CME Group confirmed that it has filed a regulatory application for a futures commission merchant but the derivatives exchange operator said it had no intention of competing with its existing FCM community.

The Wall Street Journal had reported that CME had registered with the US Commodity Futures Trading Commission in August for an FCM, who act as intermediaries between customers and exchange members who execute or clear trades.

Terry Duffy, chairman and chief executive, confirmed on CME Group’s third quarter results call on 26 October that the firm had filed an FCM registration.

“There has been a tremendous amount of speculation about how CME would, or would not use, an FCM but it’s important to note that nobody knows what an FCM is going to look like five, 10 or 15 years from now,” he added. “Is it going to look the same as it does today or will it look completely different?”

Duffy stressed that CME’s commitment to the FCM community is “unwavering” and the firm will continue to work with them to improve the model. He also denied that CME wants to launch its own FCM because of the growing importance of retail products.

Crypto venue FTX US has applied to CFTC to offer central clearing of margin products directly to retail customers. FTX US Derivatives’ proposal would replace the traditional distributed risk clearing model involving FCMs with an automated and centralized process that does not use intermediation, which has been opposed by derivatives exchanges and clearinghouses.

Duffy also highlighted that CME has filed an application in order to prepare for potential changes in the market, but has not put any money into the initiative.

“We will be watching this space very carefully,” Duffy added. “I want to make it clear that CME has not applied for a defined FCM that is competing with the existing FCM model today.”

Increased volume

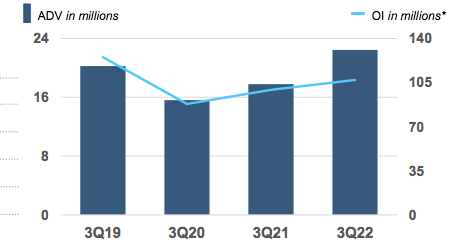

CME reported revenue of $1.2bn, 10.6% higher than a year ago, and operating income of $739m for the third quarter of 2022, driven by a 26% increase in trading volume. Total average daily volume (ADV) was 22.4 million contracts

“During the quarter, year-over-year volume rose in five of our six asset classes, led by interest rates, equity indexes and a near-record quarter for foreign exchange,” he added. “Likewise, the demand for our products remains strong, with year-to-date volumes up 22%, as clients continue to manage risk amid global economic and geopolitical uncertainty.”

Duffy continued that CME’s third quarter and year-to-date performance also demonstrates the effectiveness of its risk management solutions.. Year-to-date trading volumes were 23% higher than the same period last year, and up 19% from the same period in 2019 before the pandemic.

The first quarter of 2020 had record average daily volume and the the first three quarters of this year have been the second, third and fourth highest ADV quarters in CME’s history according to Duffy.

“Our interest rate products reached at an all-time high last week suggesting this represents a risk-on environment,” he added. “Additionally, the third quarter represented our fifth sequential quarter of double-digit year-over-year growth in total ADV.”

Duffy argued that uncertainty around both inflation and interest drives activity in CME’s fixed income contracts which cascades to other asset classes such as equities, due to the impact on corporate valuations, and foreign exchange.

Sean Tully, global head of rates & OTC products, said on the call that interest rate futures and options ADV were up 28% in the third quarter , the sixth consecutive double-digit year-over-year quarterly ADV growth for the asset class.

Trading volumes in the short-term interest rate complex rose 45% through the first three quarters. On the long end of the curve, there was double-digit ADV growth in both the second and third quarter and Tully highlighted Treasury options have had particular strength, with 21% growth in the third quarter.

“The tailwinds from Fed balance sheet reduction and inflation are becoming larger, and have the potential to be long lasting due to the huge increase in government debt,” Tully added. “Uncertainty in monetary policy drives uncertainty in other asset prices.”

Tully said CME has been progressing the Eurodollar to SOFR migration as SOFR futures and options both now trade more contracts per day than their Eurodollar counterparts. A record 5.9 million SOFR contracts were traded on October 13th.

Tim McCourt, global head of equity and FX products, said on the call that the first three quarters of this year were the first, second and third highest ADV quarters on record, both for overall equity index ADV and equity index options ADV.

“Year-to-date through the third quarter, total ADV increased 44% and options ADV increased 74% compared with the same timeframe last year,” added McCourt. “Our growth is driven not only by volatility but also by product innovation.”

Derek Sammann, global head of commodities, options & international markets, said on the call that options ADV and open interest was outpacing futures.

“Year-to-date options ADV is up 27% to 4.1 million and we are on track to surpass our record year in 2019 of four million,” he said.

International volumes

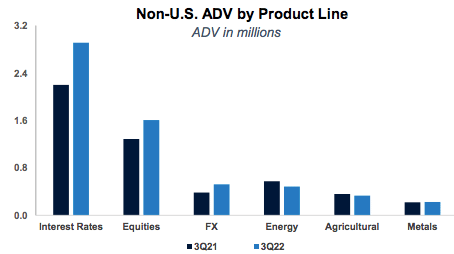

Sammann continued that CME’s international business continues to generate record volume with an ADV of 6.1 million contracts in the third quarter, up 21% versus a year ago, due to double-digit growth across all financial asset classes.

“Based on our strong year to date results, we are on track to deliver another record year, with our non-US ADV through September of 6.5 million compared to our record 5.5 million ADV from last year,” said Sammann.

Asia had the highest growth rate of 41%, followed by 31% in Latin America and 14% in EMEA.