The industrial hemp industry has been making headlines for its impact on several mature markets – from food and textiles, to building construction and nutraceuticals.

In the summer of 2019, the hottest topics in the legalized cannabis industry are hemp and cannabidiol (CBD), which are related but sometimes confusingly different elements of the Cannabis sativa (marijuana) plant.

The market for industrial hemp is being powered by the passage of the 2018 Farm Bill allowing American farmers to cultivate hemp in a fully federally legal setting starting with their 2019 harvests, activating the long-dormant U.S. market for the first time since World War II. With the U.S. being the world’s largest importer of hemp products, its hemp cultivation industry is poised to serve a massive and still-growing domestic market.

In the early 1990s there were fewer than 10 countries growing hemp as part of organized commercial markets. Today, approximately 30 countries commercially grow hemp, with 15 countries conducting research. In all, there are nearly 50 countries now growing hemp, and many more considering whether to permit its cultivation.

Hemp is a fast-growing, environmentally friendly plant with a low cost to produce. It is one of the world’s most diversely applied and sustainable crops. Indeed, recent discoveries suggest that hemp may have been among the first plants humans domesticated, over 10,000 years ago. Historical data shows how past cultures of Asia, India, and Europe utilized hemp for industrial and medical benefits. Ancient documents from Egyptian and Greek physicians illustrate its use for both medical and industrial purposes.

Hemp has many uses and byproducts that have driven farmers to embrace the crop as a hedge against lower-value crops like soy, cotton, canola, and alfalfa. As an agricultural commodity, hemp is grown for its seed, fiber, and flower, or as a multicrop (i.e., hemp grown for both seed and fiber). The seed, stalk, and flower are all used commercially. A hemp seed (or grain) is smooth, hard, and about ¼ of an inch long. The stalk is comprised of a short woody interior (called hurds), while the plant’s outer part consists of long fibers (called bast fiber). Flowers (and to a small degree other parts of the plant such as the leaves) are used to create hemp extracts, oils and cannabinoid isolates. Biologically, hemp belongs to a family and genus of plants with wide chemotypic diversity. The genus Cannabis (hemp and marijuana) is part of the Cannabaceae family of plants, which includes a total of 170 species. Interestingly, a primary ingredient of beer, Humulus (hops), is also from the Cannabaceae family, making hops and cannabis genetic cousins.

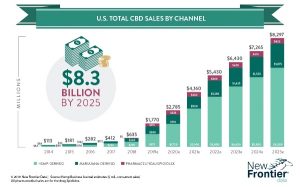

As reported in New Frontier Data’s Global State of Hemp: 2019 Industry Outlook, the total global hemp market reached $3.7 billion in retail sales in 2018, with an annual growth rate of 15% driven by continued strength in Chinese textiles, European industrials, Canadian foods, and the U.S. hemp-derived CBD market. The hemp-derived CBD market is expected to quickly expand and be the primary driver of global industry growth.

The industrial hemp industry has been making headlines for its impact on several mature markets – from food and textiles, to building construction and nutraceuticals. Hemp is emerging as a potential commodity ripe to not only influence but possibly revolutionize major economic sectors around the world. While China and Canada represent two of the world’s leading markets, their leadership will be challenged as countries around the world begin to embrace the plant and its applications.

In the U.S., while the 2018 Farm Bill legalized hemp, the legal status of hemp-derived CBD remains in limbo: CBD can be derived from hemp or cannabis, but if a hemp plant contains more than 0.3% delta-9-tetrahydrocannabinol (or THC, which provides the psychoactive “high” ingredient in cannabis) it is technically and legally a “marijuana” plant. Under the Controlled Substances Act (CSA), CBD is currently a Schedule I substance since it is a chemical component of marijuana.

Thus, adding to the buzz about the potential market for CBD is the open question of how the U.S. Food and Drug Administration (FDA) will decide to regulate it. CBD has been formally codified as a drug by the FDA since Epidiolex was approved in June 2018 for patented use in treating epileptic seizures for patients suffering from Lennox-Gastaut syndrome or Dravet syndrome. Epidiolex is the first (and to date, only) FDA-approved drug containing a purified drug substance derived from marijuana.

According to a 2017 report from the World Health Organization, “In humans, CBD exhibits no effects indicative of any abuse or dependence potential…. To date, there is no evidence of public health-related problems associated with the use of pure CBD.”

That noted, however, the FDA treats all other CBD products remain subject to the same laws and requirements as FDA-regulated products that contain any other substance. The FDA’s stance is that the agency has not approved any other CBD products beyond Epidiolex, and that there is very limited available information about CBD, including about its effects on the body. The Food Drug and Cosmetic Act prohibits adding any non-approved drug to food, beverages, or dietary supplements.

Some experts have said that drafting and implementing regulations could take years, though in July the FDA closed its period for public comment, and Dr. Amy Abernethy, FDA’s principal deputy commissioner and acting chief intelligence officer pledged to provide guidance by the early fall after pressure from the industry and lawmakers wanting more transparent guidance.

Standing on the sidelines are large-scale national retailers, many of which understand the potential profits but prefer not to pique the ire of federal authorities. While some retailers are avoiding CBD craze completely, others are taking a calculated risk for profits by splitting the difference by offering topical CBD products, which are less likely to draw the legal wrath of the FDA.

Though CBD may have some pharmaceutical applications, the hemp industry at large has asserted that the intent of the Farm Bill is to regulate hemp and its derivates like any other agricultural crop. In the case of hemp-derived CBD, that would mean regulating it as a dietary supplement as defined by the Dietary Supplement Health and Education Act of 1994 (DSHEA). By so regulating CBD, licensed producers and mass-market retailers would have more assurance (and less risk) to sell ingestible, hemp-derived CBD products on their shelves.

In March, CVS and Walgreens became the first national retailers to announce that they were peddling CBD creams, patches, and sprays in their stores. CVS was selling them in eight states (Alabama, California, Colorado, Illinois, Indiana, Kentucky, Maryland, and Tennessee), while Walgreens marketed them in nine (Colorado, Kentucky, Illinois, Indiana, New Mexico, Oregon, South Carolina, Tennessee, and Vermont). Following suit, Kroger — the nation’s largest grocery chain — in June announced plans to sell CBD products in 945 stores in 17 U.S. states (Arizona, Arkansas, Colorado, Illinois, Indiana, Kansas, Kentucky, Michigan, Missouri, Nevada, Oregon, South Carolina, Tennessee, West Virginia, Washington, Wisconsin and Wyoming).

Both chains were deliberate in noting that their offerings would be limited to topicals, while stopping short of any foods, beverages, or dietary supplements as the FDA determines its policies for oversight and quality assurances.

Sachin Barot is co-founder of CERESLabs, a Cannabis Analytical Testing and Research Company in Greenfield CA,

New Frontier Data is an independent, technology-driven analytics company specializing in the cannabis industry.