Electronic trading in fixed income markets is gaining traction, driven in part by increased data availability and new regulations, according to the results of the Global Client Fixed Income Markets Structure Survey by the Barclays Market Structure team.

The global fixed income market represents roughly $130 trillion in debt outstanding, eclipsing the total market capitalization for stocks. Over the past five years, there has been some growth in electronic trading of fixed income markets, but it has lagged that of electronic trading in equities and will continue to evolve on a different path because of the differing trading styles and the complexity of fixed income instruments.

“We’ve seen significant electronification, as well as adjustments in how firms trade fixed income securities over the last five years, but also observed a rapid acceleration over the last couple of years,” said Matthew Coupe, Director of Cross Asset Market Structure for the Global Markets business at Barclays. “As more firms migrate to electronic trading, the trend becomes self-perpetuating.”

To understand the current state of the electronic evolution in fixed income, Barclays surveyed a range of institutions including central banks, asset managers, insurance companies and hedge funds, asking over 50 questions on topics ranging from trading tools and protocols, execution solutions, best execution analysis, dealer selection and regulatory change.

The three key takeaways from the survey were: i) the notional value and volume of electronic trades is increasing; ii) many investors are still wary of automation; and iii) firms are taking a more systematic approach to best execution.

The value and volume of trades is increasing

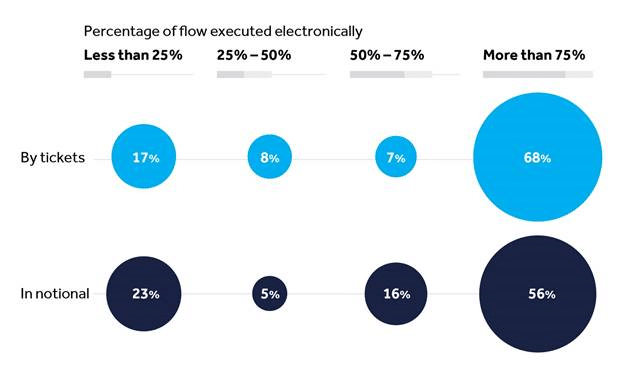

The survey results challenged two typical assumptions about how electronic trading manifests in fixed income markets. First, that mostly just highly liquid standardized products are traded electronically. And second, that electronic trading volumes come from many tickets at relatively small notional values.

Contrary to those assumptions, the survey revealed that the gap between the number of tickets and notional value, for both rates and credits, is closing as investors execute larger trades electronically.

Figure 1: What proportion of your trading is executed electronically for Rates and Credit?

The survey also indicates that electronic trading is not focused solely on the most liquid and generic products. For example, more clients indicate they are using electronic trading for emerging market currencies and interest rate swaps.

Wariness towards automation persists

Although the categorization of trades as electronic generally means that they are executed with an order management system, this may only cover a small part of the trading lifecycle. On the other hand, trades executed with execution management systems potentially automate the full lifecycle, from pre-programmed trading to settlement.

Notably, the survey found that over 60% of respondents did not have an EMS, and less than half were looking to implement one by the end of 2021. What’s more, less than 25% of respondents’ flow is executed using automation.

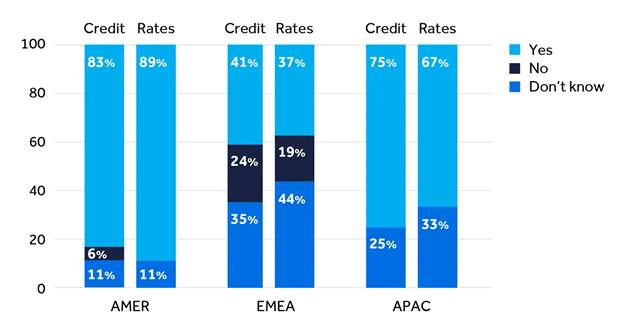

One of the main reasons for this could be that many investors, particularly those in the Americas and Asia Pacific, indicated that they have experienced pricing fragmentation across different platforms for the same instrument.

Figure 2: Have you experienced pricing fragmentation across different platforms for the same instruments?

Taking a more systematic approach to best execution

Many variables affect the true cost of a fixed income transaction. To that end, best execution, the legal mandate to execute trades advantageously for clients, encompasses many factors beyond price, including the size of a trade, market impact, liquidity, speed and information leakage, among others. In the survey, more than half of respondents said they are using a transaction cost analysis system to fulfil their regulatory responsibilities.

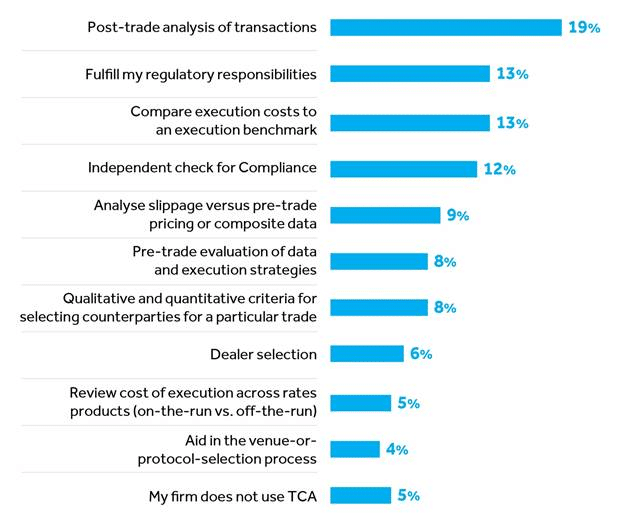

That said, respondents found value in TCA systems beyond satisfying regulatory obligations. The most popular use case is to understand trading performance, but respondents also used their TCA solution for cost and pricing analysis and benchmarking, as well as to inform dealer or counterparty selection.

Figure 3: What are your core reasons for having a transaction cost analysis system?