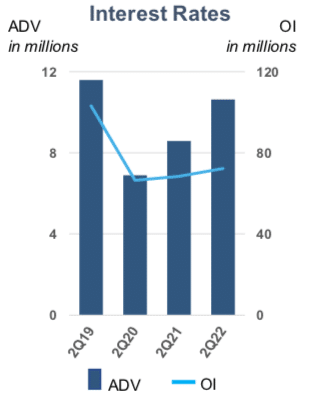

CME Group had record volume and revenue in its interest rate franchise in the first half of this year, boosted by rate hikes from the Federal Reserve and the transition from Libor.

On July 27 CME Group reported revenue of $1.24bn in the second quarter of this year, up more than 5% from the same period last year.

Trading activity during the second quarter increased 25% to an average daily volume of 23 million contracts, which CME said was primarily driven by double-digit year-over-year average daily growth in interest rates, equity index and foreign Exchange. CME added: “Highest ever Q2 ADV with every month in the quarter representing all time volume records for that respective month.”

Terry Duffy, chairman and chief executive of CME Group, said on the results call: “As global market participants continued to navigate extraordinary economic and geopolitical uncertainties throughout the second quarter, demand for CME Group hedging tools drove our strong earnings and revenue growth, with our equity index, interest rate, foreign exchange and options volumes rising in the U.S. and internationally.”

Sean Tully, global head of rates & OTC products at CME, said on the call that the rates franchise set records for revenue, the average number of large open interest holders and average daily volume in the first half of this year.

Tully said volumes in the listed rates franchise have increased 21% year-over-year in the first half.

“One of the references that I have made to investors is that the current environment looks an awful lot like 1994,” Tully added. “In 1994 combined CME and CBOT interest rate volumes relative to 1993 were up 20%.”

The short-term interest rate (STIR) franchise has been boosted by the Federal Reserve’s FOMC meeting as the central bank has been raising rates. STIR futures volumes increased 48% year-on-year and STOR options volumes rose 26% over the same period.

“If you look at our overall STIR complex with the Federal Reserve being very active in monetary policy and with every FOMC meeting at play, in terms of what they might do, we are very excited and pleased with the growth that we’ve seen on the entire short-end complex,” said Tully. “What’s still left in front of us and is very exciting is the Fed balance sheet which is a potential catalyst for further growth.”

He explained that the Fed only started to reduce the size of its balance sheet in June and July this year by $47.5bn each month. From September this year the Fed is planning on reducing it’s balance sheet by $95bn per month after accumulating $9 trillion over the last 12 years.

SOFR transition

Duffy highlighted that SOFR futures and options contracts reached new records in both volume and open interest, driven by the industry’s accelerating transition away from USD Libor.

“CME’s SOFR futures reached record quarterly ADV of 1.6 million contracts and record open interest on June 30 of 6.4 million contracts,” said Duffy.

During the quarter, SOFR futures ADV represented 99% of Eurodollar futures.

In addition trading in SOFR options skyrocketed in June, with a record number of participants. SOFR options ADV represented 46% of Eurodollar options activity for the month, having also reached a weekly high of 68% and daily high of 111 % of Eurodollar options activity during the month.

After the financial crisis there were a series of scandals regarding banks manipulating their submissions for setting benchmarks across asset classes, which led to a lack of confidence and threatened participation in the related markets. As a result, regulators have increased their supervision of benchmarks and want to move to risk-free reference rates based on transactions, so they are harder to manipulate and more representative of the market. The US Alternative Reference Rates Committee (ARRC) selected SOFR to replace US dollar Libor, although other new reference rates have also been launched.

Libor was discontinued at the end of 2021 for all euro, Swiss franc and Japanese yen tenors, the overnight/spot next, 1-week, 2-month and 12-month sterling; and the 1-week and 2-month US dollar settings. The use of US dollar Libor in new contracts was banned from the end of 2021, with limited exceptions, and the remaining five US dollar Libor settings will continue to be calculated using panel bank submissions until mid-2023.

Duffy said: “Our market-wide fee waiver was instrumental in moving critical liquidity into the SOFR markets. From a competitive standpoint, I think we’ve done a lot of really smart things.”

