Booming stock markets and bursts of volatility are cementing the position of US banking giants in equity trading. Goldman Sachs led the pack with $3.5 billion equity intermediation revenues in the third quarter, overtaking close rival Morgan Stanley.

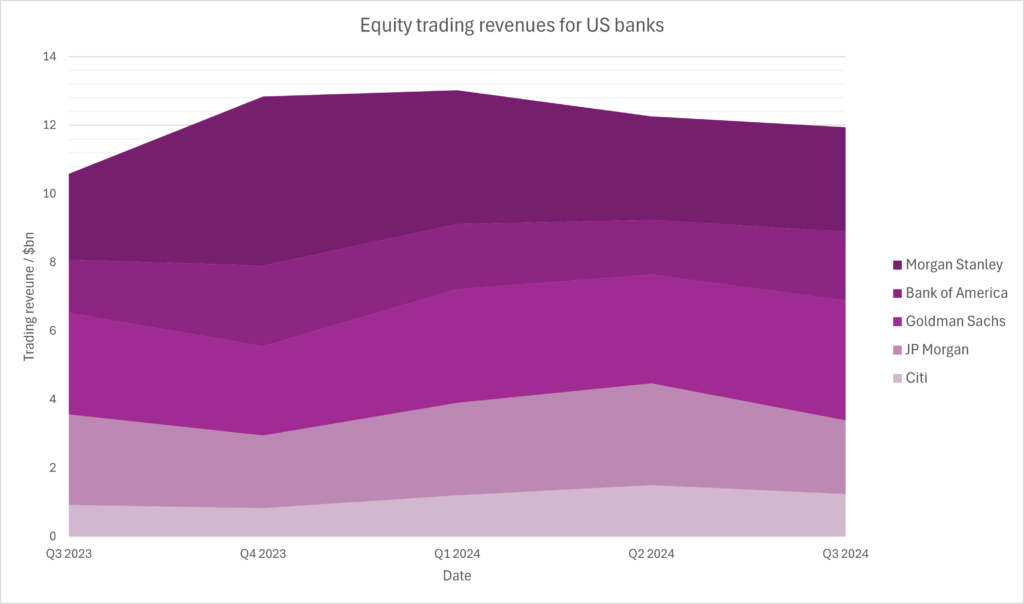

Taking the five banks’ total equities revenues into account, Q3 2024 stood at US$11.9 billion, slightly down from the Q1 peak of $13 billion, but showing a 13% increase year-over-year from US$10.6 billion in Q3 2023.

Ranking the five banks, Goldman recovered its lead with $3.5 billion equities revenues in its Global Banking and Markets division, a figure that includes $1.2 billion in financing revenues from its prime brokerage business, with $2.2 billion from trading.

Ranking the five banks, Goldman recovered its lead with $3.5 billion equities revenues in its Global Banking and Markets division, a figure that includes $1.2 billion in financing revenues from its prime brokerage business, with $2.2 billion from trading.

Speaking to analysts, CEO David Solomon highlighted his firm’s trading clients, whom he said, “in this environment that’s filled with uncertainty their need to constantly be engaging, repositioning and reshaping continues to make them very active on a broad global scale”.

Nine months ago, Morgan Stanley achieved US$4.94 billion in equities trading revenue in Q4 2023. However, it dipped to US$3 billion in Q3 2024, a decline of 38% from the Q4 peak. CFO Sharon Yeshaya highlighted the contribution of prime brokerage revenues to the result.

JP Morgan ranks third, with US$2.12 billion in equities revenues in Q4 2023 and US$2.7 billion in Q1 2024, reflecting a slight increase of 27% quarter-over-quarter. The firm’s equities revenues in Q3 2024 saw a year-over-year increase of 2.3%.

In fourth place, Bank of America saw one of the strongest year-over-year gains, with equities trading revenues jumping 29.4%, from US$1.545 billion in Q3 2023 to US$2 billion in Q3 2024. However, the bank reported a 20% decline in revenues from Q2 2024 (US$1.601 billion).

Lastly, Citi recorded the most significant YoY growth in equities trading, with a 35% increase from US$0.918 billion in Q3 2023 to US$1.239 billion in Q3 2024. However, on a quarter-over-quarter basis, Citi saw a sharp 17.4% decline from US$1.5 billion in Q2 2024.

©Markets Media Europe 2024