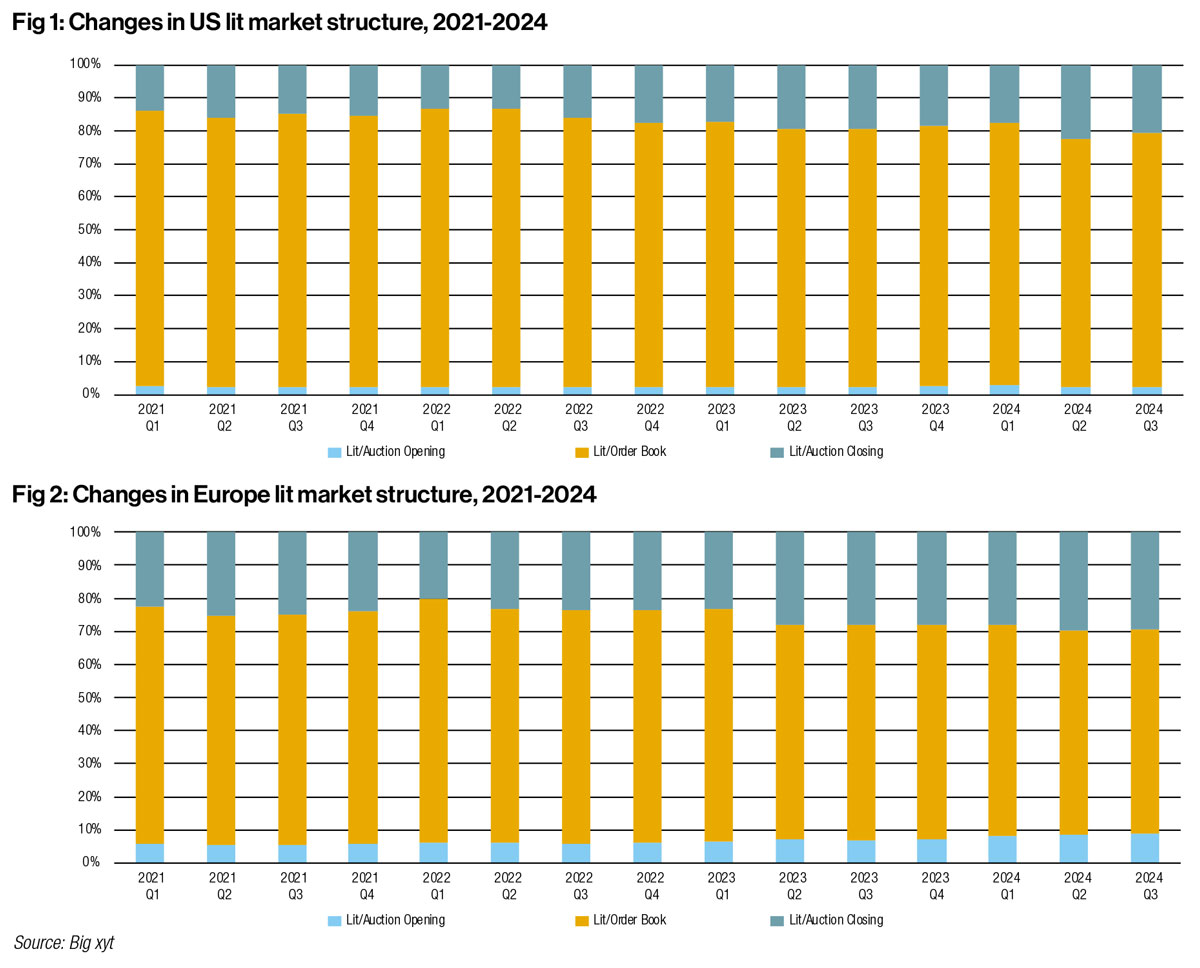

As of Q3 2024, closing auctions account for almost a third (29%) of equity trading in Europe and 21% of deals in the US. This is a rise of 6% and 7% respectively since Q1 2021, according to figures from Big xyt (see Fig 1 & Fig 2).

