In the introductory panel of the FIX EMEA Trading Conference, attendees were polled on their primary regulatory focus for 2025. A significant 46% identified the rise of bilateral trading and its impact on price formation in public markets as their chief concern.

Jamie Whitehorn, head of trading venues at the FCA, acknowledging industry concerns stated: “On bilateral trading it’s our feeling that markets are effective when there’s a choice of trading functionality. We are conscious that when you kind of change one aspect of market structure, you have to be mindful of your impact on market structure as a whole.”

While roughly 51% of notional equity traded in Europe (Uk included) in 2024 happened in Multi Lateral Trading Facilities (MTF), principally as a function of their role providing Approved Publication Arrangement (APA)- CBOE is 90% of this in Europe- Systematic Internalisers (SI), on the other hand, represent 25% of these bilateral exchanges at €1.21 trillion in 2024 according to BMLL.

Recent discussions on these venues have centred on revising the SI regulatory framework: The revisions from the FCA shift the SI definition away from rigid quantitative thresholds toward a qualitative assessment of trading activity, aiming to reduce compliance burdens while preserving market integrity. The new approach, designed to align the SI definition more closely with that of a market maker by emphasizing continuous and stable liquidity provision, will come into force on 1 December 2025 in the UK with the implementation of both Handbook changes and the relevant regulatory provisions.

The AMF in France, despite being present at the event, declined to comment on these developments.

ESMA also declined to comment while Systematic Internalisers represented €1.63 trillion of notional traded in 2024 on markets under its supervision, roughly 54% of which were bilateral trades.

On 16 December 2024, in its final report on equity transparency, ESMA also presented an early Christmas disappointment to MTFs looking to offer further bilateral trading in the form of trajectory crossing order types by blocking their development plans to offer a similar service in continental Europe as in the UK.

Market participants expressed concerns about this decision as sell side firm can offer this type of services to their client, further pushing away the UK and EU regulatory regime.

When contacted, An FCA spokesperson further explained: “In Chapter 8, we considered the issue of the definition of an SI and provided conclusions on the Handbook changes we will make. In this Chapter we want to consider the future of the SI regime, for bonds and derivatives. We are not putting forward proposals for consultation but are instead asking questions for discussion. However, with the implementation of the new definition of an SI on 1 December 2025 it would be good to try and implement substantive changes to the obligations applying to SIs by that date.”

