Edward Tilly, chairman, president and chief executive at Cboe Global Markets, highlighted global growth opportunities after the group completed its acquisition of Chi-X Asia Pacific and received regulatory approval to launch a European derivatives market.

Tilly said on second quarter results call that the group made excellent progress executing on the four incremental growth drivers outlined at the beginning of this year – the opportunity to grow recurring non-transaction revenue; the launch of a European derivatives market, expanding BIDS Trading and extending access to products and services across geographies and market participants.

Chi-X Asia Pacific

On June 30 Cboe said it completed its acquisition of Chi-X Asia Pacific gaining entrance into Japan and Australia and establishing a significant presence in Asia Pacific for the first time.

Tilly said: “We are very excited to further expand in this new region and believe the acquisition creates a tremendous opportunity for this business.”

The opportunity includes extending the block trading capabilities of BIDS Trading to the region, first into Australia and then Japan. Cboe acquired BIDS Trading, the largest block trading ATS by volume in the US, in January 2021.

In Europe Cboe and BIDS partnered in 2016 to launch Cboe LIS, an indication of interest negotiation and execution platform for European equities. Cboe LIS powered by BIDS in Canada is slated to launch in February 2022 following last year’s acquisition of MATCHNow, one of the country’s largest equities alternative trading systems.

Tilly said: “As we broaden our global footprint by entering new markets and launching new products and services we further our goal of expanding access to a broader base of customers, both institutional and retail.”

He highlighted that Cboe has announced plans to extend trading hours for SPX and VIX options to nearly 24 hours a day beginning November 21, subject to regulatory approval, complementing the Chi-X acquisition. Investors want to manage risk more efficiently, react to global macroeconomic events as they happen and adjust SPX and VIX options positions around the clock.

“This acquisition marks a pivotal moment in our corporate evolution,” said Tilly. “We are now a truly global market infrastructure provider, operating markets and delivering products and services around the world every day of the week, and around the clock.”

Cboe plans to fully integrate Chi-X Asia Pacific into its existing global business operations and technology platforms, beginning with the integration with BIDS. Chi-X Australia and Chi-X Japan are then planned to migrate to Cboe’s trading platform so market participants can access products more efficiency across regions.

In addition, Cboe plans to further broaden investor access to its proprietary products – including SPX and VIX – to meet growing investor demand globally for U.S.-based derivatives products.

European derivatives

Cboe Europe and EuroCCP have received Dutch regulatory approvals to launch Cboe Europe Derivatives, a pan-European equity futures and options market in Amsterdam, on 6 September this year.

Tilly said key market participants are ready to support the exchange from the first day to provide liquidity and client order flow.

Cboe Europe Derivatives is planned to launch with futures and options based on six Cboe Europe indices which are calculated using Cboe market data with EuroCCP providing clearing services. The exchange plans to add futures and options on additional European benchmarks, along with single stock options, based on customer demand and subject to regulatory approval.

“Our overall business in Europe was exceptionally strong in the second quarter, and we expect the launch of Cboe Europe Derivatives to build on this momentum,” added Tilly.

He continued there is significant opportunity to grow the overall derivatives market in Europe and Cboe is not aiming to simply take market share from incumbent exchanges.

“We intend to reshape expand derivatives trading across Europe, with a novel market structure designed to attract both new and existing participants,” said Tilly.

Cboe aims to bring a modern, on-screen market structure used in the U.S. to Europe and help grow the region’s equity derivatives market overall. Market participants will be able to access a pan-European derivatives market through a single access point, creating capital efficiencies in trading and clearing.

VIX Index calculation error

Cboe said in a statement that it recently discovered instances where the spot Cboe Volatility Index, VIX Index, calculation differs from the calculation described in the VIX White Paper, which details the formula used for deriving values related to the VIX.

The spot VIX Index is disseminated in 15 second intervals and is not a tradable product.

“In certain instances, an index level was not produced at the applicable interval, resulting in the dissemination of the prior index value,” said the statement.“Cboe is investigating the degree of impact and the number of instances with respect to which the redissemination occurred.”

Tilly said that Cboe believes tradable futures and options, as well as the Net Asset Value of products that track the daily closing prices, such as volatility products were not impacted. The calculation of the final settlement value for expiring VIX derivatives, which use an independent process were also not impacted.

