investor demand for bond ETFs has increased along with the operating efficiency of the investment vehicles.

Inflows will increase in active and alternative exchange-traded funds and investor demand for bond ETFs will continue to rise, according to Morningstar’s North America passive strategies team.

Each member of Morningstar’s North America passive strategies team has made predictions for ETF investors in 2024.

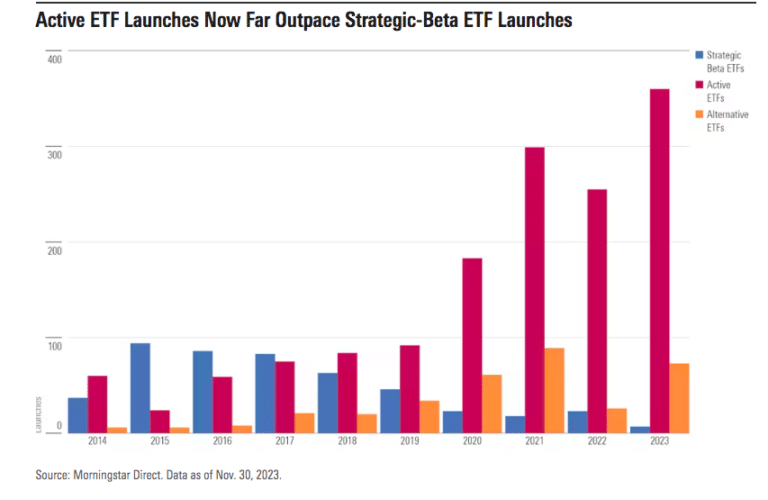

Their first prediction was that the decrease in strategic beta ETF launches will continue, while the number of closures of these funds will possibly increase.

“New money will also be drawn to active and alternative ETFs as alpha-seeking investors are increasingly choosing to allocate to these funds instead,” added Morningstar. “This is not to demerit some strategic-beta ETFs, but as the industry evolves, it is clear there are better business opportunities for ETF issuers.”

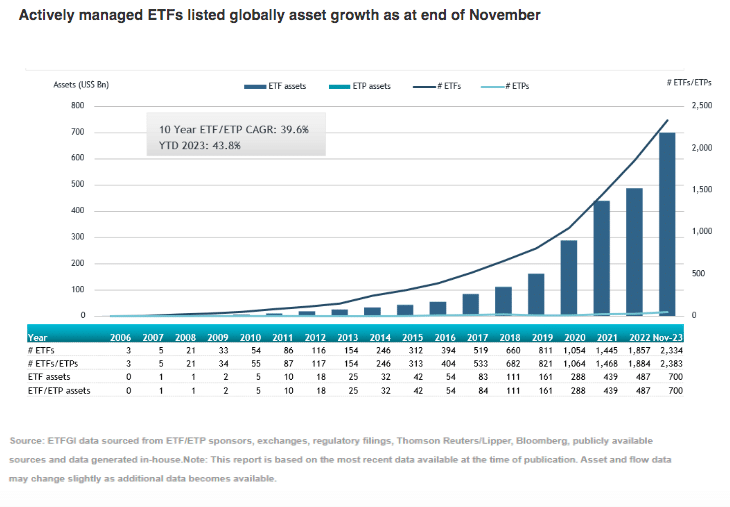

Assets invested in actively managed ETFs listed globally reached a new record of $700.4bn at the end of November 2023, up from $650bn at the end of August 2023 according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs ecosystem.

ETFGI also said that net inflows into actively managed ETFs in the first 11 months of 2023 were $167bn, the highest on record.

Bond ETFs

Morningstar highlighted that the market for U.S. taxable-bond ETFs is roughly 4 times smaller than the U.S. equity ETF market by assets and is also 3 times smaller by number of funds.

“Major players will attempt to bridge this gap as both investor demand for bond ETFs and the efficiency in operating these funds continues to improve,” added Morningstar. “Combined with continuous refinement and improved liquidity on electronic trading platforms, bond ETFs will become less of an operational headache for asset managers.”

Morningstar predicted that intensifying competition among actively managed bond ETFs should continue in 2024.

“BlackRock leads the charge, but Vanguard is hot on its heels,” added Morningstar.

In December 2023 BlackRock launched the BlackRock Total Return ETF to provide ETF investors with access to the asset manager’s total return diversified core bond strategy. The launch was the second active ETF managed by BlackRock’s fundamental fixed income team, following the launch of the BlackRock Flexible Income ETF in May 2023, which had gathered $330m in flows.

The the BlackRock Total Return ETF is managed by Rick Rieder, chief investment officer of global fixed income David Rogal, and Chi Chen and has the same investment objective, benchmark, and portfolio managers as theBlackRock Total Return Mutual Fund.

“The rapid growth of active ETFs has proved that ETFs are no longer limited to index management,” said Dominik Rohe, Head of Americas ETF and Index Investments business at BlackRock. “Today’s launch represents iShares’ commitment to innovation and helping our clients achieve new sources of alpha in a more efficient and convenient way. More investors can now access BlackRock’s premier active management capabilities in an investment vehicle that best suits their needs.”

Dominik Rohe, head of Americas ETF and index investments business at BlackRock, said in a statement in December: “The rapid growth of active ETFs has proved that ETFs are no longer limited to index management. More investors can now access BlackRock’s premier active management capabilities in an investment vehicle that best suits their needs.”

Morningstar said that in 2023 the Vanguard Total Bond Market ETF became the first bond ETF to reach more than $100bn in assets.

In December 2023 Vanguard also launched two new actively managed bond ETFs – Vanguard Core-Plus Bond ETF and Vanguard Core Bond ETF. The asset manager said they offer clients broadly diversified fixed income exposure with low equity correlation and the potential to outperform broad bond benchmarks over the long term.

Sara Devereux, global head of Vanguard fixed income group, said in a statement: “Offering these strategies through the convenience and flexibility of the ETF structure meets clients’ growing preference for ETFs and further expands access to our experienced and talented active fixed income team.”

Battle of passive vs active

Total passive mutual fund and exchange-traded fund assets will surpass total active mutual fund and ETF assets by early 2024, according to Cerulli Associates. The research provider said in a report, U.S. Product Development 2023: Resource Reallocation Through Product Rationalization, that the flight toward passive may be slowing, as active management seeks ground in vehicles other than the mutual fund.

Cerulli said that approximately 10 years ago, passive mutual funds and ETFs were neck and neck in the asset race against each other, while they collectively held one-quarter of the market share of total mutual fund and ETF assets.

Since then, passive mutual funds and ETFs reached 49% of market share at the end of the second quarter of 2023.

Cerulli said: “As the industry looks into the future, questions persist regarding how much market share passively managed assets will eventually control, and whether the trend toward passively managed assets will slow based on changing economic conditions and investor preferences.”

Geopolitical shock and recession are believed to most increase demand for active management, while a sustained equity bull market is the scenario most believed to decrease demand for active management.

Matt Apkarian, associate director, said in a statement: “Asset managers must adapt to changing demand from financial advisors and end-investors to remain relevant in the industry. Increased focus on defined outcome products with better downside capture can serve to be the tool that meets advisor needs when attempting to provide their clients with a smooth ride toward their financial goals.”