The right regulatory framework and infrastructure could be the catalyst to unlock new opportunities.

Fusion Digital Assets, TP ICAP Group’s spot crypto asset market, has completed its first transaction as investors said confidence in the way the nascent asset class is traded is key to driving greater adoption.

Simon Forster, co-head of digital assets at TP ICAP, described 2022 as a watershed moment for the industry as it included the high-profile crypto exchange FTX filing for bankruptcy. He said the industry is moving away from a retail speculative offshore market to a new chapter which feels more wholesale and institutional with a focus on regulation, and more established participants providing appropriate infrastructure in major traditional financial jurisdictions.

“The next chapter is going to look very different in terms of the participants and the operating models,” he added. “A lot of vertically integrated exchanges are unbundling that stack and trying to separate execution from custody, which we believe is important.”

However, he argued there is an outstanding question of how easy it will be for an exchange with a retail client base to reframe that business for institutional clients.

Fusion Digital Assets is a solely institutional trading venue with a segregated operational structure aligned with traditional financial (TradFi), rather than crypto, markets. The electronic trading platform is operated by TP ICAP, who are registered with the FCA as a crypto exchange provider, and with Fidelity Digital Assets providing custody.

“The roll out of a crypto asset exchange registered with the FCA means we have a segregated solution, with independent custody from Fidelity Digital Assets for a global client base working within the appropriate regulatory parameters,” Forster added.

Fusion Digital Assets currently supports trading in Bitcoin and Ether against US dollars. The business feels comfortable with these assets in terms of their classification and UK registrations, and which have the most demand from clients.

“We absolutely think that different types of products will be traded and settled versus spot on Fusion Digital Assets,” he said. “We are in the very early stages of this shift and the right regulatory framework and infrastructure could be the catalyst for unlocking new opportunities, such as the DLT Pilot Regime within Europe.”

First trade

In May Fusion Digital Assets completed its first Bitcoin/US dollar pairs trade. Pre-trade credit check, orders and settlement instructions were all API-driven with Fidelity Digital Assets processing settlement which showed that a live trade could be processed end-to-end, and so was a significant milestone for the business according to Forster.

“The settlement was seamless and happened within minutes compared to days in traditional asset classes,” he added. “This settlement precision will, in our view, become a key narrative as people begin to see the power of this superior settlement technology.”

Forster described the launch of Fusion Digital as “methodical”, in line with everything that TP ICAP has done from a digital assets perspective. The firm is taking a staged approach to the rollout. Other clients are being onboarded and Forster said there is a very healthy pipeline.

He described a sensible progression as moving to a soft launch in the second half of the year with a critical mass of liquidity providers and clients trading on Fusion Digital Assets in truncated market hours.

The firm will look towards a formal hard launch towards the end of this year, or early next year, with full initial opening market hours. Forster added that crypto is a 24/7 market and there is still an outstanding question on whether traditional financial firms will move in that direction, but it is something that the business is prepared for.

Mike Kuehnel, chief executive of Flow Traders, said in a statement: “Flow Traders is a strong supporter of developments that enhance the institutional digital assets infrastructure, promoting efficient markets and best practices.”

Digital assets have reached a pivotal point in their journey towards mainstream, widespread institutional adoption according to Jos Dijsselhof, chief executive of Swiss infrastructure provider SIX.

He said in a report: “Market participants are seeking partnerships with providers who can manage risk and utilize blockchain technology in a way that promotes greater confidence.”

Cornerstones for Growth, the latest report in the Future of Finance series from SIX, said the digital assets sector is experiencing rapid evolution and holds immense potential but survey participants emphasized the need for effective and secure market infrastructure to boost confidence and accelerate its growth. Censuswide, on behalf of SIX, surveyed portfolio managers, asset allocators, and hedge fund managers across 300 international financial institutions in April 2023.

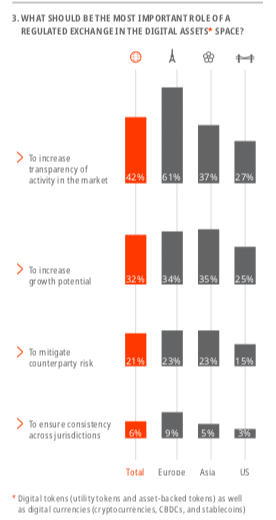

The majority, over 60%, of respondents said a safer trading environment was a key driver to greater adoption and that a regulated exchange would provide such an environment. Nearly half, 42%, of buy-side respondents said companies increased transparency was what they expected from a regulated platform for digital assets.

The report added: “With its unique position, the regulated exchange for digital assets has the capacity to provide visibility, security, liquidity, and ultimately instill confidence in the industry.”

More than half, 55%, of respondents also indicated they would be more likely to trade digital assets if they were held by a recognized, traditional custodian.

Growth strategy

TP ICAP’s first move in digital assets was to set up a traditional broking desk for crypto derivatives in 2019, which now has global coverage according to Forster.

