Navigating market complexity with data-driven insights

Anya van den Berg, Global Head of Analytics Sales – reflects on an impressive year’s performance across Eurex’s futures and options trading volumes, leading to increased uptake of Eurex Analytics datasets. This article will delve into the statistics and trends captured in 2024 within Europe’s leading derivatives market and how this has positively impacted data and analytics adoption within Deutsche Börse.

In times of ever-increasing trading volumes, data-driven insights are becoming more and more important. This has never been more apparent this year than across Eurex’s derivatives products and the corresponding analytics datasets produced within Deutsche Börse’s Market Data + Services department (MD+S).

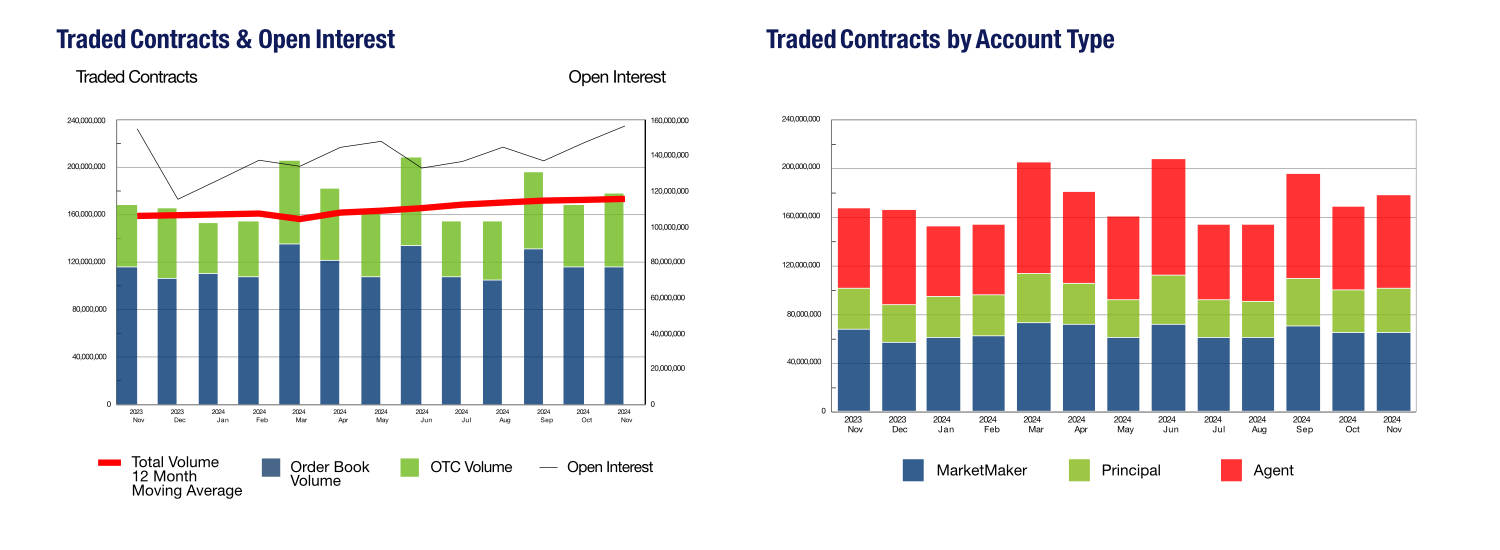

In November 2024, Europe’s premier derivatives exchange, Eurex, announced another impressive month in its overall trading volume. Total trading volume climbed 6% compared to the same period last year, reaching 177.6 million contracts, up from 167.5 million contracts in the same month last year. Similarly, total trading volumes increased in October 2024, with a further 4.5% year-on-year rise to 168.5 million contracts compared with 161.2 million contracts the previous year. Notable gains were attributed to interest rate derivatives, as well as equity derivatives and OTC clearing.

