FX cash and derivatives were combined into one unit in 2023.

In December last year CME Group said it is launching an all-to-all spot foreign exchange market to connect cash market participants with the exchange’s FX futures liquidity. CME FX Spot+ is expected to be made available for client testing during the second half of this year.

Paul Houston, global head of FX Products at CME Group, told Markets Media: “FX futures and options and the EBS platforms are all on Globex, which is the CME Group technology infrastructure. The collective strength of the businesses can offer more to customers, enable us to be more streamlined and innovate across cash and derivatives FX.”

Houston said the technology migration was critical to set the conditions for launching CME FX Spot+.

He was appointed to his current role in August 2023 when CME combined its FX futures, options, cash and over-the-counter businesses into a single unit. Previously, Houston had overseen CME’s futures and options business for seven years.

Tim McCourt, head of financial & OTC products at CME, said in a statement at the time: “We have been working to create tighter alignment among all of our FX businesses since CME Group purchased EBS through its acquisition of NEX in 2018. This new structure is the last step in that process.”

CME acquired EBS Market for spot FX when it bought NEX, which included electronic FX and fixed income cash execution platforms. A number of enhancements to EBS Market, ranging from market data changes to new order types have been announced, which reflect the evolving FX landscape according to Houston. He said the changes started late last year and are being rolled out sequentially until June 2024.

Launch of CME FX Spot+

The new market will allow spot FX participants to access CME FX futures liquidity in over-the-counter spot terms in a central limit order book environment, while FX futures market users will have expanded access to OTC FX liquidity.

“CME FX Spot+ will automatically create spot prices from our futures prices,” said Houston. “Customers will be able to access futures liquidity in this new spot marketplace without needing a futures account, as both a taker and maker of prices.”

Liquidity between the two trading environments is connected through FX Link, a liquid and tradable spread between OTC spot FX and CME’s FX futures.

“FX Link is a spread between the FX futures and spot market- linking both marketplaces,” added Houston. “FX Spot+uses a technology called implied matching that has been in place in other markets for a number of years.”

There are more than 90,000 participants trading in the futures market who can offer liquidity to EBS, and more broadly, the OTC marketplace according to Houston.

CME is building the matching engine and the technology for transferring a futures price into a spot price. Testing is slated to start in the second half of this year for launch in the G7 currencies, with the aim of providing access to these key currencies on one platform.

Houston said: “We want to make it as easy as possible for customers to adopt and trade, so it needs to look and feel just like spot trading today.”

In December CME also said in a statement that it will combine its two non-deliverable forward (NDF) liquidity pools on the EBS Market platform onto a single trading venue this year, subject to regulatory approval.

“We are the largest primary venue for NDFs but currently have separate liquidity pools for swap execution facility (SEF) and non-SEF markets,” added Houston. “In October 2024, they will be brought together into one liquidity pool to make it more efficient for liquidity providers and customers.”

FX volumes

CME reported that annual daily volume for foreign exchange contracts increased 10% to a record 1.1 million contracts in December 2023.

The group also reported that its Latin American FX futures complex reached record average daily volume of 82,000 contracts in 2023, up +7.4% year-over-year, as well as record open interest of 304,000 contracts, up 20.4% over the same period.

Houston said in a statement: “As client participation continues to grow, we are focused on building and maintaining consistent liquidity that will support the long-term development of the electronic FX markets in Latin America.”

Mexican peso futures reached a record $1.8bn in equivalent notional value ADV and Brazilian real futures achieved a record $300m in equivalent notional value ADV.

“Recent surveys such the BIS report in April 2023, emphasise the important role of EBS and Refinitv as primary markets, but also the increased prominence of the futures market, which we see directly with increased participation and volumes in our FX futures market,” added Houston.

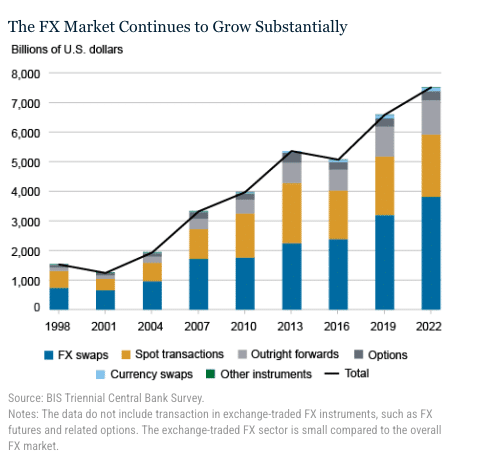

In January this year economists at the Federal Reserve wrote a blog about the evolution of the FX market over the past 25 years towards increasing complexity. They said that average daily turnover rose from $1.5 trillion to $7.5 trillion between 1998 and 2022 according to the Bank for International Settlements, with the increase occurring across both FX spot and derivatives.

“Over the past ten years, however, FX spot trading volume has stagnated, while much of the growth has come from activity in FX swaps, instruments used primarily for funding and hedging,” said the blog. “The growth in FX swap turnover owes in part to the shortening in maturity of these instruments, as they now have to be rolled over more frequently.”

The number of execution methods and trading platforms has grown and the market has become increasingly electronic since the late 1990s when two electronic brokers, Refinitiv and EBS, established themselves in the interdealer market as the clear sources of price discovery, becoming known jointly as the “primary market” according to the blog.

Nearly 60% of trading now takes place electronically, more than double the volume in 1998 when many trades were still conducted by telephone. By the early 2000s, electronic multi-dealer platforms began to emerge and banks also began to offer proprietary platforms, added the blog.

The Fed economists said these developments have increased competition and provided new options to market participants, but may have made price discovery more difficult in FX.

“Because of the multiplicity of trading platforms and the growth in internalization, the primary market has experienced a substantial decline in trading volume in the past decade and is no longer the sole locus of price discovery,” added the blog. “Large market participants now consider a broader set of trading platforms when assessing the current level of each exchange rate, and the futures market has also become increasingly important to price discovery in the spot FX market.”