“We are the market leader for CME crypto derivatives and there is a really interesting opportunity to explore pairing those contracts with Fidelity Digital Assets as a custodian in a new settlement infrastructure to support new products,” Forster added. “There is no silver bullet to accelerate plans but building market infrastructure for our clients is something that we are experienced in.”

He said the business feels well placed with a fully crypto exchange and an independent, segregated custody model. They started talking to clients two years ago about plans for digital assets, and he said they were always quite realistic about the time it would take to get a registration, mobilise the platform and create an operational liquid marketplace.

“Beyond our Global Broking division, which is the home of bank-to-bank activity and our market leading Energy and Commodities division we are blessed with Liquidnet who have a phenomenal buy-side facing equities and fixed income platform business,” he said. “They acutely understand the needs of the buy side which we believe will give us a real advantage as this cohort of client will, in our opinion, drive this next wave of adoption.”

Regulatory clarity is imperative for a firm like TP ICAP to build products and provide a service to clients according to Forster.

“We are seeing an emergent regulatory framework across the globe, with different regions taking different stances and we feel fortunate to be a UK-headquartered firm,” he added.

In addition, the EU is a significant part of TP ICAP’s overall revenue and the firm’s continental European home is in France. AMF, the French regulator, is also being quite proactive and thoughtful around crypto according to Forster and the firm is working through what that means for its business in France, and then more broadly into continental Europe as MiCA comes in.

In April this year the European Union approved the Markets in Crypto-assets (MiCA) regulation, making the EU one of the first jurisdictions in the world to introduce comprehensive rules on crypto-assets which aims to protect consumers and financial stability while encouraging innovation. MiCA is expected to come into force in 2024 and includes provisions covering transparency, disclosure, authorisation and supervision of transactions, as well as regulating public offers of crypto-assets.

In one year’s time Forster would like to see Fusion Digital Assets as one of the primary markets for crypto trading.

“There will also be a better understanding from the market around the importance of connecting to other parts of TP ICAP and adding diverse and uncorrelated liquidity into our CLOB [central limit order book] from avenues such as Liquidnet,” he said.

Forster also imagines other custodians will be connected, which is a key part of the operating model. Fusion Digital Assets uses technology from GMEX for trading and market surveillance, as well as a new post-trade platform to connect to multiple digital asset custodians for credit checking, netting and settlement for all trading activity.

Hirander Misra, chief executive of GMEX Group, said in a statement: “This will lay strong foundations for the digital assets sector as the platform meets the increasing demand from institutional customers to access liquidity and trade spot cryptoassets, with the security that is provided by institutional grade prefunding and settlement by multiple custodians which is enabled by credible regulations.”

In addition, TP ICAP is increasingly aware of the importance of tokenization and has formed a working group.

“There will be some announcements over the course of 2023 about our broader firmwide initiative as it pertains to tokenization,” added Forster. “This shift has always been the biggest risk and opportunity for a market intermediary such as TP ICAP as such something we are exceptionally focused on.”

Exchange volumes

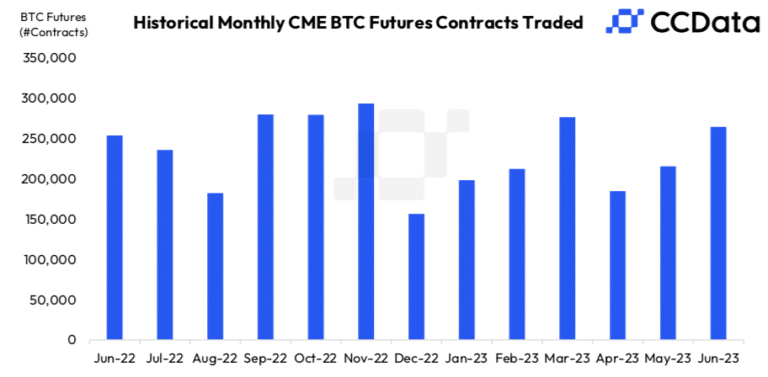

In June the combined spot and derivatives trading volume on centralised exchanges increased for the first time in three months according to the Exchange Review from CCData, the FCA-authorised benchmark administrator and digital asset data provider. The report said combined volume rose 14.2% to $2.7 trillion.

“Trading activity across spot markets increased in June, following the filing of Bitcoin spot ETFs by multiple TradFi companies including BlackRock and Fidelity,” said CCData.

The report continued that the ETF filings changed sentiment in the market which had been hampered by the lawsuits against Coinbase and Binance.US. Although the US Securities and Exchange Commission has previously rejected applications for spot Bitcoin ETFs, the current applicants have assured that they will use the services of Coinbase to provide market surveillance.

The ETF filings also affected derivatives volumes. The report said that in June CME’s Bitcoin futures volume rose 28.6% to $37.9bn. CME’S micro Bitcoin futures traded $702m in monthly volume, up 21.1% from May.

“This is the highest volume for BTC futures traded on the CME since November 2021, highlighting the increased speculation in the market following BlackRock’s filing for its Bitcoin spot ETF,” added CCData.