The COVID-19 pandemic has resulted in a significant impact to financial markets and sectors around the globe. The new report from the Barclays Quantitative Investment Strategies group explores the effect of the pandemic on CAPE® ratios across five major equity markets and examines their usefulness as a model-based forecasting tool during such volatile periods.

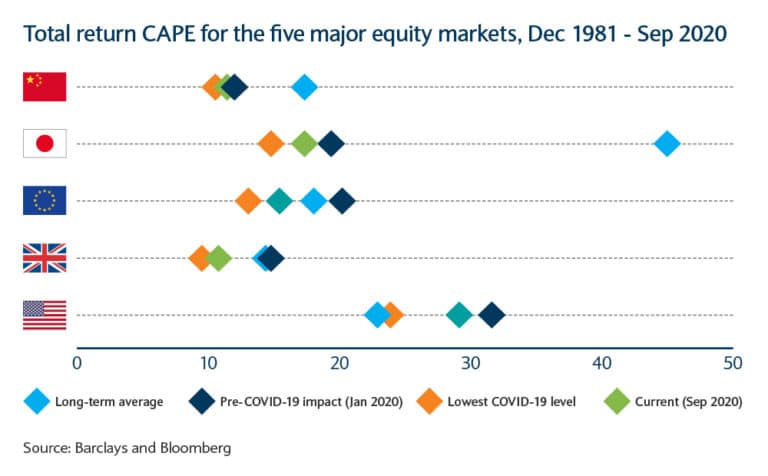

The report looks at what has happened to the CAPE® ratios of five regional economies – the US, UK, Europe, Japan and China – over the course of 2020, and examines the sectors that have played a key role in their recovery from the initial turbulence of the pandemic, such as healthcare, communication services and technology sectors, which have all seen a boost, likely as a result of the “work from home” and “home improvements” narratives that are leading to a change in people’s day-to-day behaviours. It also identifies those that are still suffering from the negative effects of local and global economic slowdowns, such as the finance, energy and industrial sectors.

In addition to demonstrating that CAPE® ratios remain relevant, the report also introduces a new measure: the Excess CAPE® Yield. As interest rates remain low globally, rather than valuing equities in isolation, Barclays Quantitative Investment Strategies used the conditions created by the COVID-19 pandemic to develop a way to consider equity valuations relative to other investment opportunities, such as long-term bonds, in order to inform expected returns.

The report finds that there are multiple reasons why equities are currently highly attractive relative to bonds, which despite the on-going pandemic, may be driving the speed of the recovery in certain markets, and for certain sectors in particular.

To read full report please click HERE.