Source: Eurex Monthly Statistics

Source: Eurex Monthly Statistics

This growth reflects broader market trends and signals the ongoing shift in trading preferences among institutional investors, with significant gains particularly in the interest rate derivatives segment. The 9.4% year-on-year rise in Eurex’s total trading volumes YTD, including November 2024, indicates not only increased trading activity but also a growing demand for data-driven insights. Thus, market participants are turning to sophisticated analytics tools to gain deeper insights into market trends, improve decision-making and manage risk more effectively.

This shift is reflected in the growing popularity of Deutsche Börse’s unique analytics offerings, particularly ‘Eurex Flow Insights’, ‘Eurex Open Interest Insights’ and the newly launched ‘Eurex Cleared Flow Insights’, which form the Eurex Flows Suite. These tools are helping market participants navigate the complexities of the derivatives market with greater precision. As trading volume builds momentum, the need for advanced data analytics is greater than ever.

One of the main factors contributing to the growth in trading volumes at Eurex is the increasing sophistication of market participants. As trading activity increases, there is a growing need for platforms that can deliver reliable and actionable data. The Eurex Flow Insights offering provides information about trending flow of derivatives contracts and has become an essential tool for traders seeking to track and analyse market sentiment and activity. The product uniquely aggregates market participant groupings into three categories: agent (buyside flow), market maker and proprietary trading. It allows users to monitor the movement of these contracts, providing essential insight into market trends and enabling traders to anticipate price fluctuations.

The sharp rise in interest rate derivatives trading, which increased by 8 percent in November and 33 percent in both September and October 2024, is a prime example of how ‘Eurex Flow Insights’ can be leveraged. Given the sensitivity of interest rate products to macroeconomic shifts, and the ongoing adjustments by central banks, it is essential for traders to have a detailed understanding of how these products are performing in the market.

Similarly, the ‘Eurex Open Interest Insights’ offering is another crucial tool that has seen a significant rise in adoption in line with Eurex’s rising volumes. Open interest, defined as the total number of outstanding contracts that have not been settled or closed, serves as a key indicator of market sentiment and investor positioning. A notable increase in open interest frequently indicates that traders are establishing or unwinding substantial positions in anticipation of future market movements.

For equity derivatives trading, ‘Eurex Open Interest Insights’ addresses the need to track market sentiment as the surge in equity derivatives has seen 40 percent growth in trading volume in November 2024 alone. Considering the increased number of traders entering positions in equity products amidst heightened volatility in global markets, it is crucial to gain insight into open interest trends. A rise in open interest may indicate that traders anticipate continued movement in a specific direction, whereas a decline could imply that market participants are adopting a more cautious stance or closing out their positions.

