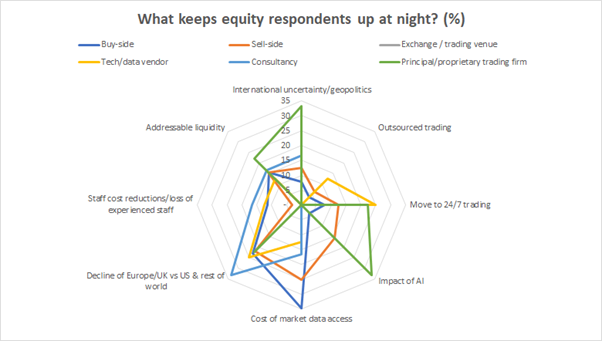

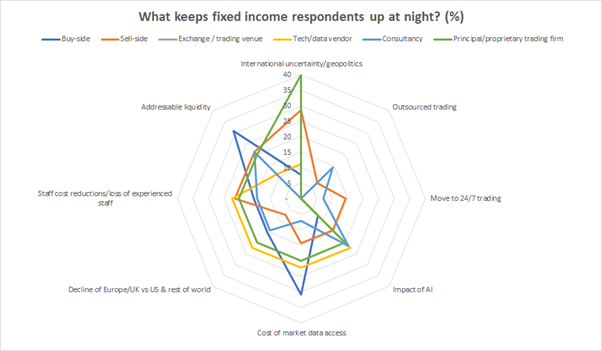

Analysis of 50 decision makers attending the FIX EMEA conference in London on 6 March 2025 found that the decline of Europe and the UK’s capital markets was the single greatest concern across all demographics for equity market participants, but a near non-issue in fixed income markets where addressable liquidity saw more concern across different groups of market participants.

For equity market experts, between 20-25% of buy-side, sell-side, proprietary trading and tech vendor respondents cited the decline of Europe and UK vs the US and the rest of the world as keeping them up at night, making it the most consistent concern across all groups. This was even greater for consultants at nearly 33%.

For proprietary traders, the main fears were international uncertainty/geopolitics and the impact of AI, each at 33% of respondents, reflecting the challenge that unpredictable volatility can have upon more automated trading strategies, and potentially the ability of AI to replace traders – or create risks – for the same strategies.

For buy-side and sell-side equity market respondents, the largest single concern (for 35% and 25% respectively) was the cost of market data. This topic has been well flagged in a recent paper by consultancy Market Structure Partners and backed by industry groups including the European Fund and Asset Management Association (EFAMA), the Association of Financial Markets in Europe (AFME) and Plato Partnership [Buy side cries price gouging, exchanges say it’s a smokescreen – Global Trading], which claimed data providers were price gouging. In a low margin business such as equities, the pressure of operational costs are keenly felt.

Addressable liquidity was a concern for 15-16% of buy- and sell-side respondents, but greater for proprietary traders (22%).

In fixed income markets, ‘addressable liquidity’ was cited as the issue most likely to keep respondents up at night across all demographics, with 31% of buy-side and 21% of sell-side professionals survey making it their biggest concern.

Market data costs were also a challenge for buy-side firms (31%) who are tasked with aggregating prices on screen, and from dealer axes / dealer quotes in the absence of a consolidated tape in Europe, where there lack of primary venues – which are present in listed markets – removes a potential source of information.

Commenting on the results, Rudolf Siebel, managing director of the German Investment Funds Association (BVI) sounded an optimistic note for the future.

“Where, because of Brexit, we have separated transparency rules and in part created different pools of liquidity, we would hope that because of the new geopolitical situation, the UK and the EU are coming more together, and differences can be more easily overcome,” he said. “But right now it looks we will have two different deferral and bond consolidated tape regimes.”

Although ‘the decline of Europe and the UK vs the rest of the world’ was less of an issue for fixed income respondents than their equity peers, the division between European Union and UK markets itself was a contributor to the fragmentation of liquidity and data viability, and competition was likely to be an issue going forward, Siebel observed.

“The majority of investors in EU bonds are international investors, who can always go to the UK and more likely go to the UK first anyway,” he said. “But you can also access London liquidity as an EU-based investor. The larger issue are international investors investing in EU bonds, which is where we see also a lot of appetite for these to be issued as defence and infrastructure bonds.”

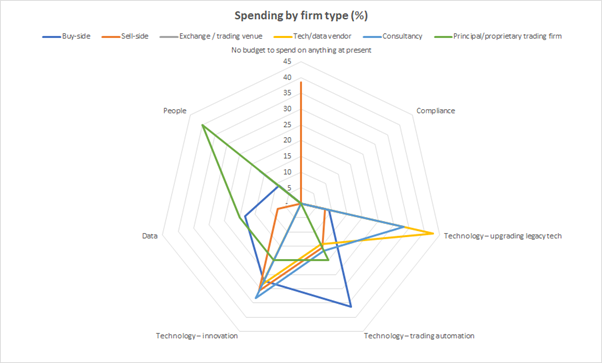

If spending is a proxy for the way businesses are seeking to tackle some of these challenges, then the respondents’ notes were telling. While 38% of sell-side survey participants said they had no budget to spend on anything at present, the 31% reported they were spending on innovation, creating a potential ‘haves and have nots’ scenario, noted Rebecca Healey, co-chair of the EMEA Regional Committee, speaking at the event.

“We are starting to see investment in technology as an asset in and of itself, rather than as a support function, when you see some of the innovations taking place notably in the ELP space, you have to ask who is prepared to put their hand in their pocket and spend their money and technology innovation?” she said.

Although a possible asset class bias was suggested by one attendee, with less innovation in equity discussed, this was discounted by a market participant who noted several examples of innovative equity tech innovation.

For the buy-side, trading automation was the biggest spend across the board, with 36% of respondents flagging it as a key investment. Given the concern across equity and fixed income participants around the cost of market data, it seems clear that the buy side will need increasingly better access to quality data in order to support more automated processes and to optimise fragmented liquidity.

©Markets Media Europe 2025