Cboe Global Markets has agreed to acquire BIDS Trading, the alternative trading system for equity blocks in the US, as competition in on-exchange trading has increased with three new entrants.

BIDS Trading will operate as an independently managed trading venue separate from the Cboe U.S. securities exchanges, and will be led by Tim Mahoney, chief executive of the ATS.

Learn more about our planned acquisition of @BIDSTrading at https://t.co/1Qbf5a2XPb. pic.twitter.com/3QFBw4CRCB

— Cboe (@CBOE) October 16, 2020

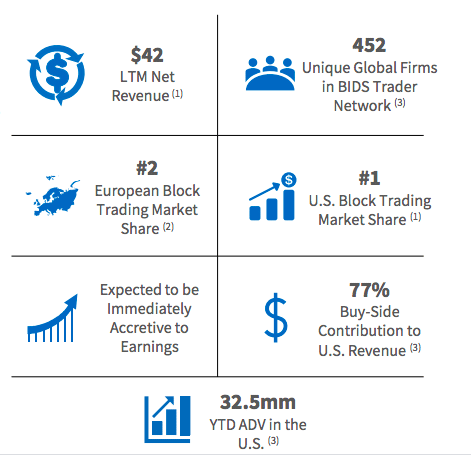

David Howson, president of Cboe Europe, told Markets Media: “BIDS is the largest block-trading ATS in the US and gives Cboe a foothold in the off-exchange segment where BIDS is a market leader. Along with our acquisition of MATCHNow in Canada, these deals give Cboe a very strong presence in the North American equities off-exchange segment.”

Cboe completed its acquisition of MATCHNow, the largest equities ATS in Canada in August this year. MATCHNow had nearly 65% of market share in total Canadian dark trading, or approximately 7% in total Canadian equities volume, according to the exchange.

The Covid-19 pandemic has triggered a major shift in US equity trading volumes away from exchanges this year according to a report from Greenwich Associates. Off-exchange trading reported to the Trade Reporting Facility remained relatively stable last year at between 35% and 40% said the consultancy.

“In all of 2019, there were 16 days with TRF volume above 40%,” added Greenwich. “In contrast, as of early June 2020, the reporting to the TRF had already exceeded 40% of market volume 58 times.”

In addition, competition in US equities trading on exchanges has increased with Members Exchange (MEMX), MIAX Pearl Equities and Long Term Stock Exchange (LTSE) all launching last month.

BIDS Trader

Another attraction of the acquisition is BIDS Trader, a proprietary buy-side front-end trading platform which seamlessly integrates with existing order/execution management systems.

Howson said the BIDS’ trading platform is part of the workflow of 450 global asset managers and provides Cboe with a potential opportunity to launch into new asset classes and geographies.

“It is a differentiator that the BIDS model does not disintermediate the sell side, allowing for a mix of rich interactions between the sell side and the buy side,” he added.

The partnership between Cboe and BIDS Trading began in 2016 with the launch of Cboe LIS in Europe. Cboe licensed BIDS’s proprietary technology for the pan-European equities block trading platform, which is the second largest in the region with average daily volume of approximately €240m.

“There are approximately 220 buyside firms using Cboe LIS,” added Howson. “The BIDS network has approximately 450 asset managers so there is runway to onboard new clients.”

In addition BIDS’ buy-side network could potentially benefit Cboe Europe Derivatives, an Amsterdam-based futures and options market that the US exchange is planning to launch in the first half of next year, subject to regulatory approvals.

A very interesting series of deals for CBOE in 2020 – first MATCHNow, a Canadian ATS, and now BIDS Trading, a US ATS.

— Hide Not Slide (@HideNotSlide) October 16, 2020

The message CBOE's sending is "if equity volume is going off-exchange, we'll go off-exchange"

Similar strategy to TP ICAP's Liquidnet purchase.

Sylvain Thieullent, chief executive of Horizon Software, a provider of electronic trading systems to financial institutions, said in an email: “As part of a wider industry drive to better serve the end-investor, exchanges like Cboe know they have a responsibility to ensure trades can happen in a fair and well-balanced market. As the bigger venues continue to get bigger, it is paramount that members are not trading too far away from what could be considered to be the fair value price.”

Legal advisors to Cboe Global Markets on the transaction are Davis Polk & Wardwell and WilmerHale, and financial advisors are Goldman Sachs and Centerview Partners. Legal advisor to BIDS Trading is Morgan, Lewis & Bockius LLP, with Broadhaven Securities as financial advisor.

Third quarter outlook for exchanges

Kyle Voigt, an analyst at financial services boutique KBW, said in a report that he had decreased his estimated earnings per share for exchanges for the third quarter.

He added that MEMX, MIAX Pearl Equities and LTSE have only garnered a small share of trading in the quarter and earnings will present an opportunity for the exchanges to address the new competition.

“Alongside CBOE’s September monthly metrics release, CBOE guided to 3Q20 cash equities revenue capture of $0.016 per 100 shares (at the midpoint of its guidance) following quarterly fee changes,” said the report. “Voigt believes the changes are in part due to the continued volume shift off-exchange partially driven by the retail trading surge; however, it is also likely a defensive move made ahead of the MEMX launch.”

Other areas of focus for the results are M&A integration and the London Stock Exchange Group’s sale of Borsa Italiana. The UK firm sold Borsa Italians to Euronext in order to satisfy the European Union’s anti-trust concerns ahead of LSEG’s planned purchase of data provider Refinitiv.

ICE has also completed its acquisition of Ellie Mae, which provides technology for the mortgage industry, so he expects updates on integration efforts and contributions to results.

Voigt said there could also be potential impacts from a possible Joe Biden presidency.

“This includes the potential for an increase to the U.S. corporate tax rate to 28% from 21% previously, as well as a potential return of a DOL-like (Department of Labor) fiduciary rule, among other topics,” he wrote.

In addition the US Securities and Exchange Commission has signed a memorandum of understanding with the Department of Justice to look into cash equities exchange market data.

The report said: “Voigt thinks investors will try to gain a better understanding of what can be expected from now through year-end as well as what a new administration could mean for the momentum behind these issues.”