A stock’s closing price, which is decided in the last five to 10 minutes of the trading day, is a key reference price in equity markets. Closing prices are used to calculate portfolio returns, tally the net asset values of mutual funds, and as a basis for many types of derivative contracts. Equity closing prices are often determined using auctions, which are exchange mechanisms that aggregate orders from multiple market participants and match buyers and sellers at a distinct point in time to establish the market clearing price.

The heavier reliance on closing auctions in Europe compared to the US comes down to differences in market structure, regulatory environment and trading practices. For example, the US market is more decentralised, with significant volumes occurring on alternative trading systems and dark pools which offer requisite liquidity and cost saving.

According to Jason Warr, global head of ETF markets at BlackRock, institutional traders on both sides of the Atlantic place enormous importance on closing stock prices as benchmarks of value, and the closing auction is increasingly attractive as a source of favourable prices and liquidity.

Warr says: “Increased trading of equities at market close benefits markets through reduced spreads, lower price volatility, better transparency and greater execution certainty. Advances in technology have improved algorithmic trading which has contributed to increased volumes at the close.”

Active participation

Much of the increase in trading at close is attributed to the rise of exchange traded funds (ETFs) and the trend to passive investing. Since January 2020, $3.8 trillion has flowed into equity ETFs, according to data from BlackRock and Markit.

Many ETFs rely on closing auctions to reach their price target as they are index replications, while passive funds trade near the market close to stay in line with the indices they track and reduce tracking errors.

Paul Squires, head of trading for EMEA and APAC equities at Invesco, says: “Closing prices are key because they’re used as a daily reference for performance evaluation, risk management, and compliance – giving the most accurate snapshot of a stock’s value for the day.”

But active managers are now getting in on the closing auction act attracted by the liquidity and price benefits.

Eric Champenois, head of trading at Unigestion, says: “Market on close trading has a lot of benefits for active managers because the closing auction has the highest trading volume of the day, and tends to be less volatile than any other part of the day, as you have a balancing effect of buy and sell orders from many market participants.”

Champenois adds that higher liquidity and less volatility together help minimise the market impact, which is “very positive for investors who have to deal with sizeable orders”.

“If we look at figures and take the STOXX 600 as an example, recent closing auction trading volumes stand at around 30% versus 1% for the opening auction. This highlights the importance of the close in a trading day session and shows that it is hard to avoid it if you want to achieve satisfactory results on your portfolio implementation.”

Squires says Invesco has seen an increase in the use of closing auctions for its ETFs and active funds, while Champenois notes that trading at close has always been a significant portion of Unigestion’s equity order flow and in 2023 it represented around 45%.

He says: “In the past, we used to only trade at close for passive orders related to inflows/outflows in our funds/mandates mainly for valuation purposes. On active orders such as rebalancing trades, we prefer to trade against an Implementation Shortfall benchmark but, depending on the size and liquidity profile of the trade, we may opt for a close benchmark.”

Systemic risk

While the attractions of trading at close are clear, financial regulators have expressed concern about the possibility of increased systemic risk.

In 2019 French watchdog L’Autorité des Marchés Financiers (AMF) issued a report on closing auctions noting that the growing proportion of volumes traded at day end “could generate or exacerbate a number of risks concerning the orderly functioning of financial markets”.

These include undermining the price formation process for lack of sufficient liquidity, while increasing intraday volatility “whether accidentally or due to manipulation”.

Champenois agrees that a rush to late trading can impact markets. He says: “A higher concentration of trading volume at the close can diminish liquidity during other parts of the trading day, increasing the likelihood of sharp price movements and higher intraday volatility.”

But Squires notes that the volume of trading at close is still far smaller than those traded throughout the day, suggesting that the concern about systemic risk may be overblown. He says: “We’re talking about approximately 25% of the daily volume rather than say 75%. Most exchanges/trading workflows have become unconstrained to capacity concerns.

However, he adds: “Of course, there is always a point where there is either a major breakdown or performance degradation.”

Sakeena Lalljee, head of sales at stock exchange Aquis, argues that trading at market close in itself does not create systemic risk, however she concedes that the closing and opening auctions “remain a single point of failure despite the existence of alternative pan-European venues for intraday trading [which] creates that risk during those two times of day.”