Cboe intends to publish an addendum to the VIX White Paper by 2 August outlining this difference in methodology in further detail for market participants. In accordance with its index governance process, Cboe will promptly open a consultation on the planned changes for public comment.

Financial results

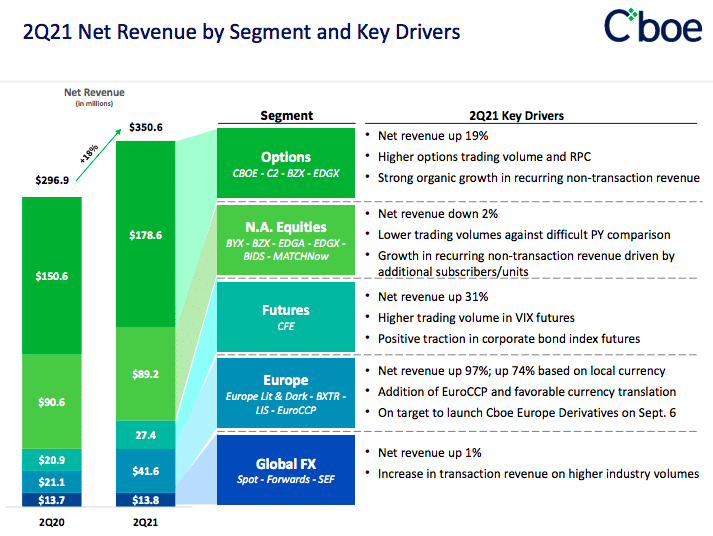

Net revenue for the second quarter was $351m, up 18% from a year ago.

Tilly argued that Cboe’s transactional expertise allows the firm to create a host of market data analytics, and index products.

“Having recognised benchmark indices allows us in turn, to develop additional tradable products and new markets for these products creating a virtuous cycle of transaction and non-transaction product growth,” he said.

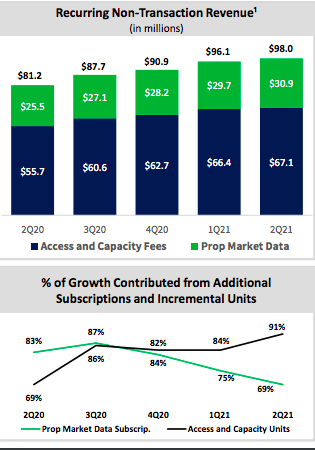

Brian Schell, chief financial officer and treasurer, said on the results call that CBOE is increasing full-year recurring non-transaction organic revenue growth target to between 12% and 13% from 10% to 11% to incorporate stronger organic growth.

“Recurring non-transaction revenue, which includes acquisitions, is now expected to increase by 15% to 16%, up from previous guidance of 11% to 12% due to stronger organic growth and the addition of Chi-X,” Schell said.

Schell said growth in recurring non -transaction revenue was driven by stronger than expected results from data and access solutions due to new subscribers as well as demand for market data as customers look for global market access.

Later this year the firm plans to launch Cboe Global Data Cloud, which will provide cloud distribution for certain data products.

“Overall, recurring non-transaction revenue businesses remain a critical component of the CBOE growth story, and one that we expect to continue to accelerate and diversify our revenue stream over time,” Schell added.

In trading revenues, options net revenue of $178.6m was up 19% from the second quarter of last year as a result of higher trading volumes in both index and multi-listed options, as well as increases in access and capacity fees and market data fees.

North American equities had net revenue of $89.2m, down 2% over the same period, reflecting a 15% decline in U.S. equities industry average daily volume.

“While our overall market share has trended lower, our continuous trading market share has held up relatively well,” added Schell. “We are optimistic about the many innovations we have introduced and plan to introduce to the market, including retail priority quote depletion protection, earlier trading hours and periodic auctions. “

In contrast, in Europe average daily notional value for the overall market was up 5% during the second quarter and ADNV traded on Cboe European Equities was €7.3bn, up 16% from last year’s second quarter.

Cboe European Equities had 17.4% market share, up from 15.8% a year ago, primarily due to the introduction of a liquidity incentive program in May 2020, as well as the re-introduction of Swiss securities on Cboe UK order books in February 2021.