Nicolas Rivard, global head of cash equity and data services at Euronext, spoke to Global Trading about the liquidity landscape in European cash equities, and the evolution of dark trading.

How would you characterise the liquidity picture in European cash equity markets?

The picture is good. In terms of trading volumes: focusing exclusively on Euronext markets, since the beginning of the year, cash equity trading turnover is up by more than 30% versus last year, with a daily trading turnover of about €13 billion on average. It is both driven by conjunctural events but also by a more fundamental geopolitical shift, where European markets are regaining traction globally.

Then, in terms of market structure. Whilst European markets can first appear as over fragmented, the reality is more subtle. For lit trading, one can access 98% of available lit liquidity across European markets by connecting only to nine trading venues. Lit liquidity on European equities is therefore highly accessible.

And Euronext is a pioneer in the space. We have spearheaded a unique model which balances on one hand seamless cross-border trading and on the other hand strong local market grounding. On Euronext, global and local market participants can seamlessly access to seven European markets via one single connectivity and one single trading platform. As a result, in the cash equity market, Euronext is the largest lit venue in Europe, with more than 25% equity volumes and more than 2000 equity instruments traded. And Euronext is now willing to further facilitate cross-border trading and investments by addressing one of the key remaining pain points of EU equity markets: post-trade fragmentation, with the ambition to further boost the attractivity of EU markets.

How do you see the use of lit and dark trading in Europe?

The share of reported trading outside of lit trading venues is growing in Europe, being it on so-called dark pools (dark MTFs) or on bilateral platforms (systematic internalisers, off-book on-exchange and OTC). Lit markets are still, I think, working very well. The price formation has not suffered, the liquidity at-touch on Euronext is as good as before COVID. So the market quality is there but indeed, there needs to be an honest and open industry-wide debate around the balance between bilateral trading and price-forming markets. And this cannot just be a market structure practitioner debate, as it equally impacts investors, issuers and the overall attractiveness of the European capital markets. To do so, first things first: we need to have a shared diagnosis. Today, it is still very difficult to get an accurate granular view of the market structure. The soon to be launched EU Consolidated Tape on equities will hopefully help to get a better sense of the market structure evolution and create a new impetus for more informative transaction flagging and reporting.

Euronext launched its dark trading offering in 2024. One year later, what’s the state of play?

Euronext introduced its Mid-Point Match following our move to a new data centre near Bergamo, Italy. This initiative was driven by client demand for a dark pool that offers zero latency with the reference price from Euronext’s lit book, ensuring members can trade at the real PBBO without any latency tax. A key differentiator of our offering is our technology, in which we invest continuously. We aimed to provide brokers with a seamless way to trade at the midpoint on the same infrastructure they already use, eliminating the need for additional IT development.

One year later, we are pleased with the platform’s progress. Nearly all global brokers and many local brokers are now connected, and volumes continue to grow steadily. Building liquidity takes time, but we made three key moves in December to accelerate development:

-

- Technical Enhancements: We made it much easier for clients to access the dark pool. If an order can’t be executed in the dark, it can now seamlessly transition to the lit book without latency, offering a plug-and-play experience.

