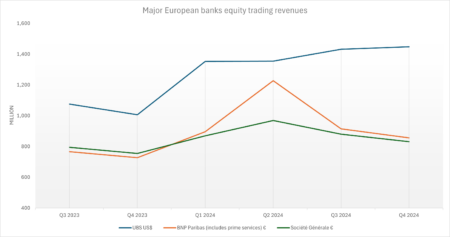

European banks have enjoyed strong revenue growth in equity trading in Q4 2024, UBS leads the way, harvesting the benefits of Credit Suisse integration.

European banks reported a standout performance in equity trading in the final quarter of 2024, capitalising on supportive market conditions and robust client activity. While most players saw strong sequential and year-on-year revenue growth, UBS emerged as the undisputed leader, recording a 44% surge in equity trading revenues in its investment banking division from Q4 2023. If transaction income from the Swiss lender’s private banking arm is included, then UBS’s equity trading revenues are on a par with JP Morgan and Bank of America, and only beaten by Goldman Sachs and Morgan Stanley.

Trump deregulation will unleash Goldman’s risk appetite, Solomon says – Global Trading

UBS’s equity trading revenues climbed to US$1.45 billion in Q4 2024, up from US$1.01 billion a year earlier. “We continue to gain market share across our equities and prime services businesses, with client engagement at record levels,” said Sergio P. Ermotti, chief executive office (CEO) of UBS, in the bank’s earnings call.

While UBS stole the limelight, other European banks also benefited from increased market activity with varying degrees of success. BNP Paribas, which has been aggressively expanding its equities franchise since acquiring Deutsche Bank’s prime brokerage unit, reported €856 million in equity trading revenues for Q4 2024, down from €915 million in Q3 but still up 18% year on year.

French rival Société Générale posted €831 million in revenues, down sequentially but still reflecting a resilient derivatives business. Spanish-based Santander reported a ‘gains on financial transactions’ of €413 million during the fourth quarter but did not disclose the equity portion of this figure. Equity value-at-risk in the bank’s trading portfolio increased to €9.5 million, up from €6 million a year earlier.

Banks attributed the surge in equity trading revenues to a supportive market environment. UBS cited “increased client activity on higher cash volumes and supportive volatility across equities and FX”. The bank added “This led to our best fourth quarter markets revenue on record with particular strength in financing supported by all-time-high client balances.”

BNP Paribas echoed this sentiment, emphasising the role of increased hedge fund participation and structured product activity. “Global markets and their activities were up 32%, driven by strong performance both in equity and prime services, as well as robust performance for FICC, thanks to strong activity in primary, macro, and Forex,” Lars Machenil said on the BNP call.

UBS capitalised on these conditions by leveraging its expanded prime brokerage capabilities and deepened client relationships, particularly among private bank clients. “Structured products, equities, and alternatives all recorded double-digit transaction revenue increases. Our investments in capabilities, solutions, and unified teams support the durability of this revenue line and fuel our ability to capture wallet-share in all climates,” said UBS.

While the past year has been a boon for European investment banks, expectations for 2025 remain tempered by macroeconomic uncertainty. However, volatility -a key driver of trading revenues- is expected to persist, potentially creating another lucrative environment for banks.

BNP Paribas executives signaled optimism about the trading outlook in their earnings call, noting that markets may outperform current consensus expectations.

“We expect ’25 is going to be a year with a lot of volatility for a lot of reasons. So global markets and CIB globally will deliver probably much more than the consensus is telling us today,” BNP CEO Jean-Laurent Bonnafe said.

©Markets Media Europe 2025