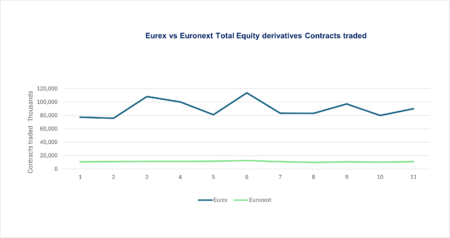

Eurex has continued to dominate the equity derivatives market this year, reporting 90 million contracts traded in November – more than eight times Euronext’s 10.8 million.

Both companies have seen growth in contracts traded this month, Eurex by 12% and Euronext by a more modest 6%.

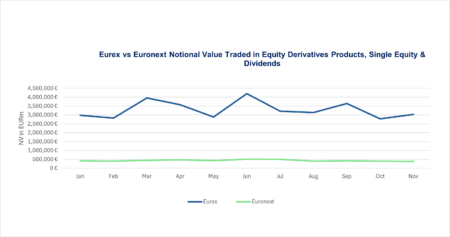

Although the ratio between the two is similar in notional traded value, with Eurex recording €3 trillion to Euronext’s €384 billion in November, month-on-month results were up 8% at Eurex but down 5% at Euronext.

Eurex’s market share, in terms of traded contracts, has hovered around 90% throughout the year. Its lowest point was 87%, seen in February.

The German giant gets the bulk of its power from the Euro Stoxx indices, which cover the most actively traded euro-denominated equity index derivatives in the eurozone.

Euronext is taking a number of measures to fight back. “The migration to Euronext Clearing has given us more agility,” Charlotte Alliot, group head of institutional derivatives at the firm, told Global Trading. “We’re focused on maximising returns, updating its service for existing Euronext equity derivatives, and going into new business lines.”

The group has recently completed its coverage of all DAX index constituents in Germany, adding 21 new single stock options to its roster, along with six Irish. It is the first to offer access to the Portuguese market, offering six single stock options in the region.

READ MORE: Euronext steps up Eurex competition with new stock options offering

“We’re narrowing the gap with Eurex, not removing it. We’re the natural exchange choice for institutional investors after Eurex, and the natural choice for retail,” Alliot concluded.

©Markets Media Europe 2024