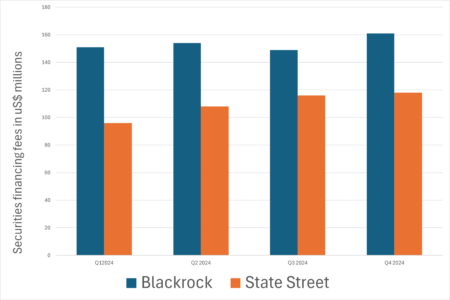

The two asset management giants earned US$1.05 billion from securities lending during the year, with US$611 million coming from equities.

Both firms reported stagnant to lower securities financing revenues compared with 2023, based on Global Trading analysis of 10‑K and quarterly 10‑Q filings. – even as client and loan balances reached new highs. This apparent disconnect, set against record or near‑record equity markets, was largely attributed to “muted specials” activity, as described by State Street management.

In securities lending, “specials” refer to those hard‑to‑borrow stocks that command higher lending fees. State Street noted in multiple earnings calls and disclosures that, despite robust volumes and elevated on‑loan balances, the scarcity premium on certain in‑demand stocks remained subdued for much of 2024. As a result, while the absolute notional of equities on loan climbed steadily for both firms, the actual revenue generated from those loans did not keep pace.

For BlackRock, 2024’s annual securities lending revenue was reported at Us$615 million across all asset classes, of which about $335 (estimates were made based on share of equities in fees and securities financing revenues) was linked to equities. The company’s total equity AUM finished the year at approximately US$6.31 trillion, up from around US$5.3 trillion at the end of 2023. Nonetheless, the portion of based fees derived from lending was down about 9% reflecting narrower spreads.

For State Street, the story was similar. The firm’s full‑year securities finance revenue was US$438 million, with roughly US$279 million attributable to equities (estimated based on share of equities in its AUM). In contrast, the notional amount of indemnified equities on loan peaked at US$360 billion or more during third quarter of the year. While volumes of securities lent were at or near record levels, the average fee rate contracted.

This was echoed in State Street’s Q2 2024 investor meeting, where Eric Aboaf, vice chairman and chief financial officer said : “Our US specials activity was subdued in the quarter, which impacted margins and contributed to the year on year decline in securities finance revenues.”

A recurring theme across both companies’ filings was the divergence between the quantity of assets on loan and the yield on those loans. BlackRock, for instance, highlighted its robust ETF inflows and the consequent expansion of lendable securities. State Street similarly reported strong inflows into its SPDR ETF line-up and other institutional equity index strategies. Yet, with fewer “special” securities commanding premium fees, the incremental revenue gain from these higher balances was not as large as one might expect in a rising‑market environment.

In its annual and monthly report, for December 2024, IHS Markit noted of the US equity financing market that it was down month on month 14% and year on year 15% to US$283.3 million while revenues from specials for the full year declined to US$191.5 million compared to US$230.8 million the previous year.

BlackRock and State Street together pulled in over US$1 billion from securities lending in 2024, but with flat to declining yields on each dollar of securities loaned. Both firms point to subdued specials as the key factor limiting revenue growth.

Both firms declined to comment.

©Markets Media Europe 2025