Overall, Norges Bank Investment Management posted record profits of US$222 billion on assets valued at US$1.75 trillion, trailing its benchmark by 0.45%.

In a show of transparency, uncommon across the industry, Norges Bank Investment Management (NBIM) disclosed transaction costs in its 2024 annual report, both in the form of direct commissions paid to brokers and indirect market impact costs gleaned from transaction cost analysis (TCA).

According to NBIM, equities represent 71.4% of the fund’s total market value, approximately NOK14.113 billion (US$1.2 trillion) and delivered an 18.2% return over the year. Performance fell 0.45 % short of a bespoke benchmark based on the FTSE Global All-Cap.

CEO Nicolai Tangen said: “That 0.45 percentage point underperformance isn’t an operational weakness—it’s the outcome of our deliberate, risk-adjusted rebalancing strategy designed to mitigate downside risk in volatile markets while positioning us for long-term gains.”

NBIM’s fund is the world’s largest sovereign investment portfolio by assets under management, ahead of the China Investment Corporation (CIC) and Abu Dhabi Investment Authority and was set up to invest Norway’s oil revenues.

Central to NBIM’s operational efficiency is its rigorous cost discipline. In 2024, management fees totalled approximately US$655 million—just 0.05% of assets under management. Direct transaction costs amounted to approximately US$550 million, which NBIM defines as ‘commission fees and transaction taxes, including stamp duty’. The vast majority of this – US$500 million – came from equity trading.

The report also specifies indirect transaction costs which NBIM defines as being ‘due to fluctuations in prices from the time we initiate the trade until it is implemented in the market’. Disclosed solely for equities, NBIM’s Transaction Cost Analysis points to a stable cost of US$1.43 billion versus 2023 despite what the fund called ‘increased activity levels in 2024’. due to what it said were ‘improved market conditions and implemented cost-saving measures.’

The question of how the buy-side gains market impact benefits from algorithmic execution, trajectory crossing and off-exchange systematic internaliser trades is a hot topic in the industry. NBIM declined to comment on its transaction volumes or trading strategies.

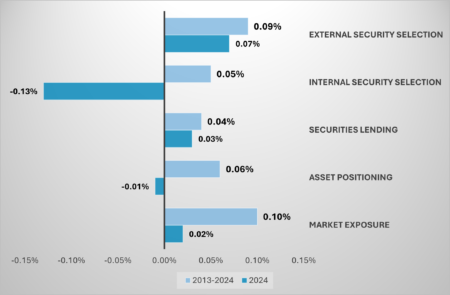

The report also details the various contributions of each profit centre to the fund. Over the short and long run, the relative returns of the fund are as dependent on the quality of its execution through its asset positioning and securities lending program as is the securities selection process.

In 2024, asset positioning contributed a negative one basis point to its performance against benchmark while securities lending contributed a positive three basis points. Annualised over ten years the asset positioning division added six basis points to the annual returns of the fund. This compares with the securities selection, which lost six basis points last year and gained fourteen basis points annually over ten years.

Sources familiar with NBIM approached by Global Trading mentioned the increasing difficulty of generating assets positioning alpha as the fund grows. On the securities lending front, the fund transferred equities worth approximately US$76 billion through secured lending transactions—roughly 6.1% of its total equity portfolio. The fund lending program is managed by its custodian Citigroup through a lending agreement, sources told Global Trading.

Throughout 2024, NBIM repositioned its equity holdings from 8,859 to 8,659 companies.

NBIM management said: “We have streamlined our portfolio by reducing our equity holdings from 8,859 to 8,659 companies— a targeted divestment strategy that reduces concentration risk while sharpening our focus on high-conviction positions,”.

CEO Nicolai Tangen encapsulated the fund’s ethos when he noted, “It is not easy to be a large financial investor in a turbulent world. We must constantly be willing to change, embrace new technology and learn from everything we do, whatever the markets throw at us.” He added, “Our disciplined approach to securities lending and transaction efficiency is a cornerstone of our strategy—generating incremental income that significantly bolsters net returns while maintaining strict risk controls.”

©Markets Media Europe 2025