“We are operating in an environment that unquestionably requires risk management.”

Terry Duffy, chairman and chief executive of CME Group, said on the third quarter results call on 25 October the total average daily volume of 22.3 million contracts was just less than 1% lower than the record set in the third quarter of last year.

“We are operating in an environment that unquestionably requires risk management,” said Duffy. “This is particularly true in the interest rate markets as the shape of the yield curve and interest rate views continue to shift and our customers need to manage that risk.”

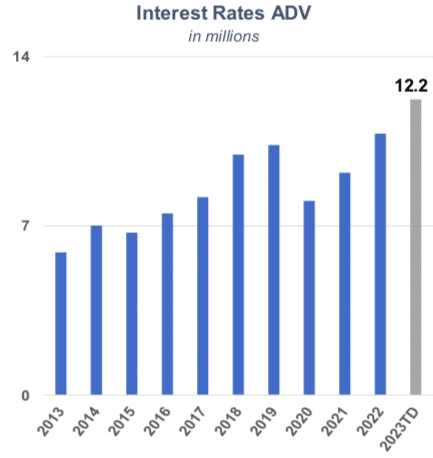

CME had a record year in its interest rate business in 2022, and volumes have increased. The third quarter volume was the highest on record, up 6% from the same quarter last year, as there are divergent market views around inflation, unemployment, monetary policy and ongoing geopolitical tensions.

Interest rate volumes were boosted by the Treasury complex, where volumes rose 16% in the third quarter and are off to a strong start in the fourth quarter according to Duffy. Treasury futures average daily volume rose 18% and Ultra 10-Year and Ultra T-Bond futures set records.

CME launched Treasury Bill (T-Bill) futures on 2 October. Duffy said more than 15,000 contracts have been traded in the first three weeks and means that CME now has tradable products across the entire yield curve. He added: “This is one of the most successful launches of a rates product.”

The group has also announced enhancements to its existing cross-margining arrangement with DTCC, the US post-trade market infrastructure, that will increase capital efficiencies for clearing members that trade and clear both US Treasury securities and CME’s interest rate futures and is due to go live in January next year.

Suzanne Sprague, global head of clearing and post-trade services for CME Group, said on the results call the proposals for central clearing of US Treasuries will potentially enable higher participation in the enhanced cross-margining program.

Tim McCourt, global head of financial & OTC products at CME, said on the results call that unlocking capital efficiencies significantly increases risk management capabilities in the marketplace and can lead to increased trading velocity of products.

“Portfolio margining of futures versus swaps has been in place since 2012 and is probably a good analogue,” added McCourt. “Unlocking capital is beneficial to the volume and velocity of the complex and we are optimistic about what we can do once it comes online early next year.”

Since the introduction of portfolio margining average daily savings have grown from $1bn in 2013 to a little over $7.5bn a day in 2023. During the same timeframe, rates volumes grew 109% and open interest doubled in the complex.

McCourt continued that in the several months since the transition from Libor to SOFR, volume in the SOFR complex in the year-to-date is 14% above the best year in Eurodollars previously.

In addition, there has been growth in volume and open interest in CME’s crypto complex.

“Just this week we saw over 130,000 contracts trade for $7.6bn,” added McCourt. “That’s our largest day in the crypto complex and speaks to the fact that we are an institutional grade offering for the crypto community.”

He highlighted that the exchange also produces the CME CF Bitcoin Reference Rate, which could underlie any spot Bitcoin exchange-traded funds, if they are eventually approved by the US Securities and Exchange Commission. McCourt believes that if the SEC approves spot Bitcoin ETFs, CME’s bitcoin futures volumes will increase and there will be additional revenue generation opportunities from licensing the reference rate.

Overseas

McCourt added that CME is seeing continued growth in non-US volumes following a record 2022. In the third quarter, international volume increased 7% year-on-year with growth in agricultural and energy volumes, and strong growth in EMEA. Non-US options volumes rose 31% compared to overall options volume increasing 21%.

“Our non-US business continues to be a source of strength and I think we are on track for another record across asset classes. I like our position going into 2024,” said McCourt.

Financials

CME’s revenue in the third quarter rose 9% year-on-year to $1.34bn which Duffy said is the highest third quarter revenue in the group’s history. Operating income was $820m for the third quarter.

Lynne Fitzpatrick, chief financial officer, said on the results call that the third quarter was the ninth consecutive quarter of double-digit adjusted earnings growth.

Duffy continued that his appetite and position on M&A remains the same as it has been for several years – that if the group sees something that could benefit users and shareholders it will take a very strong look.