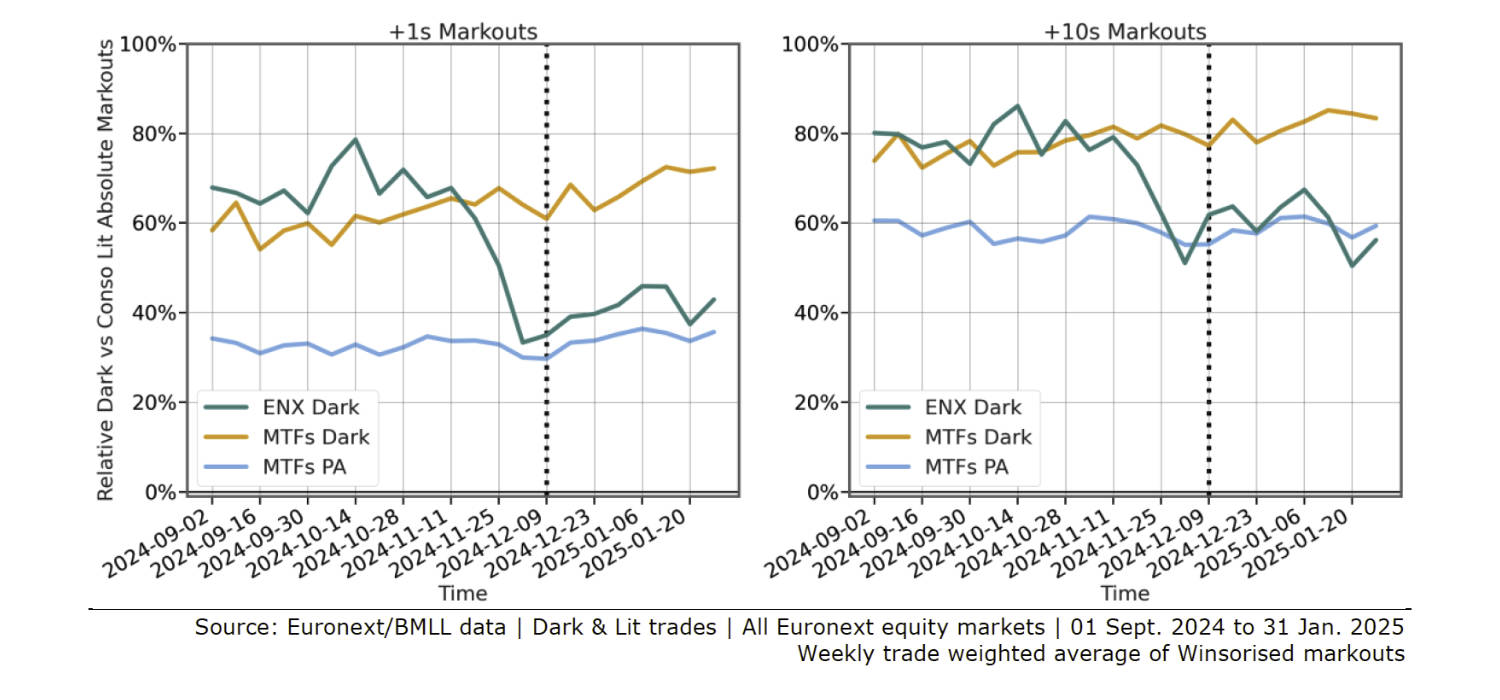

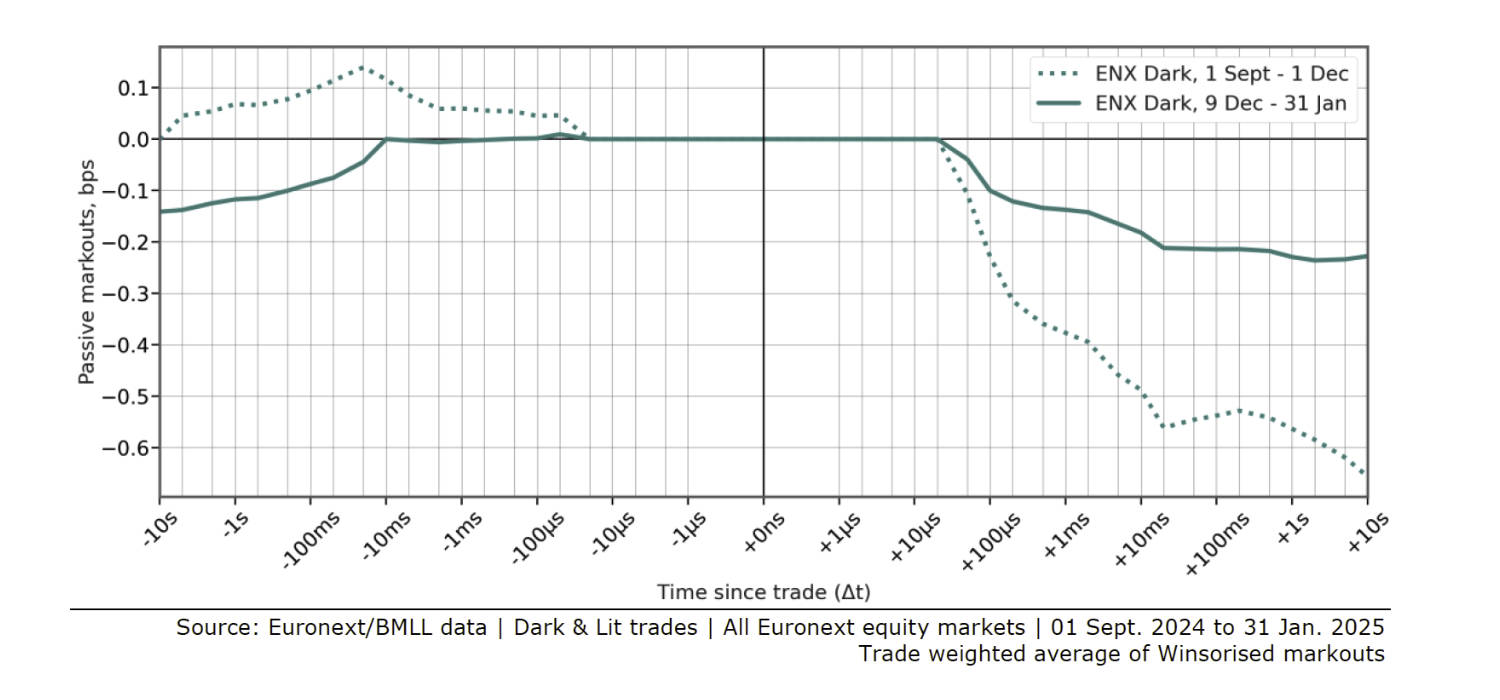

- Market Quality Demonstration: Euronext Dark has proven to be significantly less toxic than competing Dark MTFs trading Euronext stocks. We delivered on our initial promise: trading at the real market price without unnecessary frictions.

- Liquidity Incentives: We introduced a commercial rebate program to encourage liquidity provision, supporting momentum in dark trading and fostering deeper market participation.

With these improvements in place, we are confident in the continued growth and adoption of our dark trading offering.

What other product developments and innovations do you have in the pipeline as part of your 2027 strategic plan?

We invest significantly in our trading technology and we have a number of products in design phase as we speak. In addition, we continue to develop our order entry via microwave technology we launched in July last year. We are also beefing up our retail offering. We are extending our Global Equity Market, GEM, to offer the ability to trade on Euronext technology and with the same rules basically all the blue chips in the Eurozone. Finally, there are a few areas in our market where there is untapped liquidity, and we are working to allow participants to tap into it.

Passive Markouts ENX Dark, halved since December 9 (bps, “Mid to Mid” PBBO)

Relative Dark & Periodic Auction vs Consolidate Lit Absolute Markouts (“Mid to Mid” PBBO). Euronext dark demonstrates much less toxicity than competing Dark MTFs