Assets under management at funds that integrate environmental, social and governance criteria have grown at 15.3% each year since 2016 and this is likely to continue.

The overall value of assets using ESG data has increased from $22.9 (€20.5) trillion in 2016 to more than $40 trillion this year according to a report, ESG Data Integration By Asset Managers: Targeting Alpha, Fiduciary Duty & Portfolio Risk Analysis, from consultancy Opimas.

Axel Pierron, co-founder and managing director of Opimas and analyst Anne-Laure Foubert, authors of the report, wrote: “With ESG data integration becoming prevalent at asset managers, this growth trajectory is unlikely to slow any time soon.”

Growth is likely to be boosted as ESG indices have outperformed their parent indices during volatile markets caused by the COVID-19 pandemic. For example, the report said the Dow Jones Sustainability Index lost “only” 8.4% of its value from 3 March to 16 April this year, while the S&P Global BMI fell 12.4%.

“To meet this evolution of clients’ demand and focus, asset managers, even those operating non-ESG funds, are going through various ESG data integration projects,” said Opimas. “However, considering the nascent nature of the market and the complexity of integrating granular ESG data in investment allocation strategy, the vast majority of buy-side firms are still missing alpha-generation opportunities by not leveraging granular ESG data.”

Factset, the data provider said in a report that as investors adopt more sophisticated strategies, there has been more demand for raw ESG data that comes directly from a company or regulatory body and has not been aggregated or transformed by a vendor, especially as many investors want to build custom ESG metrics in-house.

“In doing so, firms have the flexibility to adjust the weight placed on specific ESG factors in response to the evolving market, geopolitical, and societal context,” said Factset. “The agility offered by in-house ESG analysis is often hard to replicate with vendor-provided top-level scores.”

Other firms are layering more granular information for specific ESG issues on top of vendor-provided ESG scores.

“The demand we have seen thus far has been for vendors that collect this data and deliver it in standardized formats so that firms can avoid collecting the underlying data themselves,” added Factset. “The key advantage of these datasets is the depth of detail and transparency they provide, allowing for customization in the application and ability to tweak aggregation methodology in alignment with investors’ values.”

Staff

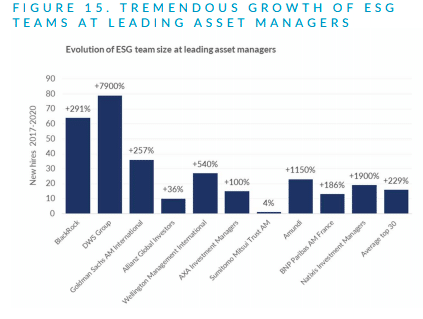

Opimas continued that asset management is gearing up for increased adoption of ESG data within investment strategies through recruitment.

“At the top 30 global asset managers, ESG teams have grown on average by close to 230% between 2017 and 2020,” said the report.

In addition, stewardship teams have grown by 67% on average over the same time period.

The increase in engagement is shown by 71 ESG-related proxy proposals being brought to U.S. company meetings in the first half of this year according to FactSet.

“This accounts for 74% of all proxy proposals brought to company meetings in this period and a 6% increase in ESG proxy proposals from the first two quarters of 2019, despite the market downturn,” added Factset. “While this is promising, it likely does not offer a full picture of ongoing shareholder engagement as many investors opt for private discussions with company leadership.”

Passive

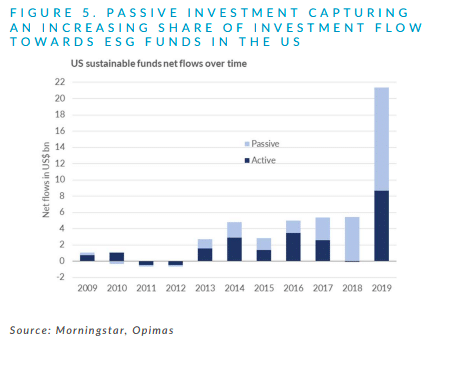

ESG strategies have mainly been used in active strategies, but passive funds are growing in the space.

Opimas said: “The situation is particularly pronounced in the US, where net flows into passive ESG funds have exceeded those into active ones since 2017.”

Last year US ESG passive funds had nearly 60% of the ESG-focused investment net flows according to the consultancy.

The growth in passive is shown by assets invested globally in ESG exchange-traded funds reaching a record at the end of May according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem.

@etfgi reports assets invested in Environmental, Social, and Governance (ESG) #ETFs and #ETPs listed globally reached a new record of US$82 billion at the end of May 2020

— ETFGI (@etfgi) June 25, 2020

Highlights

· Assets invested in ESG ETFs and ETPs listed globally reached a new record of $82 Bn.

Year-to-date net inflows to the end of May were $28.5bn, compared to $7.2bn at the same time last year.

Another passive growth indicator is that Deutsche Borse’s Qontigo has just launched two new families of Climate Indices: the STOXX Paris-Aligned Benchmark Indices and the STOXX Climate Transition Benchmark Indices.

📢 Proud to launch two new families of Climate Indices: #STOXX Paris-Aligned Benchmark (PAB) and #STOXX Climate Transition Benchmark (CTB)! Learn more: https://t.co/3RoB3wWh3V

— Qontigo (@Qontigofinance) July 2, 2020

👉Visit https://t.co/gvc6KIwUlE for more info about #STOXX climate benchmarks pic.twitter.com/0Rg2LCNyAj

The climate transition benchmarks are specifically targeted towards decarbonization while the Paris benchmarks have stricter requirements around energy efficiency that coincide with the long-term global warming target of the Paris Climate Agreement. The indices were constructed in collaboration with ISS ESG and Sustainalytics, two providers of sustainability data.

Marija Kramer, head of ISS ESG, the responsible investment arm of Institutional Shareholder Services, said in a statement: “These important new offerings will significantly aid institutional investors seeking to provide beneficiaries greater choice when it comes to climate-conscious portfolios.”