A cross-industry survey from Global Trading and Substantive Research found a lack of confidence that the buy side would be able return research costs to clients. But now that rebundling is definitely on its way, what does the industry expect to see? And what do they want the new rules to prioritise?

Analysis from Substantive Research in August 2023 found that 85% of buy-side firms would welcome removing external research costs from their P&Ls. However, they added that regardless of regulatory decisions a number of obstacles stood in the way of this, and a large majority (90%) had no plans to make changes to their practices until the final details of an FCA plan into attribution of costs were published. A further 85% said that even if FCA rules aligned with EU reforms, they did not expect to be able to return research costs to their end investors.

With this in mind it is perhaps unsurprising that a Q4 2023 cross-industry survey by Global Trading, in partnership with Substantive Research, found that 68% of respondents did not expect the UK and EU-based buy side to return research costs to clients once the FCA and the EU implement their research recommendations.

With this in mind it is perhaps unsurprising that a Q4 2023 cross-industry survey by Global Trading, in partnership with Substantive Research, found that 68% of respondents did not expect the UK and EU-based buy side to return research costs to clients once the FCA and the EU implement their research recommendations.

The 38% who did expect this, however, have been proved right – with both the UK and EU in recent months confirming plans to rebundle research. The UK confirmed its plans to roll back MiFID II research unbundling rules in July 2023 (on the back of the Investment Research Review by Rachel Kent) and the European Council affirmed this February that its agreement with the European Parliament would allow the rebundling of payments for research and execution of orders under the EU Listing Act.

A lack of confidence in this outcome was mainly down to unknowns around the detail that the FCA’s rules would go into, and the implications that this would have on operational complexity and cost. A further 19% reported that they had no appetite to approach clients to reintroduce these costs.

Those who expected costs to be returned to clients were primarily convinced by the idea that end investors are more focused on transparency, so that if the correct disclosures exist they would accept the change, with 19% stating that this was the main reason it was achievable. Among those who did not expect costs to be returned, more than a quarter (26%) stated that clear and specific guidelines from the FCA and EU Listing Act covering disclosure – that were not left open to interpretation – would enable implementation.

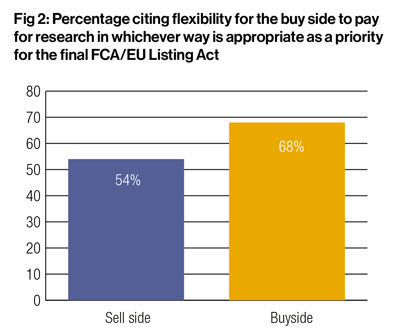

More than half (52%) of participants stated that flexibility for the buy side to pay for research in whichever way is appropriate was what they were most hoping to see in the final FCA and EU Listing Act rules. This was by far the most popular choice for the buy side, with 68% selecting this option.

More than half (52%) of participants stated that flexibility for the buy side to pay for research in whichever way is appropriate was what they were most hoping to see in the final FCA and EU Listing Act rules. This was by far the most popular choice for the buy side, with 68% selecting this option.

The second priority, according to the survey results, was freedom for the buy side to set up traditional CSA programmes in the name of the broker, rather than using RPA structures which would be in the asset manager’s name. Interestingly, the sell side spearheaded this ranking with more than 60% hoping for it to be included in the rules, compared to just 31% of the buy side.

Along with this, two other potential components of the Listing Rules shared second place on the buy side’s priorities list: clear and definitive guidance on how much disclosure on buy side research payments to end investor clients would be required, and clear stipulation that the sell side cannot force bundled payments. By contrast, just 9% of the sell side favoured the latter point.

A further 38% were looking for freedom for the buy side to set up traditional CSA programmes in the name of the broker, rather than using RPA structures which would be in the asset manager’s name. Around a quarter wanted either clear and definitive guidance on how much disclosure on buy side research payments to end investor clients would be required, or clear stipulation that the sell side cannot force bundled payments to be included.

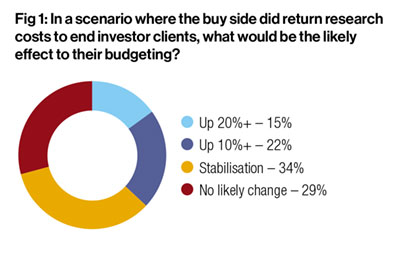

Following implementation, a third of participants expect to see research budgets stabilise where they may otherwise have decreased. This opinion was the most popular of the buy side (37%), followed by an expectation of “no likely change” (31%). On the sell side this was reversed, with 27% predicting stabilisation and 36% anticipating no change.

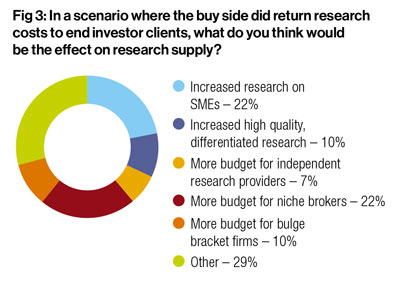

The impact of this on research supply was also considered, and produced far less consistent results. Of those surveyed, 22% expected to see research on SMEs increase. A further 22% said niche brokers would benefit from greater budget availability, an opinion held by 45% of the sell side. The most popular buy-side prediction was that more budget would be available to bulge bracket firms (16%), with none from the group expecting to see independent research providers granted more budget.

The impact of this on research supply was also considered, and produced far less consistent results. Of those surveyed, 22% expected to see research on SMEs increase. A further 22% said niche brokers would benefit from greater budget availability, an opinion held by 45% of the sell side. The most popular buy-side prediction was that more budget would be available to bulge bracket firms (16%), with none from the group expecting to see independent research providers granted more budget.

Of those in the survey, 36% had US$0-10bn in assets under management. A third held more than US$50bn, and 12% reported between US$10-50bn. Respondents included 45% buy-side, 26% sell-side and 26% from other areas.

©Markets Media Europe 2024 TOP OF PAGE