She adds: “The risk exists already, whether or not there’s an increase in trading at the close.”

Market outage

This alludes to AMF’s second concern about concentration of trading at close; operational failure.

The regulator states: “The volumes at the closing auction remain exposed to potential incidents or occasional failures of the infrastructure or of one of the members, possibly impacting a larger quantity of interests.”

Outages at close are rare, but they do happen. In November 2022 Nasdaq’s Nordic markets closed without an auction after an outage. While, marketplaces of the European exchange operator, Euronext, also suffered a three-hour interruption to trading in October 2020 that prevented the closing auction from successfully taking place.

Champenois says “If the closing auction system breaks down or has a glitch like an exchange outage, it could throw off a key part of the trading day, causing confusion and potentially leading to losses for funds that rely on it to set prices and execute trades.”

He continues: “With global investors relying on closing auctions across time zones, disruptions in one market’s closing auction could have ripple effects on other markets. For example, a problem in US markets at the close could influence European or Asian markets through ETFs or derivatives.”

Lalljee says Aquis “remain committed to proposing and advocating for solutions that reduce such risks or contribute to a better marketplace”, and has worked with fellow exchange Cboe on a joint proposal for a technical back-up and a set of procedures.

These include forming an opening price in the event of a market of listing outage at the start of day, and for trading at the close to move to an alternative venue should there be an outage on the primary at or leading up to the close.

However, she notes that “due to the range of other areas for improvement and innovation in the market this hasn’t come to fruition yet”.

She says “[Establishing a single official opening price and closing price] is something we are well-positioned to deliver on if it gains the necessary industry-wide support. We also contribute to regulatory discussions around the topic of reducing risk and improving outage communications procedures.”

Squires says recent market outages have “given us some insights about recommended practices which creates a playbook which is helpful for all market participants”, and he points to the work by not-for-profit member organisation Plato Partnership which this November announced new standards for managing cash equities market outages.

Among the five proposed standards is ‘determination of closing prices’ where all trading venues in an outage must apply a standard cut-off time to declare the closing price. In the event an outage prevents a closing auction taking place prior to the cut-off time, the determination of the official closing price should be applied in the following order by the trading venue.

Mike Bellaro, CEO of Plato Partnership, says: “As someone who’s spent years on the buy-side, I know how disruptive outages can be for market participants. These new standards go a long way in providing the clarity and consistency we need. By working closely with Europe’s leading exchanges, we’re making a tangible step toward ensuring markets can function smoothly despite unexpected challenges. This isn’t just about improving procedures – it’s about safeguarding the trust and integrity of the entire trading ecosystem.”

The Board of the International Organization of Securities Commissions notes that while outages were not more prevalent in the opening or closing of a trading session than any other time, it does make specific reference in a best practice document for how exchanges should legislate for technical problems.

Meanwhile Warr says exchanges are tackling risk by introducing a variety of new order types and access mechanisms to strengthen the closing call, while some brokers have launched closing cross facilities of their own.

He says: “Market structure evolution now allows institutional traders to place large orders at the close with confidence that there will be sufficient liquidity, and that any price movement or reversals will be minimal.”

Given the increasing trading volumes happening at market close, and the potential for increased systemic an operational risk, a European Securities and Markets Association (ESMA) spokesperson told Global Trading that the regulator is monitoring the rising trend in closing auction activity.

They say: “We are focused on how this might impact price formation and the potential risks posed by larger trading volumes during closing auctions, particularly in the case of technical outages, as highlighted in our guidance on outages published last year. While we are not overly concerned at this stage, we continue to monitor developments in the trading landscape, including closing auctions, to ensure that any emerging risks are addressed.”

Closing auctions have cemented their place as essential sources of price and liquidity but they remain secondary to continuous trading activity. And while there are legitimate concerns about systemic and operational risks, these appear to be relatively well managed and are unlikely to provoke regulatory intervention, which means traders can continue to make the most of last orders.

©Markets Media Europe 2024