The BIS blames pre-market option quotes for August VIX spike, but CBOE defends its methodology

The 5 August spike in the CBOE’s VIX ‘fear gauge’ to 66%, a post-Covid record, was an artifact caused by the index’s dependence on market maker quotes for pre-hours trading, according to a study by the Bank for International Settlements.

“Spikes in VIX can reverberate through the financial system and affect broad markets via margins and general market sentiment, making it paramount to ensure that VIX follows a robust methodology”, the BIS said. “Our analysis suggests that pre-market VIX can be significantly affected by illiquidity with wide bid-ask spreads, leading to a less precise volatility indicator”.

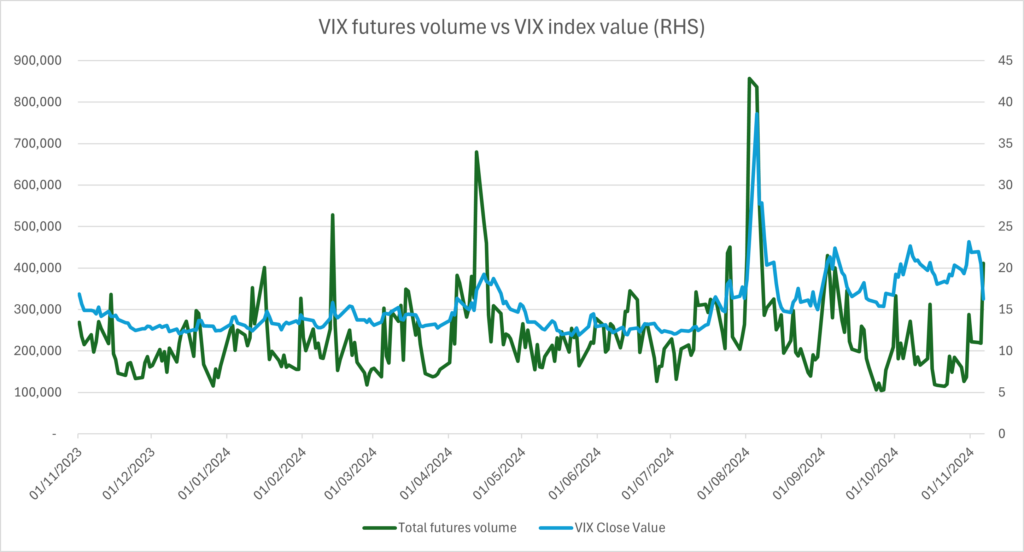

The VIX index has attained global importance as a risk indicator, while institutions increasingly use the VIX as a tail risk hedge for equity portfolios. However, the spot value of the VIX is not actually traded. In order to hedge, VIX futures and options have to be used, which pay off based on the index’s forward value. Volumes of these contracts have steadily grown, boosting revenues at CBOE which were a highlight of the exchange’s latest earnings.

According to the study, written by BIS economist Karamfil Todorov along with Grigory Vilkov at the Frankfurt School of Finance & Management, the spike began outside US trading hours, when the Japanese Topix index fell by 12%. Pre-US open (referred by the CBOE as ‘global trading hours’ or GTH), S&P 500 futures and the value of at-the-money S&P 500 options only fell by a modest amount. But the value of the VIX reached 66%, before rapidly declining again once US markets opened.

With pre-market trading volume of S&P 500 options 80 times smaller than during market hours, there was very little actual trading behind this change in value. And the reason was a sudden adjustment of quotes for out-of-the-money put options by market makers, characterised by the BIS as ‘asymmetric bid-ask spread widening”.

As the BIS paper explains, “since VIX is based on quotes rather than actual trades, even an anticipation of a one-sided market can lead market makers to widen bid-ask spreads to avert facing an imbalanced book, thereby mechanically lifting the value of VIX”. According to the BIS, on 5 August, bid-ask spreads for deep out-of-the-money options spiked to 80% of their mid price, contributing 86% to the VIX’s ascent to 66% before US markets opened.

The phenomenon highlights a decision made by CBOE in 2004 to ensure that the value of the VIX closely tracks the value of a portfolio of one-month S&P 500 options contracts with a range of strikes K. The value of these options depends on both the volatility of the index and the level of the index itself. In order for the VIX to reflect only the volatility rather than the S&P 500 level – known as long gamma – the weighting of the options in the calculation uses a formula delta K over K-squared. For low values of K, corresponding to deep OTM puts, the weighting is largest.

John Hiatt, vice president of CBOE Labs at CBOE Global Markets, told Global Trading. “When skew steepens at a time like what we saw on August 5, the VIX is going to respond more sharply than an at-the-money measure. Any way that we changed it away from delta k over k-squared would make the VIX itself a little bit less tradable than it is today, in terms of the products: the VIX futures and the VIX options.”

Rob Hocking, a former trader who is now global head of product innovation at CBOE Global Markets, defends the VIX against the BIS criticisms. “In the absence of trades, the next best thing are quotes where people are committed to trading. And I think, when quotes are available, the VIX does a really good job of showing you at that moment in time where people felt comfortable being committed to trade.”

“As a trader, you are wondering how much is this market going to move and at what point am I going to be comfortable stepping in and committing capital with all of this uncertainty? As a market maker it’s natural to widen markets out to make sure I have adequate padding to my market so that I can inventory risk knowing that I will be properly compensated for it.”

Hocking urges users of the index to incorporate other CBOE metrics into risk indicators. “We have a one day VIX, a nine day VIX, a 30 day VIX, a three month VIX, six month VIX, a one year VIX. We have tradable futures where people are actually transacting. If you want an accurate picture of volatility in a market event like we saw in August 5, there’s a lot more indicators that you should also be taking into account.”

©Markets Media Europe 2024