Cboe’s volatility products saw a strong month in August, analysis from Global Trading has found, with VIX options notional volume hitting record highs and dwarfing competitor Eurex’s VSTOXX offerings. The exchange plans to launch S&P 500 Variance Futures next week, and options on VIX futures in October.

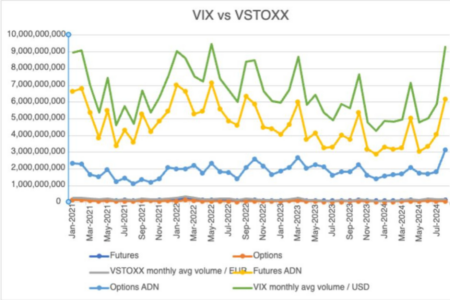

Analysis from Global Trading has revealed that VIX options average monthly notional volumes reached a more than three-year high of US$3.1 billion in August, up more than 70% from fairly static May, June and July figures (US$1.7-1.8 billion). VIX futures volumes, while not setting records, also spiked in August – to US$6.1 billion, building on slow growth since May.

Cboe has maintained a significant majority of market share in this space, dwarfing Eurex’s VSTOXX futures and options performances. Although the European exchange also recorded an increase in activity in August, the VSTOXX monthly average was up a more modest 18% over the month. Futures volumes reached €133 million, while options ADNV dropped – as it did the month before.

In light of increased client interest in volatility products, Cboe is set to launch S&P 500 Variance futures on Monday 23 September. Developed to compete with variance swaps, a long-established over-the-counter derivatives product offered by sell-side banks, the exchange-traded solution will give market participants another way to trade volatility in the US equities market, Cboe said.

S&P 500 Variance Futures allow users to trade the spread between implied and realised volatility in a more streamlined way and take advantage of the difference between market expectations and actual outcomes.

On the product expansion, Rob Hocking, head of product innovation at Cboe, said: “The launch of Cboe S&P 500 Variance Futures comes at a crucial time when risk management is top of mind for many market participants, amid the backdrop of the upcoming U.S. election, shifting monetary policy and ongoing geopolitical tensions.”

Catherine Clay, head of global derivatives at Cboe, commented: “As investor needs for hedging, trading, diversification and asset allocation continue to evolve, we are committed to expanding our offerings to meet their demands.”

Uncertain macro conditions have put volatility front and centre over recent months, most notably during the 5 August market tumble. At the time, the VIX hit 65 and set a four-year record when it closed at 38.57, with the spike in the so-called ‘fear index’ fueling panic about recession and a global crash. A rapid return to more normal levels reassured market participants, but the incident acted as a stark reminder of the current climate’s unpredictability and prompted greater interest in volatility products.

Hocking added: “As demand for hedging and income generation rises, our goal is to broaden access to the derivatives markets by simplifying complex, capital-intensive strategies and making them more easily tradable in an exchange-listed, centrally cleared environment. For those looking to hedge against or capitalise on volatility moves, we believe this new product will offer an accessible and capital-efficient way to replicate the exposures of OTC variance swaps.”

Contracts will settle based on a calculation of the S&P 500’s annualised realised variance. This will be calculated daily, based on a series of values in the S&P 500 Index from the closing index value on the day a VA futures contract is listed for trading to the special opening quotation on the contract’s final settlement date.

©Markets Media Europe 2024