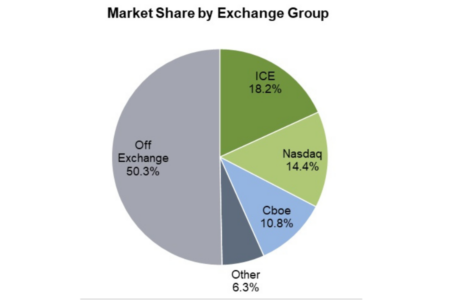

ICE gained a stronger lead over Nasdaq in 2024, the difference in cash equity volumes between the two widening from 20.2% to 24.6%. However, market share was dominated by alternative trading systems (ATS).

US cash equity trading volumes were up year-on-year at both ICE and Nasdaq, with the exchanges seeing a significant bump in the final month of 2024.

According to SIFMA data, ICE took 18.2% of US equity exchange market share in Q4, and Nasdaq 14.4%. Despite trading volume growth, both saw a slight dip compared to Q3, where the exchanges held 19.6% and 16.1% respectively. Cboe, with a smaller piece of the pie, lost just 0.1% of the share over the quarter.

Off-exchange trading surpassed the 50% mark in the final quarter of 2024, closing the year with 50.3% of market share. The use of ATSs has increased at an accelerating pace over the year, up 6.9% year-on-year – almost half of which occurred between Q3 and Q4.

According to FINRA data, both ATSs run by large banks and those operated by specialised firms are seeing success. In Q4, the largest systems by shares traded were UBS ATS, Intelligent Cross and Goldman Sachs’s Sigma X2.

As for the major exchanges, between December 2023 and November 2024, trading volumes at the two largest exchanges were relatively static. Nasdaq went from 39.2 billion to 41.1 billion, a 5% increase, and at ICE figures were up by an even more marginal 3% to 53.3 billion.

However, in December there was a marked increase in contracts traded with 56.8 billion US equity cash products handled at ICE to Nasdaq’s 44.9 billion.

These increases are reflected in the yearly figures, where ICE saw double-figure growth. Volumes rose 10% to 613.7 billion, compared to a 5% increase to 479.4 billion at Nasdaq.

By contrast, volumes at Cboe fell 2% over the month to 31.5 billion. YoY, on-exchange matched volumes for US equities dropped by 1% to 352 billion.

©Markets Media Europe 2024