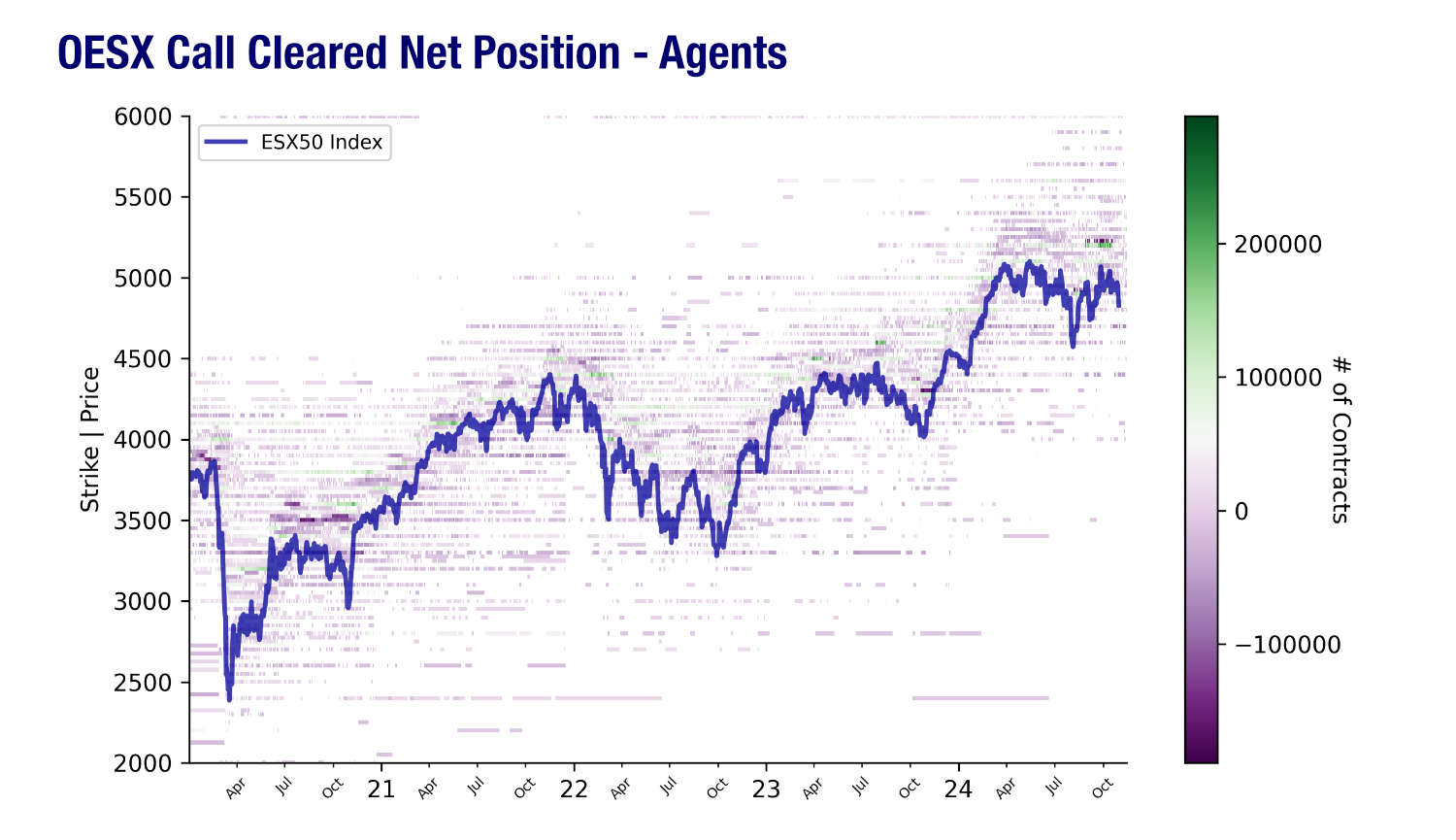

The growth trend is also directly reflected in the increasing use of cleared OTC derivatives, with notional outstanding in OTC clearing volumes increasing by 10 % in November 2024 compared with last year. In response to growing demand for transparency in derivatives, Deutsche Börse MD+S launched ‘Eurex Cleared Flow Insights’ in October this year. It has since become a key component of its analytics suite. This offering provides comprehensive insights into the flow of cleared derivatives transactions, offering detailed information about trade volumes, open interest, and same-day adjustments.

Source: “Eurex Cleared Flows Insights” – depicting the EUROSTOXX 50 Options (OESX) Cleared Position by Strike for Agents.

In conclusion, the synergy between Eurex’s growth in trading volumes and the expansion of Deutsche Börse’s analytics tools underpin a key trend in modern financial markets: the growing importance of data.

In light of the increasingly complex market conditions that traders and investors are confronted with, there is a growing reliance on sophisticated analytical tools that facilitate more informed decision-making. By offering, valuable, state-of-the-art and actionable insights into trending market flows, open interest, and cleared volumes, Eurex and Deutsche Börse MD+S are enabling its customers to maintain a good understanding of the market, making these tools indispensable in a rapidly evolving marketplace.

For further information on all Deutsche Börse’s Analytics please visit https://a7-dataplatform.deutsche-boerse.com/ or email analytics@deutsche-boerse.com