CEO says many clients are shifting from in-house technology models to BlackRock.

Laurence Fink, chairman and chief executive of BlackRock, said the industry is in the very early days of a long-term shift in client consolidation of their investment managers and technology requirements.

Fink said on the results call on 14 July that many clients are now transitioning from in-house investment and technology models to BlackRock in the same way that organizations have shifted from on-site data to hardware to cloud providers.

“We are building the sole platform in asset management that brings together products, services, and technology to solve our clients investment and technology needs,” he added. “We envision BlackRock becoming the investment manager cloud for asset managers and for asset owners.”

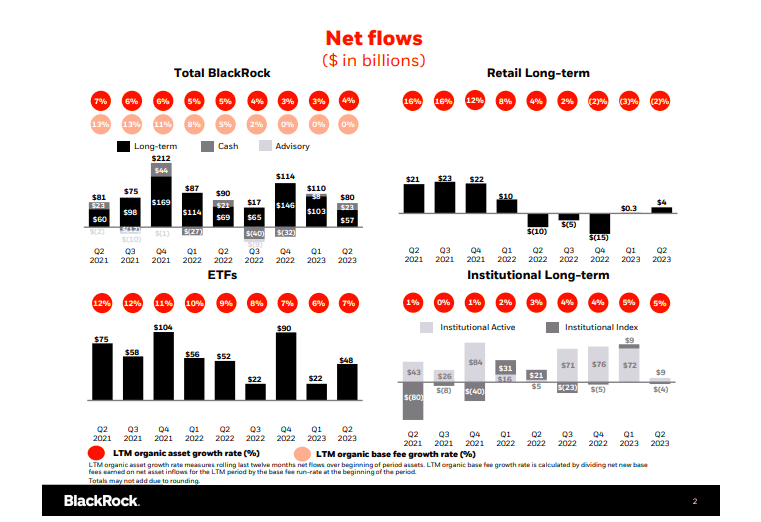

BlackRock had $190bn of net inflows in the first half of 2023, taking total assets under management to over $9.4 trillion after an increase of more than $830bn. Martin Small, chief financial officer, said on the results call that clients are coming to BlackRock for performance and scale.

“This is leading to clients consolidating more of their portfolios with BlackRock, and both first half and second quarter net inflows were positive across regions, client type, and active and index,” Small added.

Broadening adoption of iShares exchange-traded funds by asset managers, insurance companies, and wealth managers led to net ETF inflows of $48bn in the second quarter, led by fixed income ETF net inflows of $35bn.

Fink said that BlackRock aims for its bond ETF assets under management to more than triple to $2.5 trillion by 2030.

“This is not just because of the generational opportunities in fixed income, but because bond ETFs are also delivering benefits, such as access, transparency, and liquidity to both institutional and wealth clients at an accelerating pace,” he said.

Rob Kapito, president of BlackRock, said markets are preparing for a generational change in fixed income with the potential to earn attractive yields without taking much duration or credit risk, as 80% of all fixed income is now yielding over 4%.

“We are well positioned with our $3.4 trillion fixed income and cash platform,” he said. “We are calling this a once-in-a-generation opportunity and we are expecting a resurgence in demand.”

There is around $7 trillion in money market accounts and Kapito expects that when people feel that rates have peaked, they will flood fixed income. The firm had positive fixed income mutual fund flows in the second quarter led by its high-yield total return and municipal bond franchises according to Kapito.

He anticipates that bond ETFs will be used by active managers for liquidity management, hedging, and efficient tactical asset allocation. BlackRock is also advising clients on new use cases for bond ETFs such as replacing more expensive futures or swaps; or as cash and liquidity instruments; and as tools for large-scale portfolio transitions.

Kapito continued that nine of the top 10 global asset managers now use iShares.

“In the first half of the year we saw $12bn in active fixed income net inflows alongside $68bn in bond ETFs,” Kapito said. “On the active fixed income side, we believe there is finally an opportunity for alpha that hasn’t been there in many years.”

BlackRock has more than 450 bond ETF choices, which Kapito said is more than five times the next largest issuer.

“iShares fixed income ETFs had industry leading flows of $35bn in the second quarter,” Kapito said. “This is one of the biggest opportunities that we have in front of us, and we believe we are going to be able to capture those opportunities.”

Fink also highlighted that index ETFs are being used by active managers. In May BlackRock launched two active ETFs led by Rick Rieder, chief investment officer of global fixed income, and Tony DeSpirito, global CIO of fundamental equities.

In addition, Fink said BlackRock recently completed the largest global ETF launch in history with two transition-focused ETFs, one of which launched with nearly $3bn in seed capital.

Private markets

Fink said clients are doing more business with fewer managers as they are focused on outcomes, which manifests in portfolios that blend active, index, private markets, and cash. In cash management BlackRock had net inflows of $23bn in the second quarter, led by U.S.government money market funds.

