The increased capability has allowed CME to develop new trade execution analytics.

CME Group has completed building its data platform with Google Cloud and is preparing to launch services and analytics to clients, after the exchange operator and technology provider announced a partnership in 2021.

Sunil Cutinho, chief information officer at CME, said on the results call on 26 July that the data platform has been built and is available. He said: “We have developed a set of services that we are working on releasing to our clients.”

CME and Google Cloud announced a 10-year strategic partnership in November 2021 which the exchange said would transform derivatives markets through technology, expand access and create efficiencies. The intention was to migrate CME’ technology infrastructure to Google Cloud with data and clearing services, and eventually move all of its markets to the cloud.

As part of the partnership, Google also made a $1bn equity investment in CME Group

Terry Duffy, chairman and chief executive of CME Group, said on the call: “One of the things that will shape CME in the future is technology and we have that growth with our Google transaction that will allow us to do certain things that, maybe, our competitors cannot.”

Julie Winkler, chief commercial officer of CME, said on the results that revenue for the Market Data in the second quarter of this year was $163m, up 8% year-on-year, which was driven by high demand from both institutional and retail clients.

“We are seeing a steady increase in the number of professional traders that are accessing our real-time content,” she added.

Winkler said migrating CME’s data into Google Cloud had accelerated the development of new products and analytics for the data business. The move increases the flexibility of how CME can protect, distribute and price its data and makes it much easier for clients that do not currently access CME data to be able to use these new services.

“We have been highly focused on how we are going to enhance the business through making our data more available through APIs,” she added, “The computation is far enhanced and is allowing us to create some new compelling trade execution analytics.”

The new trade execution analytics have been put into production this quarter, and will be shared with clients shortly.

“This is really us being able to leverage our own proprietary data, give our clients benchmarking capabilities and allow them to take action on that data by providing them with insights,” said Winkler. “This leads into how we are helping clients better manage their risk and we are also looking at new data opportunities on the clearing side.”

Google said in a case study on CME that the cloud provides access to market data for about 10% of the cost of traditional means; offers flexible on-demand, pay-as-you-go model for market data consumption and expands the delivery of market data to more than 20 computing locations around the world

The case study said that before CME world with Google Cloud, customers could access only data by either colocating in CME’s data center in Illinois or by subscribing to a market data aggregator service.

“Over the past decade, however, demand for data grew and CME Group heard from more and more customers who wanted access that was easier, faster, and more cost-effective,” added Google. “In addition, many businesses were expecting to manage data in the cloud, which made it essential that CME Group offer a cloud-based data service.”

Options volumes

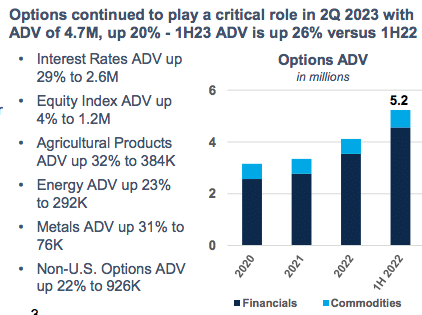

Total average daily volume at CME in the second quarter was 22.9 million contracts. There was 20% year-over-year growth in commodities, which contributed a higher proportion of overall activity in the second quarter.

Duffy said that options ADV in the second quarter increased 20% to 4.7 million contracts.

“Given ongoing uncertainty in both macroeconomic and geopolitical environments, market participants continued turning to CME Group risk management products and services in Q2, with particularly noteworthy volume increases across our interest rate, commodity and options contracts,” he added.

Tim McCourt, global head, equity & FX products at CME said on the call short-dated options including zero days to expiration remain a strong driver of growth. Volume in CME’s same-day expiring options is up 33% from last year, and up 120% since 2021, and now make up 27% of total equity options volume.

“It is important to note we are seeing volume and open interest growing across the entire maturity,” McCourt added. “While short-dated options have largely been an equity story, we are beginning to see expansion to other parts of the portfolio.”

Derek Sammann, global head, commodities, options & international markets at CME, said on the call options have become a larger part of global customers’ risk management and trading strategies. He added there has been growing demand for weekly options expirations across all asset classes, with weekly options volume up 21% in the year to date, and growing to 26% of total options trading.

“In addition to equities, commodities traders have similarly embraced shorter dated expirations, which allow our global customers to hedge to specific event risks, such as crop reports and OPEC meetings,” added Sammann.

Non-US options are growing faster than US options, and options are growing faster than the overall franchise across asset classes and client segments.

The growth in options continue is also positive for the franchise in that more volume brings more embedded futures hedging.

Duffy said: “We are the largest futures exchange in the world and our futures franchise is massive. Options only bolster our futures and hedging business going forward and the real story for me is for the futures franchise.”

Interest rate complex

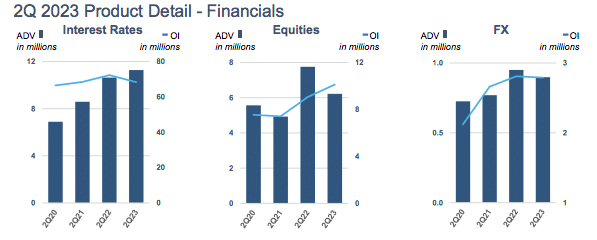

Interest rates ADV in the second quarter grew 6% year-on-year. In the first half ADV of 12.9 million was up 11% from the same period in 2022. CME said a flight to liquidity at the end of the quarter drove record inflows into Treasury futures, with open interest reaching 18 million for the first time during June, a non-roll month.

On July 11 this year 2023, CME interest rate futures aggregate large open interest holders (LOIH) crossed 3K for the first time, up 26% year-on-year primarily due to the Treasury complex.

Clients are also increasingly looking for capital efficiencies as a top priority. As a result in July this year, CME and The Depository Trust & Clearing Corporation (DTCC), the US post-trade market infrastructure, announced enhancements to their existing cross-margining arrangement that will increase capital efficiencies for clearing members that trade and clear both U.S. Treasury securities and CME’s interest rate futures.

Eligible members will be able to cross-margin an expanded suite of products, including SOFR futures, Ultra 10-Year U.S. Treasury Note futures and Ultra U.S. Treasury Bond futures. FICC-cleared U.S. Treasury notes and bonds and repo transactions that have a time to maturity greater than one year will also be eligible. Duffy said on the all that CME was confident of receiving regulatory approval to launch in January 2024.

CME’s SOFR futures and options had their second highest quarterly ADV of 4.7 million contracts, up 154%.

“Our successful, market-leading transition to SOFR has helped engender our short-term interest rate credentials with regional players and volume reached a single-day high of 23K contracts on June 30,” CME added.

McCourt continued that the transition from LIBOR benchmark to SOFR was not the end of the journey, but the beginning of what is in front of CME. The transition, coupled with macro economic backdrop and the uncertainty in rates means CME is in the early days of seeing some of those drivers factored into the risk management needs of clients.

For example, US Treasury bill issuance has increased dramatically and, over time, CME expects more coupon issuance and ongoing debt financing will contribute to greater hedging needs for years to come which will boost both futures and options.

Financials

CME Group reported revenue of $1.4 billion for the second quarter of 2023, 10% up year-on-year. Operating income in the second $839 million Net income was $778 million and diluted earnings per common share were $2.14

Duffy said the group had marked its eighth consecutive quarter of double-digit earnings growth.

“We think this is exactly the environment that we’ve been talking about for several years and that we see going up for several more to come,” he added. “Risk management cannot be neglected for one moment for any businesses and there’s a whole host of factors that are coming to fruition that we think are tailwinds for CME Group.”