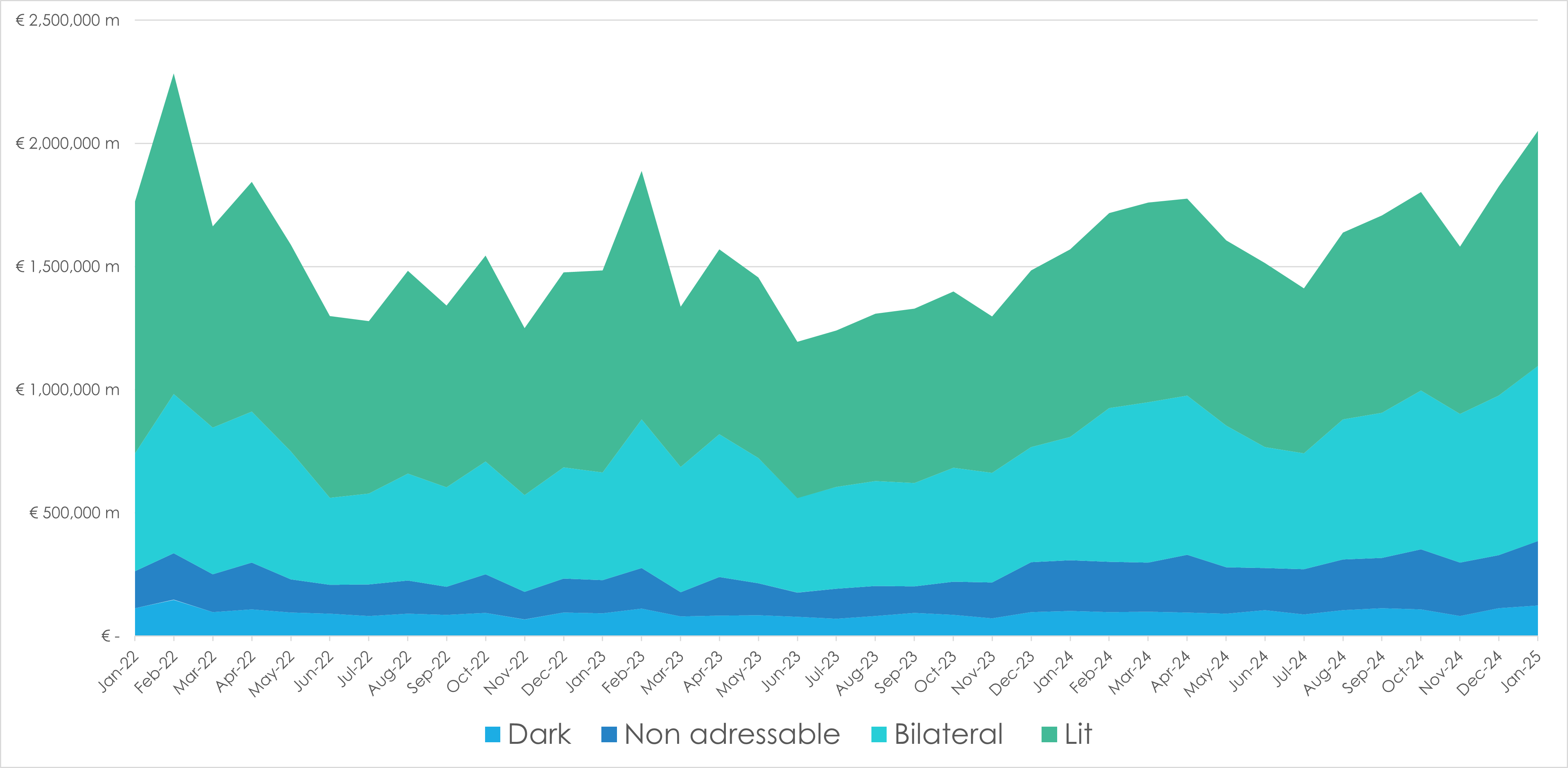

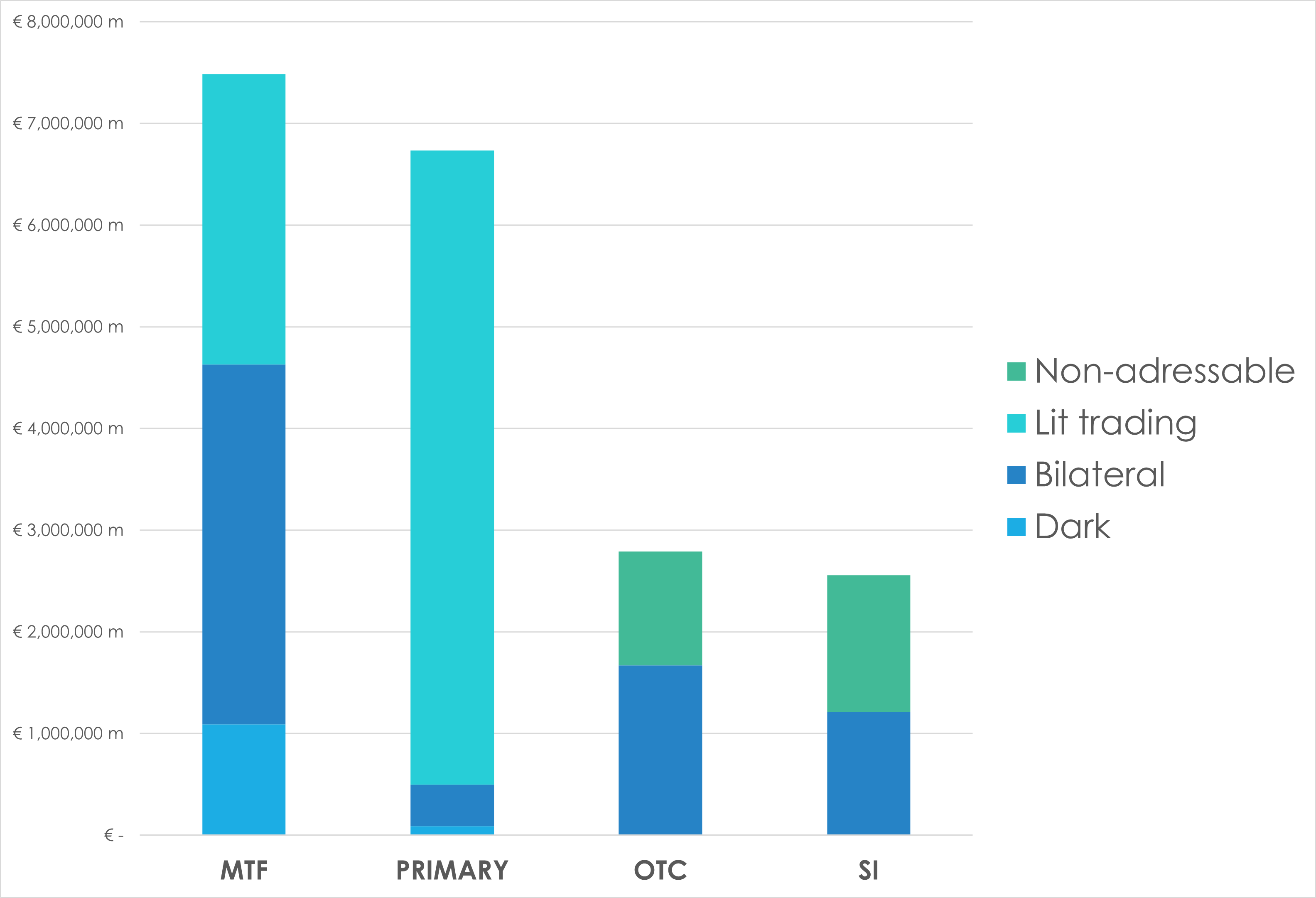

Data from BMLL highlights significant shifts in market volumes across European venues, including the UK, over the past three years.

Total notional trading volumes across MTF, primary markets, OTC, and SI markets reached €19.1 trillion). By 2024, this aggregate had increased modestly to about €19.6 trillion.

Looking at the market breakdown for 2022, MTF volumes were around €7.1 trillion, primary markets volumes contributed approximately €7.8 trillion, OTC volumes reached about €1.6 trillion, and SI volumes totalled €2.7 trillion. In 2024, these figures shifted: MTF volumes rose to close to €7.5 trillion, while primary market volumes declined to €6.7 trillion; meanwhile, OTC volumes increased significantly to around €2.8 trillion, and SI volumes experienced a slight drop to approximately €2.6 trillion.

A similar transformation is evident when classifying trades by execution type. In 2022, dark pool trading, captured through MTF and primary markets channel, amounted to about €1.2 trillion (roughly 6.2% of total volumes), bilateral trading totalled €6.3 trillion (33.1%), lit venues trading dominated with nearly €9.9 trillion (51.6%), and non-addressable trading accounted for around €1.7 trillion (9.1%). By 2024, dark pool volumes were marginally lower at around €1.2 trillion (6.0%), bilateral trading increased to €6.8 trillion (34.9%), lit trading declined to approximately €9.1 trillion (46.5%), and non-addressable trading expanded to €2. trillion (12.6%).

All data provided by BMLL.

©Markets Media Europe 2025