Private markets continued to scale in the second quarter with net inflows of $3bn, representing 10% annualized organic asset growth, led by private credit and infrastructure.

Small said: “We have approximately $30bn of non- fee paying committed capital to deploy in a variety of alternative strategies, representing a significant source of future base and performance fees.”

He continued that the clients’ need for income and uncorrelated returns in a higher inflation world, together with more volatile public equities, will continue to drive demand for alternatives.

BlackRock’s recent global private market survey found that more than half of clients said they expect to increase their allocations to private markets and alternatives, and their top requirement proprietary differentiated deal flow.

Fink highlighted a deal made by BlackRock Long Term Private Capital in 2020 as an example of outcomes that can be achieved through proprietary sourcing and underwriting. BlackRock LTPC acquired Creed, a luxury fragrance during the COVID lockdown. In June this year BlackRock LTPC announced an agreement to sell Creed to a strategic buyer.

“The LTPC team had the conviction that Creed was an extraordinary business with multiple levers for value creation that would help accelerate growth even during the pandemic,” said Fink. “With last month’s agreement the fund is expected to realize significant alpha for our clients.”

Since 2021 BlackRock has raised over $85 billion of gross capital in private funds.

In June this year BlackRock also announced an acquisition of Kreos Capital, a provider of growth and venture debt financing to companies in the technology and healthcare industries. Small said the deal is expected to close in the third quarter of this year, adding venture debt capabilities and further bolstering BlackRock’s global credit franchise.

“We’ve built really strong leading franchises, and we see good growth there in the next three to five years in private credit,” said Small. “As banks potentially become more constrained in lending, we think investors will turn more to private credit for financing.”

In addition, there are strong secular tailwinds for infrastructure due to government stimulus and tax incentives such as the US Inflation Reduction Act (IRA) according to Small. For example, BlackRock Global Energy & Power Infrastructure Fund III and Valero Energy have partnered with Navigator Energy Services to develop an industrial scale carbon capture pipeline system,

“We’ve already done some really compelling innovation in decarbonization, both in sourcing deals and in raising assets in this space, “said Small. “The next horizon for us is to think about how to integrate these things in positions of strength in BlackRock, like model portfolios.”

Fink highlighted that that BlackRock is tapping into deal flow across private market asset classes, especially focusing on credit and infrastructure.

“As I meet with clients around the world, I hear how our profile is strengthening in local markets as a result of our leadership in infrastructure investing,” he said. “I think transition investing is probably one of the greatest opportunities in the world today.”

He continued that every government is focused on transition investing, especially countries that are dependent on importation of power, so energy and power is becoming one of the dominant conversations. Countries are going to turn to private capital as the investment cannot be funded purely by the public sector, which Fink described as a great positioning opportunity for BlackRock with its worldwide relationships .

“Through the IRA, we are seeing huge interest from companies coming into the United States and taking advantage of the opportunities that present to us in terms of elevated returns,” he said. “We look at this as a multi-year growth opportunity that is significant in terms of tens and tens of trillions of dollars market opportunity.”

Fink said BlackRock’s growing profile in infrastructure investments is leading to more, and larger, deal opportunities.

“The portfolio of the future is outcome-oriented, customized, and seamlessly combines public and private markets,” he added.

Financials

In the second quarter BlackRock generated total net inflows of $80bn, representing 4% annualized organic asset growth and 2% annualized organic base fee growth.

However, second quarter revenue of $4.5bn was 1% lower year-over-year, primarily driven by the impact of market movements over the last 12 months on average assets under management mix. Operating income of $1.7bn was down 3% over the same time period.

$BLK down slightly this AM following #earnings, but stock has had a strong run over past few days. We plan to lower our fair value estimate slightly.

Details here: https://t.co/NzjlKq4Bs5 pic.twitter.com/pWHDLiYBfG

— Dave Sekera, Morningstar Chief Market Strategist (@MstarMarkets) July 14, 2023

Greggory Warren, sector strategist at Morningstar, said in a report there was little in BlackRock’s second-quarter earnings that would alter the long-term view of the asset manager.

Warren said: “We do expect to lower our $810 per share fair value estimate slightly to account for weaker flows and market gains than we were forecasting, which affects our near-term expectations.

Total assets under management of $9.425 trillion at the end of the second half were up 3.7% sequentially and 11% on a year-over-year basis, but below Morningstar’s forecast of $9.5 trillion. Net long-term inflows of $57bn during the second quarter were below expectations for $100bn in positive flows.

“That said, the company did produce annualized organic AUM growth of 5.2% during the first quarter, leaving first-half organic AUM growth near the middle of our long-term forecasted range,” added Warren.