Large market makers are paying billions to access retail orders in stocks and options, a controversial practice banned in most countries outside the US.

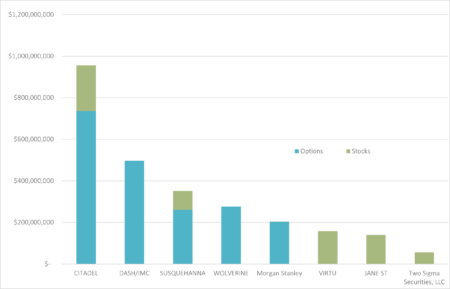

Citadel Securities paid US$732million for options order flow and US$219million for cash equity order flow between April and December 2024, according to regulatory filings of the largest five US retail brokers taking part in the payment for order Flow (PFOF) value chain, as compiled by Global Trading.

These five retail brokers, Charles Schwab, Ameritrade – now consolidated in Schwab-, Fidelity Brokerage, E*Trade – owned by Morgan Stanley-, and Robinhood were the largest receivers of market maker payments according to analysis of the filings. Interactive Brokers one of the largest retail brokers, was not part of the survey as it is not taking part in PFOF.

Amongst market makers, Citadel dwarfed its competitors in terms of retail order flows payments both for options and cash equities. In options, Dutch market maker IMC paid US$49 million for flows, followed by Susquehanna and Wolverine which paid US$352 million and US$277 million, respectively.

Amongst equity market makers, Virtu and Jane Street were in second and third place behind Citadel, paying over US$158 million and US$141 million, respectively.

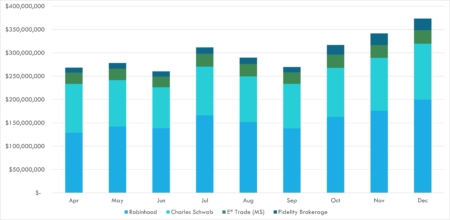

Payments increased all year, with the retail brokers surveyed seeing their related revenues ramping up from US$268 million in April 2024 to US$373 million in December 2024.

Payment for stock order flows particularly increased, almost doubling between the month of April 2024 where it stood at US$66 million, increasing to US$116 million in December 2024.

The payments reflect increasingly profitable trading at market makers. Virtu Financial reported full year net trading income in its market making division up 41% to US$1.2 billion for the full year 2024.

During their latest analyst call on 29 January 2025, chief executive officer (CEO) Doug Cifu explained:” Our market-making results were up almost 23% in the fourth quarter, an impressive result considering realised volatility was down across the board. The opportunity was markedly lower in October, but conditions improved in November, and the opportunity so far has been the same or better every month since. Further, quoted spread and executed shares per our 605 reports for the fourth quarter show an increase of 12% and 11%, respectively, versus the third quarter.”

The biggest recipient of payments from market makers was Robinhood, with $US1,14 billion in options related receipts, and US$262 million in receipt for stock related flows. Shrugging off past regulatory sanctions, Robinhood has used PFOF to power its ‘zero cost’ retail trading platform and has recently expanded its offering with low-cost trading in CME Futures.

Read more : https://www.globaltrading.net/robinhood-hit-with-us45m-sec-fine-as-market-maker-payments-surge/

Robinhood’s PFOF revenues were closely followed by those of Charles Schwab at US$927 million; Schwab’s however were skewed to stock related flows, which totalled US$359 million compared to US$568 million in options. E*Trade, owned by Morgan Stanley, received US$234million.

Morgan Stanley is atypical; it both receives large payments for the flows at its retail brokerage operation and pays for them in its market making operations. Morgan Stanley paid retail brokers within our survey US$205 millions from April 2024 to December 2024. Both JP Morgan and Goldman Sachs have a no payment for order flow policy.

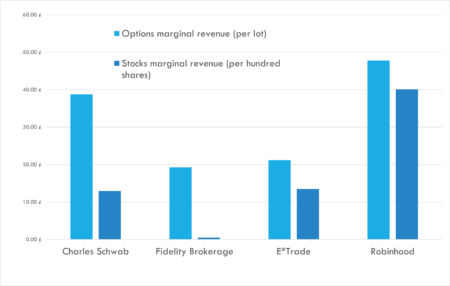

In terms of margin related to these flows, market makers paid options flows on average US$0.34 cents compared to US$0.17 cents for stocks. Passive limit orders in both options and stocks generated the most marginal revenue the most, costing market makers US$0.41 cents per option lot – one hundred shares equivalent – as opposed to US$0.24 cents per hundred shares. Marketable limit orders were the less profitable, costing respectively US$0.32 cents in options and US$0.12 cents in shares. Robinhood and Charles Schwab were paid about twice as much per hundred shares/lot option for their retail flows than those emanating from E*Trade or Fidelity; Robinhood received US$0.48 cents per option lot and US$0.40 cents per hundred shares, while Schwab received US$0.39 cents for options and US$0.13 cents for stocks on average. That compares with US$0.2 cents received by E*Trade for options and US$0.14 cents for stocks related flows.

©Markets Media Europe 2025