The Canadian bank launched algorithmic trading in European equities in May 2022.

Joe Wald, co-head of electronic trading at BMO Capital Markets, said the business had a transformational year following its launch of algorithmic trading in European equities in May 2022.

Last year BMO Capital Markets introduced algorithmic trading in European equities as the Canadian bank believed it could gain market share due to its systematic approach to trading, market structure proficiency and modern technology.

In Europe the Algorithmic Management System was built from the ground up specifically for the region’s market structure over a period of approximately 18 months before launching, including during the pandemic lockdowns.

Wald told Markets Media: “BMO Electronic Trading had a transformational year with the release and early adoption of our Algorithmic Management System in Europe. According to Coalition Greenwich, European clients are adopting electronic trading faster than North America but this is a pervasive global trend, which is a huge driver of growth.”

Consultancy Coalition Greenwich said in a recent report that electronic trading has grown to 42% of US and 44% of European equity market commissions. In addition, over three years managers expect this to grow to 48% and 50%, respectively.

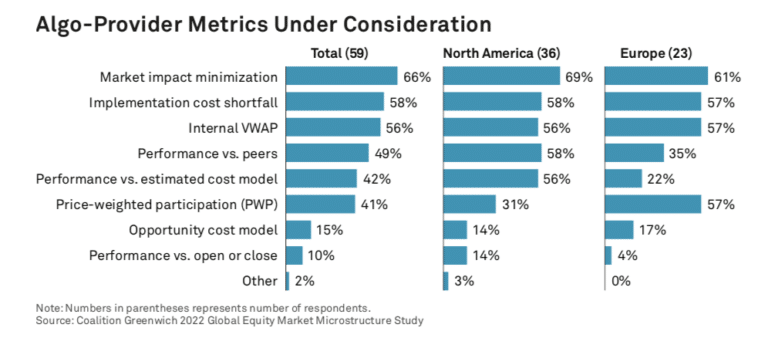

Jesse Forster, author of the report and who advises on market structure and technology globally, wrote: “Although there are some regional differences, most traders across North America and EU/U.K. agree to the broad strokes around some of the biggest challenges of algorithmic trading and the solutions to best navigate them. For starters, the perennial issues around a lack of liquidity and venue fragmentation continue to stay top of mind as the greatest market structure challenges.”

However, the report also warned that the buy side is finding it harder to distinguish between brokers’ electronic platforms as they have become to look increasingly similar in terms of their claimed features, performance and capabilities.

Wald argued that BMO’s growth in algorithmic trading was because European clients were hungry for a new entrant whose platform could be nimble and has a foundation of quantitative analytics to perform A/B testing on new venues and order types such as the intra-day cross.

The AMS offering includes seven core strategies, including a dark aggregator and a smart order router, which are all fully customizable. Arc, BMO’s proprietary liquidity-seeking algorithm was customized for the European environment where liquidity is fragmented due to the number of venues and the lack of a consolidated tape.

Coalition Greenwich’s survey found that European asset managers prioritised ease of use, reliability and quality of technical support, with less emphasis on strategy breadth and the ability to customize themselves.

Wald added: “Customizing strategies for our clients and providing performance metrics is our sweet spot with a global coverage team across regions.”

Volatile market conditions are also driving adoption of algos according to Wald, due to the demand for analytics that drive execution and measure the quality of execution.

“Our North American clients are also looking to trade in Europe with customized strategies,” he added.

Regulation

Coalition Greenwich highlighted that each market has its unique microstructure issues that participants must successfully navigate on a daily basis that is driven by both regulation and the competitive landscape. For example, the European Union is planning consolidated tape for equities and fixed income, while in the US the Securities & Exchange Commission has proposed a raft of market structure changes in December last year comprising nearly 1,700 pages of rule making.

The SEC’s four proposals that were put out for comment included updating Rule 605 which covers data disclosure enhancements for all market participants; changing tick sizes and access fees; achieving best execution; and increasing competition for orders. Market proposals have described the changes as the biggest overhaul to U.S. equity markets since the adoption of Reg NMS in 2005.

One SEC proposal, and probably the most controversial, is to change the current payment for order flow structure by forcing retail orders onto exchanges for auction execution before they are “internalized” by wholesaler firms.

Wald said: “We believe the time is right to evaluate major changes to US market structure and we are confident the changes will need to be implemented in a sensible way. The retail auction proposal presents an opportunity for retail and institutional investors to achieve high execution quality with natural counterparties.”