Tully continued that CME has significant incentives in place for SOFR futures and options adoption in terms of rate per contract. CME’s goal is for the SOFR rate per contract to eventually be equal to other interest rate contracts.

He added that CME is in an extremely strong relative position in terms of Term SOFR Reference Rates.

“We have licensed Term SOFR Reference Rates to 1,300 different firms across 74 different countries,” Tully said. “It is being used in more than $1.6 trillion worth of cash market products across the globe.”

Google partnership

In November last year CME Group and Google Cloud announced a 10-year strategic partnership to accelerate the exchange group’s move to the cloud and transform how global derivatives markets operate with technology. In addition, Google has also made a $1bn equity investment in a new series of non-voting convertible preferred stock of CME Group.

Sunil Cutinho, chief information officer at CME Group, said on the call that the migration to the Google Cloud Platform is on track and three foundational services will move by the end of this year – margin calculation services, a product dictionary and market data.

Duffy said that during the second quarter, CME invested $410m from the Google investment in the S&P Dow Jones Indices joint venture.

“This funded our portion of the acquisition of the IHS Markit indices business, which includes leading fixed income and credit indices such as iBoxx, iTraxx and CDX, and maintained our ownership stake in the venture at 27%,” he added.

The shift from active investing to indexing was growing in 2012 when CME launched the joint venture, and that momentum has only continued to strengthen since that time according to Duffy. As a result, CME’s portion of earnings from the index joint venture have more than tripled from the $75m earned for full-year 2013, which was the first full year after the joint venture was formed.

CME said that with the addition of the IHS Markit fixed income and credit indices, the joint venture is well-positioned to continue to innovate and grow across an even wider set of products and services.

“The partnership with Dow Jones has been an exceptional investment for CME,” said Duffy. “ So we are very happy to be able to extend it into other product lines.”

International business

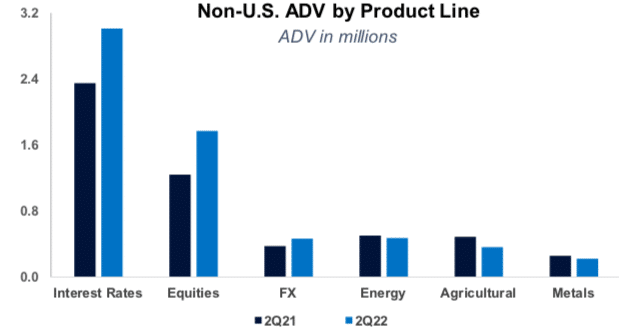

Average daily volume was 23.1 million contracts in the second quarter of this year, including non-U.S. ADV of 6.3 million contracts, led by 40% growth in Latin America, 36% in Asia and 15% in Europe, Middle East and Africa.

Derek Sammann, global head of commodities, options and international markets at CME Group, said on the call that the international business was going from strength to strength.

“Our non-US ADV was our best second quarter on record and we have now put up our best first half on record of 6.8 million ADV which is up 20%,” Sammann added.

The fastest growing country this year has been Brazil, with volumes increasing 96%, followed by India, United Arab Emirates, South Korea and Taiwan which each grew between 50% and 90%.

“It speaks to the breadth and the scale of our products that customers want to trade benchmark products that are listed on screen 24/7,” said Sammann. “Investments in technology to reach those customers across the globe are driving that business.”

Sammann continued that retail participation was particularly strong, and important to CME, driven by the launch of micro contract products.

Julie Winkler, chief commercial officer at CME Group, said on the call that 2022 is set to be another record year in terms of the number of retail participants, driven by the micro contract suite, particularly in equities.

Overall equity Index ADV and overall Micro E-Mini futures ADV both posted the second highest quarterly ADV on record in the second quarter. Micro E-mini S&P 500 futures set a record ADV of 1.4 million, a rise of 78%.

In addition, the second quarter was also a record quarter for all cryptocurrency products in terms of average daily open interest at 106.2K contracts and second best in terms of average daily volume of 57.4K contracts.

Tim McCourt, global head of equity and FX products at CME Group, said in a statement: “The variety of products, including the smaller sized micro bitcoin and micro ether futures and options, offers enhanced flexibility and trading precision for a range of market participants, including large institutions as well as sophisticated, active traders.”